The global IT asset disposition market size was estimated at USD 20,513.0 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 13.3% from 2023 to 2030. The increasing electronic waste across the globe is the primary growth driver. According to Global E-waste Monitor Statistics (formed by the UN along with other associations such as the International Solid Waste Association, International Telecommunication Union, and UN Environment Programme), 53.6 million metric tons of electronic waste was generated in the year 2019, which has been anticipated to increase to 74 million metric tons by 2030. The increased generation of electronic waste has resulted in the high growth of the ITAD market.

Data theft is among the significant factors that have been decelerating the market's growth, owing to the secretive nature of the data handled by government agencies. However, many companies in the IT asset disposition market have been coming up with facilities for IT asset disposition, with special care taken towards data destruction, enabling the market to get back on track in terms of growth. For instance, in October 2022, NCS Global Services LLC (a U.S.-based IT asset disposition company) opened a new IT asset disposition facility in Los Angeles to cater to demand among West Coast customers. The facility is NAID AAA and ISO standards certified.

The company offers asset recovery, data destruction, and lifecycle management services. The presence of companies in the ITAD market that comply with various regulatory standards enables fewer chances of data theft, resulting in broader adoption of ITAD services among various businesses and government organizations. The wider adoption is expected to accelerate the growth of the market over the forecast period.

Gather more insights about the market drivers, restrains and growth of the Global It Asset Disposition Market

Asset Type Insights

The smartphones & tablets segment is expected to witness the highest CAGR over the forecast period. The consumption of smartphones and tablets has been high over the years. For instance, according to the Telecom Regulatory Authority of India, the number of wireless telephone subscribers in the country as of June 30th, 2022, was 1,147.4 million. The high number of smartphone/tablet users also means that the amount of waste generated is larger, which has been a significant contributor to the development of the smartphone and tablet segment.

Mobile phone wastage has been increasing over the years, which companies in the ITAD market have been trying to capture. For instance, according to the international Waste from Electrical and Electronic Equipment (WEEE) forum, in 2022, at a global level, 5.3 billion mobile phones were thrown away. The WEEE forum also states that electrical and electronic waste will increase to 74 million tons annually by 2030.

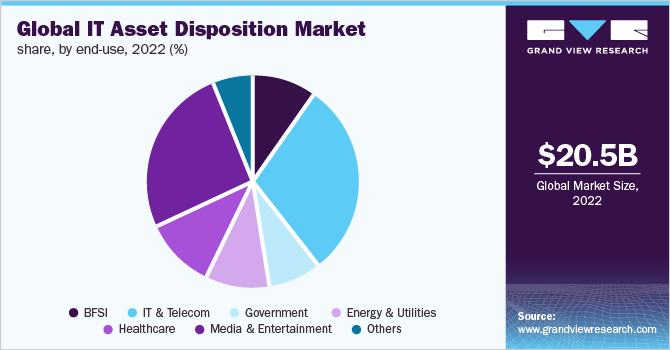

End-use Insights

The IT & telecom segment is anticipated to occupy the largest revenue share by 2030. The growth of the telecommunication industry has been significant since the number of internet users has increased. For instance, according to The World Bank Group, 91% of Germans and 99% of Denmark's population accessed the internet in 2021.

The increased number of internet users has driven the requirement for assets such as switches, telecom towers, routers, and fiber optic cables, among others. This increased usage of IT assets has also resulted in increased wastage, which has contributed to the development of the IT & telecom segment.

Browse through Grand View Research's Technology Industry Research Reports.

· Bicycle Trip Market: The global bicycle trip market size was estimated at USD 1,360.4 million in 2024 and is projected to grow at a CAGR of 14.5% from 2025 to 2030.

· APAC E-bikes Market: The APAC e-bikes market size was estimated at USD 16.27 billion in 2024 and is expected to grow at a CAGR of 10.9% from 2025 to 2030.

Regional Insights

Asia Pacific is expected to occupy the largest share of the market throughout the forecast period. Moreover, the region is expected to witness the highest CAGR during the same period. The growth can be attributed to stringent regulations coming up in several Asian countries, which have forced businesses to opt for ITAD solutions, thereby driving this market growth.

· Restricted use of hazardous substances

· Increased range of electronic goods

· Extended producer responsibility certificate

· Ensuring the recycling of 60% of electronic waste by producers of electronic goods

Key Companies & Market Share Insights

The market is competitive due to numerous prominent companies such as Dell Inc.; Iron Mountain Incorporated; Ingram Micro; and Sims Recycling Ltd. Companies have been focusing on strategic initiatives, which include product innovations, R&D investments, and value-added features, to expand their product portfolios and increase their market share. The companies engage in several strategic initiatives aimed at delivering solutions with enhanced functionalities.

For instance, in September 2022, tradefinity GmbH (a German IT asset disposition provider) joined EPC, Inc. (a U.S.-based ITAD solution provider). tradefinity GmbH will enhance its capabilities in Europe by joining forces and bringing 30 experienced employees to locations in Hamburg and Frankfurt. This collaboration will enable sustainable and secure ITAD services for large and medium enterprises throughout the region. Some prominent players in the global IT Asset Disposition market include:

· Apto Solutions Inc.

· CompuCom Systems, Inc.

· Dell Inc.

· Hewlett Packard Enterprise Development LP

· IBM Corporation

· Ingram Micro Services

· Iron Mountain

· ITRenew

· LifeSpan International Inc.

· Sims Lifecycle Services, Inc.

Order a free sample PDF of the It Asset Disposition Market Intelligence Study, published by Grand View Research.