Online Trading Platform Market Scope, Share, Size, Growth, and 2032 Forecast

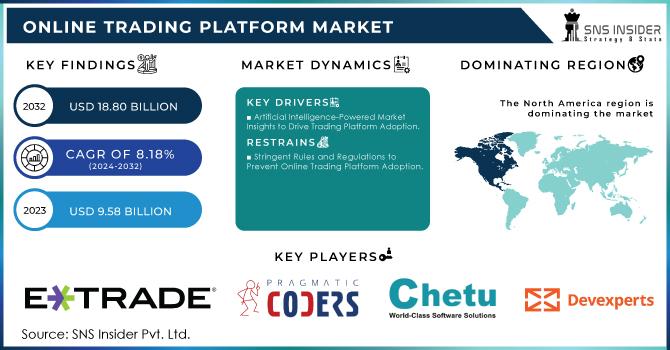

Online Trading Platform Market size was valued at USD 9.58 Billion in 2023 and is expected to grow to USD 18.8 Billion by 2032 and grow at a CAGR of 8.18% over the forecast period of 2024-2032.

The report is useful for existing companies, prospective entrants, and possible investors since it gives a thorough market assessment across important geographies such as North America, Europe, Asia Pacific, Middle East, Latin America, and the Rest of the World. For all of the segments covered in the research scope, the most recent Online Trading Platform Market analysis examines global and regional market estimations and predictions. The analysis uses previous market data to estimate revenue. Market trends, top companies, supply chain trends, technological improvements, significant developments, and future strategies are all covered in this report.

Download Sample Copy of this Report: https://www.snsinsider.com/sample-request/3350

Online Trading Platform Market Key Players:

l MetaQuotes Software Corp. (MetaTrader 4, MetaTrader 5)

l TD Ameritrade (thinkorswim, Mobile Trader)

l Interactive Brokers (Trader Workstation, IBKR Mobile)

l Charles Schwab Corporation (Schwab Mobile, StreetSmart Edge)

l E*TRADE (Power ETRADE, ETRADE Pro)

l Saxo Bank (SaxoTraderGO, SaxoInvestor)

l Robinhood Markets Inc. (Robinhood Web, Robinhood App)

l Fidelity Investments (Active Trader Pro, Fidelity Mobile)

l IG Group (IG Trading Platform, ProRealTime)

l Plus500 (Plus500 WebTrader, Plus500 App)

l CMC Markets (Next Generation Platform, CMC Mobile Trading App)

l eToro (eToro CopyTrader, eToro WebTrader)

l Binance (Binance Exchange, Binance DEX)

l Coinbase Global, Inc. (Coinbase Pro, Coinbase Wallet)

l TradingView (TradingView Web Platform, TradingView Mobile App)

l Zerodha (Kite, Coin by Zerodha)

l Ally Invest (Ally Invest LIVE, Ally Invest Mobile)

l TradeStation (TradeStation Platform, TradeStation Mobile)

l OANDA Corporation (OANDA fxTrade, OANDA Mobile)

l IQ Option (IQ Option Platform, IQ Option Mobile) and others

The Online Trading Platform market is experiencing significant growth as more investors turn to digital solutions for trading stocks, cryptocurrencies, and other financial instruments. These platforms provide users with convenient access to global markets, offering a range of tools for analysis, real-time data, and user-friendly interfaces that cater to both novice and experienced traders. The rise of mobile trading applications has further democratized access to financial markets, allowing individuals to trade anytime and anywhere.

A combination of primary and secondary sources were used to produce the Online Trading Platform Market statistics. Sales revenue from all of the identified segments and sub segments in the study scope is used to compute the market size. For data validation and accuracy checks, the market sizing analysis uses both top-down and bottom-up methodologies. Other areas of the sector have been evaluated, such as the supply chain, downstream buyers, and sourcing strategy, to provide a comprehensive and in-depth understanding of the market. The study's purchasers will also be subjected to a market positioning analysis, which will take into account aspects such as target consumer, brand strategy, and pricing strategy.

Market Segmentation

The segment study of the Online Trading Platform Market will help determine how each segment will influence market growth in the next years. The research report also examines all market categories and sub-segments in order to determine the market's true potential.

By Component

l Platform

l Services

By Deployment

l On-premise

l Cloud

By Application

l Institutional Investors

l Retail Investors

By Type

l Commissions

l Transaction Fees

By End-Users

l Banking and Financial Institutions Investors

l Retail Investors

l Brokers

l Others

Browse Complete Report: https://www.snsinsider.com/reports/online-trading-platform-market-3350

Competitive Outlook

The analysis includes current company profiles, gross margins, selling price, sales income, sales volume, product specs with photographs, and contact information for each of the market's major competitors. A descriptive section in the report's conclusion highlights the feasibility of new projects that may succeed in the worldwide market in the near future, as well as the global market's overall scope in terms of investment feasibility in different segments of the Online Trading Platform Market.

Key Highlights of the Online Trading Platform Market Report

· The influence of COVID-19 on firm operations and revenue creation in the target market

· Accurate forecasts of future trends and discernible shifts in consumer behavior

· Detailed information on the variables that will drive market growth over the next few years

· Providing specific details on the reasons that will limit the market's growth.

· An in-depth look at the competitive landscape of the market, as well as thorough information on individual vendors.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology