Identity Verification Market Size, Share, Growth Analysis & Forecast Report 2024-2032

Summary:

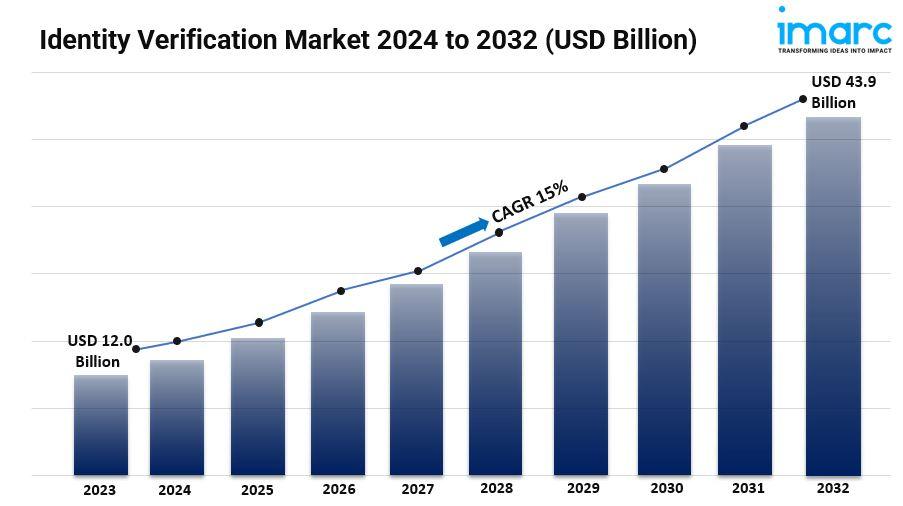

- The global identity verification market size reached USD 12.0 Billion in 2023.

- The market is expected to reach USD 43.9 Billion by 2032, exhibiting a growth rate (CAGR) of 15% during 2024-2032.

- North America leads the market, accounting for the largest identity verification market share due to its advanced technological infrastructure and strict regulations.

- Biometrics accounts for the majority of the market share in the type segment because of its high accuracy and security.

- Solutions holds the largest share in the identity verification industry as organizations look for comprehensive identity verification tools.

- On-premises remain a dominant segment in the market as many companies prioritize control and security.

- Large enterprises represent the leading organization size segment owing to their need for advanced security measures.

- BFSI holds the majority of the market share as it encounters strict regulations and high risk of frauds.

- The rising instances of identity fraud across the globe is a primary driver of the identity verification market.

- The growing need for regulatory compliance and rapid digitalization are further reshaping the identity verification market.

Request to Get the Sample Report: https://www.imarcgroup.com/identity-verification-market/requestsample

Industry Trends and Drivers:

- Growing Instances of Identity Fraud:

The surge in identity fraud cases has become a significant driver for the identity verification market. Cybercriminals are employing more sophisticated techniques to steal personal information, which has led businesses across sectors to prioritize security. In particular, financial institutions, e-commerce platforms, and social media networks are prime targets for identity fraud, resulting in substantial financial losses and reputational damage.

This growing threat has forced companies to adopt stronger identity verification measures to safeguard their customers’ sensitive information. Fraudulent activities such as phishing, synthetic identity fraud, and account takeovers are rampant, leading to higher investments in technology to combat these risks. The cost of data breaches is increasing, prompting businesses to seek more advanced solutions, such as biometric verification and two-factor authentication, to ensure they can accurately verify the identity of users.

- Rising Digitalization and Online Transactions:

The global shift towards digitalization is one of the most significant factors boosting the identity verification market. With consumers and businesses embracing digital platforms for transactions, the need for secure identity verification has become crucial. Industries such as banking, e-commerce, and fintech have seen exponential growth in online transactions, making secure identification a priority to protect against fraud and ensure compliance with regulatory standards.

As companies expand their digital operations, they face the challenge of verifying the identity of users without compromising the speed and ease of online transactions. This has led to the rise of digital identity verification tools that offer real-time authentication, which not only enhances security but also improves user experience.

- Regulatory Compliance:

Stringent regulations around know your customer (KYC), anti-money laundering (AML), and general data protection regulation (GDPR) have become critical drivers for the identity verification market. Governments across the globe have implemented rules requiring organizations, especially in the financial sector, to verify the identities of their clients to prevent money laundering, fraud, and other illicit activities. Failure to comply with these regulations can result in heavy fines, legal issues, and reputational damage.

This has prompted businesses to adopt comprehensive identity verification solutions that ensure compliance with regulatory requirements. KYC mandates, particularly in financial institutions, require companies to perform thorough identity checks on their customers before offering services. Similarly, AML regulations compel organizations to monitor transactions and identify suspicious activities, making reliable identity verification essential.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=4704&flag=C

Identity Verification Market Report Segmentation:

Breakup By Type:

- Biometrics

- Non-Biometrics

Biometrics account for the majority of shares due to its high accuracy, security, and growing use in identity verification across multiple industries.

Breakup By Component:

- Solutions

- Services

Solutions dominates the market because organizations require comprehensive identity verification tools that offer end-to-end security and compliance.

Breakup By Deployment Mode:

- On-premises

- Cloud-based

On-premises represents the majority of shares as many companies prioritize control, security, and regulatory compliance over cloud-based alternatives.

Breakup By Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises hold the majority of shares due to their need for advanced security measures and complex identity verification systems to manage a vast user base.

Breakup By Vertical:

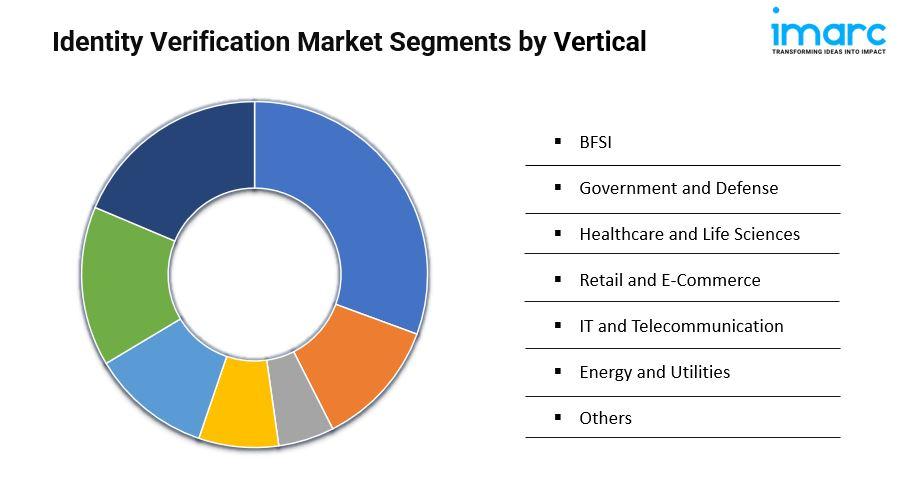

- BFSI

- Government and Defense

- Healthcare and Life Sciences

- Retail and E-Commerce

- IT and Telecommunication

- Energy and Utilities

- Others

BFSI exhibits a clear dominance as it faces stringent regulatory requirements and high risks of fraud, driving demand for robust identity verification.

Breakup By Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America holds the leading position owing to its advanced technological infrastructure, stringent regulations, and widespread digital adoption.

Top Identity Verification Market Leaders: The identity verification market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

- Acuant Inc.

- AuthenticID Inc.

- Equifax Inc.

- Experian PLC

- Intellicheck Inc.

- Jumio Corporation

- Mastercard Inc.

- Mitek Systems Inc.

- Onfido

- Thales Group

- TransUnion

- Trulioo

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1–631–791–1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology