The global disposable gloves market size is anticipated to reach USD 16.77 billion by 2030, It is expected to expand at a CAGR of 8.4% from 2024 to 2030, according to a new report by Grand View Research, Inc. The market is anticipated to grow significantly over the coming years on account of several factors including favorable occupational safety regulations, increasing importance of safety and security at workplaces, rising healthcare expenditure, and the outbreak of the COVID-19 pandemic.

The heightened awareness regarding the importance of hand protection in healthcare settings, food handling, and diverse industrial applications has significantly contributed to the expansion of the market. Furthermore, strict regulations and standards pertaining to safety and hygiene in sectors like healthcare, food processing, and pharmaceuticals have played a pivotal role in driving the demand for disposable gloves.

The healthcare industry in major developing economies is poised for notable growth due to various factors, including increased investments in both public and private sectors, a growing population, a rising geriatric demographic, and a substantial influx of migrants. Additionally, the surge in healthcare expenditure is expected to fuel the expansion of the healthcare sector, consequently boosting the demand for medical disposable gloves throughout the forecast period.

Gather more insights about the market drivers, restrains and growth of the Disposable Gloves Market

Detailed Segmentation:

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The disposable gloves market is characterized by a high degree of competition, with a few key players dominating the industry. Major players in the market often have a global presence, supplying products to various regions and industries. Companies in this sector usually offer a diverse range of disposable gloves, catering to different industries such as healthcare, food, pharmaceuticals, and industrial sectors.

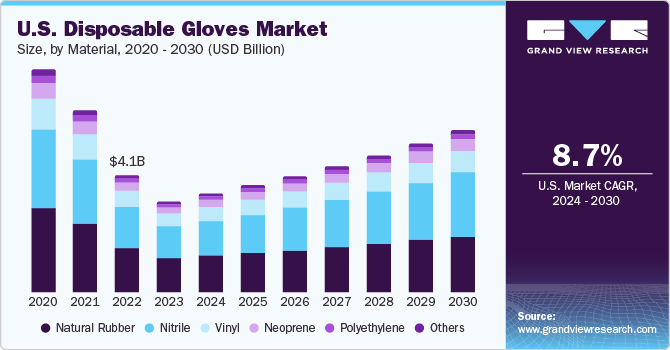

Material Insights

Natural rubber (latex) led the market and accounted for 36.7% of the global revenue demand in 2023. Natural rubber disposable gloves offer superior performance and protection in various applications such as medical & dental, food processing & service, janitorial & sanitation, pharmaceutical, and automotive. However, allergy caused by natural latex acts as a significant restraint in the latex medical gloves market. This has limited the penetration of natural rubber gloves in the medical and food industries. Nitrile emerged as the fastest growing material used for disposable owing to the latex-free, chemical resistance, and long shelf life offered by nitrile gloves. Owing to these properties nitrile has found itself to be one of the highest penetrated materials within the disposable surgical gloves market. Disposable examination gloves have witnessed significant growth in the medical & healthcare sector on account of higher demand product in hospital, veterinary, and dental applications further driving the disposable nitrile gloves market and cleanroom disposable gloves market.

Product Insights

The powder-free product segment led the market and held significant share of the market in 2023. Stringent regulations on the use of powdered gloves by several governments worldwide are expected to have a positive impact on the powder-free gloves market over the forecast period. Powder-free gloves are treated with chlorination, which makes them less form-fitting to eliminate the use of powder for easy donning and removal. Rising preference for powder-free gloves across several industries, including chemical, medical, and food processing, among others, is projected to drive the market over the forecast period.

End-use Insights

The medical end-use segment dominated the market in 2023. Regions with advanced healthcare systems and a large geriatric is expected to boost the disposable medical gloves market. Additionally, global events that heighten awareness of hygiene, such as pandemics, can significantly boost market demand, especially in the healthcare sector. Disposable gloves are often classified based on application as surgical gloves and examination gloves. Disposable examination gloves have witnessed substantial growth in the medical sector on account of higher demand in hospital, veterinary, and dental applications. Surgical disposable gloves have high-quality standards compared to examination gloves and are commonly used by surgeons and operating room nurses.

Regional Insights

North America led the market and accounted for 37.3% of the global revenue share in 2023. The region has experienced a substantial surge in demand for disposable gloves due to the onset of the COVID-19 outbreak. This trend is further propelled by heightened healthcare spending, the expansion of the elderly demographic, and an increased consciousness regarding healthcare-associated infections. The upgrading of the public healthcare system and infrastructure coupled with investments in new facilities are part of the reform plan. These developments are expected to drive the demand for medical equipment and devices. The demand for hand protection equipment such as disposable and durable gloves is anticipated to witness growth owing to the expanding medical sector in the country.

Browse through Grand View Research's Specialty Polymers Industry Research Reports.

• The global rigid packaging market size was valued at USD 479.9 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.0% from 2024 to 2030.

• The global thermoplastic polyolefins market size was valued at USD 4.52 billion in 2023 and is anticipated to grow at a CAGR of 6.7% from 2024 to 2030.

Key Companies & Market Share Insights

Some prominent players in the disposable gloves market include: Top Glove Corporation Bhd, Hartalega Holdings Berhad, Ansell Ltd, Kossan Rubber Industries Bhd

• Top Glove is one of the largest manufacturers of rubber gloves globally. The company produces a wide range of disposable gloves, including latex, nitrile, and vinyl gloves. It serves various industries such as healthcare, food, and industrial sectors.

• Hartalega, specializes in the production of nitrile gloves. Known for its focus on innovation and technology, Hartalega is a key player in the disposable gloves industry, supplying gloves to healthcare and laboratory settings.

Key Disposable Gloves Companies:

• Ansell Ltd

• Top Glove Corporation Bhd

• Hartalega Holdings Berhad

• Supermax Corporation Berhad

• Kossan Rubber Industries Bhd

• Ammex Corporation

• Kimberly-Clark Corporation

• Sempermed USA, Inc

• MCR Safety

Disposable Gloves Market Report Segmentation

Grand View Research has segmented the global disposable gloves market based on material, product, end-use, and region:

Disposable Gloves Material Outlook (Revenue, USD Million, 2018 - 2030)

• Natural Rubber

• Nitrile

• Vinyl

• Neoprene

• Polyethylene

• Others

Disposable Gloves Product Outlook (Revenue, USD Million, 2018 - 2030)

• Powdered

• Powder-free

Disposable Gloves End-Use Outlook (Revenue, USD Million, 2018 - 2030)

• Healthcare

• Construction

• Manufacturing

• Oil & Gas

• Chemicals

• Food

• Pharmaceuticals

• Transportation

• Mining

• Others

Disposable Gloves Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o UK

o France

o Russia

o Italy

o Spain

• Asia Pacific

o China

o India

o Japan

o Australia

o South Korea

o Indonesia

o Thailand

o Malaysia

• Central & South America

o Brazil

o Argentina

• Middle East & Africa

o Saudi Arabia

o UAE

o South Africa

Order a free sample PDF of the Disposable Gloves Market Intelligence Study, published by Grand View Research.

Recent Developments

• In February 2023, Ansell Ltd. announced the acquisition of Careplus (M) Sdn Bhd (Careplus). This acquisition increased Ansell’s production capacity of surgical gloves to meet the growing global demand and strengthen its supply chain and ensure greater control over the quality of its products.

• In August 2022, Supermax Corp Bhd's subsidiary, Supermax Healthcare Canada, unveiled a strategic partnership with Minco Wholesale & Supply Inc. through a formal agreement. This collaboration entails distributing Canadian manufacturer Supermax's products throughout North America. These offerings encompass rubber gloves, masks, and non-woven cotton medical products.