Operating Room Integration Market Opportunities: Expanding Solutions for Healthcare Facilities

The global operating room integration market size is anticipated to reach USD 4.38 billion by 2030, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 11.4% from 2023 to 2030. Increasing redevelopment projects and the adoption of advanced healthcare IT solutions in hospitals is a major factor boosting the market growth. Operating Rooms (OR) are increasingly becoming complex and congested due to the requirement of devices during surgeries such as surgical lights, operating tables, and surgical displays. Integrated Operating Rooms (I-ORs) are becoming a solution for this complexity in ORs.

Though digitization was now high on the agendas of most companies, the COVID-19 pandemic speeded up the paradigm shift towards digitization in 2020. Besides, the trend toward digital ORs was also quickened up by the pandemic. Thus, the COVID-19 crisis created new opportunities to innovate and new ways to create value in the evolving healthcare world. For instance, in March 2021, Olympus has introduced EASYSUITE, a next-generation OR integration solution, in the EMEA area. EASYSUITE features video management and routing, medical content management, procedure recording, and virtual collaboration. As a result, with the introduction of EASYSUITE, the company promoted digitalization in surgery and boosted its position in the EMEA territory.

Gather more insights about the market drivers, restrains and growth of the Global Operating Room Integration Market

The use of video communication solutions has increased during COVID-19, in response to restrictions on travel, to lower the risk of cross-infection and ensure continuous education of surgeons in training. According to a June 2020 article published in Wiley Online Library, Microsoft Teams and Zoom were used for live surgical training teleconferencing at the National University of Malaysia to comply with government protocols during the COVID-19 pandemic. The teleconferencing solution enabled webinar lectures, surgery case-based discussions, viva voce examination, and journal critique exercises. In such unprecedented conditions, teleconferences, online learning, and webinars can be advantageous for surgical education and assessments.

The modern operating room provides consolidated data and offers access to audio and video and controls for all surgical devices at the central command station, allowing the surgeon to achieve various tasks efficiently without the prerequisite to move near the OR. Other advantages of OR integration are it minimizes manpower, maximizes OR efficiency takes less surgical time procedure, and manages patient surgical records.

Most of the Minimally Invasive Surgeries (MIS) procedures such as TAVR, and EVAR, laparoscopic procedures are performed in hybrid integrated OR. Surging patient preference for MIS is boosting the market growth. MIS includes robotic surgery; laparoscopic surgeries that have a wide range of applications in the medical sector. In addition, hospitals have shifted their preference towards advanced MIS procedures for diagnosing chronic diseases. The preference is due to the benefits that this procedure provides such as lower postoperative complication rates along with reduced hospital stay, less pain and offers fast recovery time. It also provides a high accuracy rate as compared to traditional open surgery. The aforementioned factors are anticipated to boost the demand for I-ORs over the forecast period.

The competitors operating in the market are focusing on other strategies such as mergers and acquisitions, collaborative agreements to mark their presence in the market. For instance, In January 2020, Brainlab declared its acquisition of Vision Tree Software. Vision tree Optimal Care (VTOC) platform, which provides EHR, research, and registry platform. The acquisition will provide an opportunity to capture data by point-of-care electronic forms and use inefficient workflows. The strategies like these implemented by the leader in this vertical are further propelling the market growth.

Browse through Grand View Research's Healthcare Industry Research Reports.

· Pet Herbal Supplements Market: The global pet herbal supplements market size was estimated at USD 895.0 million in 2023 and is estimated to grow at a CAGR of 10.6% from 2024 to 2030.

· Spatial Proteomics Market: The global spatial proteomics market size was estimated at USD 77.6 million in 2023 and is projected to grow at a CAGR of 14.76% from 2024 to 2030.

Operating Room Integration Market Highlights

· OR integrated services are expected to witness the fastest growth rate in coming years owing to the growing demand from ambulatory surgical centers and hospitals

· The documentation management systems segment dominated the market in 2022 owing to the associated benefits such as data management with minimal errors

· Demand for fully integrated solutions to automated surgical workflows is growing in accordance with the requirements to access all the necessary information on a single platform. This helps in expediting the surgical procedure and eliminates the need for various devices arranged all over in the operating room

· The orthopedic surgery segment is anticipated to show a lucrative CAGR owing to its growing demand. There is an increase in the number of cases of orthopedic conditions, including osteoarthritis, osteoporosis, rheumatoid arthritis, and ligamentous knee injuries

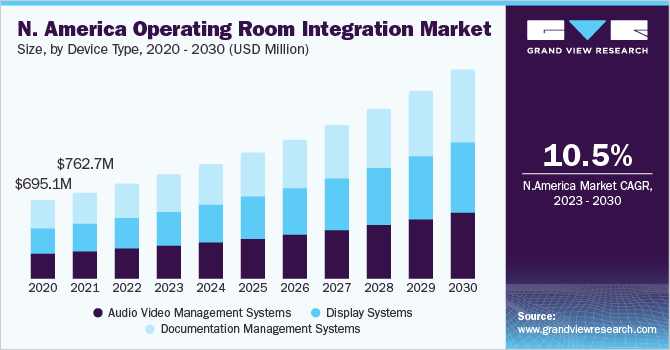

· North America dominated the market as of 2022, which is attributable to supportive government initiatives promoting the adoption of surgical automation, telemedicine, and other advanced technologies to support the use of integrated solutions in operating rooms

· Market players are involved in extensive research for the development of cost-efficient and technologically advanced OR integration solutions. Subsequently, the introduction of such solutions is expected to provide the market with lucrative growth opportunities.

· In April 2021, Barco proclaimed its partnership with Sigma - Jones | AV LLP to deliver best-in-class digital experiences in healthcare for its next-gen operating room video integration solution Nexxis

Operating Room Integration Market Segmentation

Grand View Research has segmented the global operating room integration market by component, device type, application, end-use, and region:

Operating Room Integration Component Outlook (Revenue, USD Million, 2017 - 2030)

· Software

· Services

Operating Room Integration Device Type Outlook (Revenue, USD Million, 2017 - 2030)

· Audio Video Management System

· Display System

· Documentation Management System

Operating Room Integration Application Outlook (Revenue, USD Million, 2017 - 2030)

· General Surgery

· Orthopedic Surgery

· Neurosurgery

· Others

Operating Room Integration End-Use Outlook (Revenue, USD Million, 2017 - 2030)

· Hospitals

· Ambulatory Surgery Centers

Operating Room Integration Regional Outlook (Revenue, USD Million, 2017 - 2030)

· North America

o U.S.

o Canada

· Europe

o U.K.

o Germany

o France

o Italy

o Spain

· Asia Pacific

o China

o Japan

o India

o Australia

o Singapore

· Latin America

o Brazil

o Mexico

o Argentina

· Middle East & Africa

o Saudi Arabia

o UAE

o South Africa

Order a free sample PDF of the Operating Room Integration Market Intelligence Study, published by Grand View Research.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology