Nanosatellite and Microsatellite Market 2030: Analyzing the Impact of Regulatory Changes

Report Overview

The global nanosatellite and microsatellite market size was valued at USD 2.12 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) exceeding 23.3% from 2022 to 2030. The growing demand for miniaturized satellites across multiple verticals is expected to provide an impetus to market growth. For instance, in November 2021, a Japan-based Epsilon rocket launched nine miniature satellites into orbit in the latest endeavor to encourage educational institutions and businesses to participate in space exploration.

The launch of small satellites via heavy vehicles has proved to be quite challenging over the recent years, resulting in the increased demand for small launch vehicles. Earlier, small satellites were launched as an additional payload with larger satellites, which increased launch and cost constraints. The growing demand for small launch vehicles that can overcome these cost constraints culminated in the development of Small Satellite Launch Vehicles (SSLVs). For instance, in April 2022, China's scientists worked on a fleet of small satellites for cutting-edge astronomical investigations.

Gather more insights about the market drivers, restrains and growth of the Global Nanosatellite And Microsatellite Market

Mass Insights

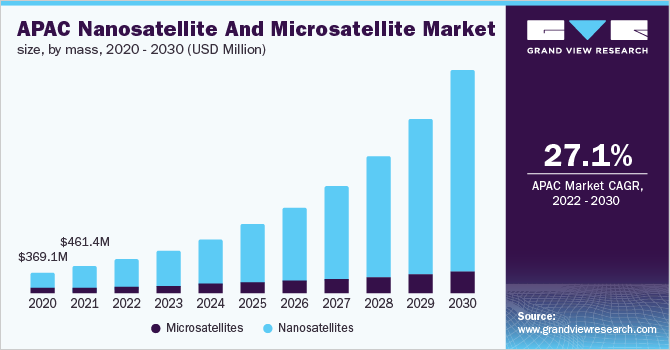

The nanosatellites segment accounted for a revenue share of more than 79% in 2021 owing to the growing deployment of a nanosatellite for Earth observation missions. The data from Earth observation satellites have proven to be significantly beneficial for applications such as improving water management, tracking refugee populations, carrying out relief operations, and national defense. A nanosatellite has further revolutionized navigation and transportation capabilities, resulting in improved safety records, efficient routes, and lower operating costs.

Application Insights

The Earth observation/remote sensing segment accounted for a revenue share of more than 51% in 2021 as several governments continued to invest in Earth observation and meteorology projects. For instance, according to the U.S. Group on Earth Observations, the U.S. government allocates more than USD 3 billion per annum for civil Earth observations and space-related missions.

End-use Insights

The commercial segment dominated the market for nanosatellite and microsatellite with a revenue share of more than 44% in 2021 owing to an increase in communication, broadcasting, and navigation activities. For instance, in March 2021, Open Cosmos launched two commercial nanosatellites, which demonstrated the ability of low-cost satellites to deliver IoT connectivity and data collection to remote places of the world. According to the Satellite Industry Association (SIA), the demand for broadband satellites is expected to grow at a CAGR of 29% by 2024.

Regional Insights

North America dominated the nanosatellite and microsatellite market with a revenue share of over 47% in 2021 owing to the increasing investments in space-related activities. For instance, every year, NASA allocates a specific budget for space-related activities, including science, aeronautics, space technology, exploration, and other space operations. Moreover, the rise in the demand for small satellites from different end-use sectors such as research organizations, military & defense, and telecommunications has provided an impetus to the regional market growth.

Key Companies & Market Share Insights

Nanosatellite and microsatellite have witnessed substantial growth in terms of spacecraft development, building, and launches over the past decade. The CubeSat concept enabled companies to find a different role in satellite design compared to their traditional roles. Moreover, large system integrators dominated the space industry for a long time but advances in the small satellite industry allowed smaller companies such as Innovative Solutions in Space (ISIS) and Tyvank Inc. to emerge and have a more established role at the forefront of the small satellite industry.

For instance, in March 2021, Rocket Lab USA, a public American aerospace manufacturer and small satellite launch service provider launched seven small satellites into the Earth’s orbit, including its spacecraft for future missions. The seven payloads sent into space included an Earth-observation microsatellite and two "internet of things" nanosatellites. Furthermore, there were three experimental satellites onboard and a tech-demo CubeSat for the U.S. Army's Space and Missile Defense Command (SMDC).

Browse through Grand View Research's Communication Services Industry Research Reports.

- Finance And Accounting Business Process Outsourcing Market Size, Share & Trends Analysis Report By Services (Order-to-Cash, Procure-to-Pay, Record-to-Report), By Enterprise Size, By Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Video Conferencing Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Deployment (On-premise, Cloud), By Enterprise Size, By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

Some prominent players in the global nanosatellite and microsatellite market include:

- Dauria Aerospace

- GomSpace

- Innovative Solutions in Space (ISIS)

- Sierra Nevada Corporation (SNC)

- Spire Global, Inc.

- SpaceQuest Ltd.

- Surrey Satellite Technology Limited (SSTL)

- The Boeing Company

- Tyvak Inc.

- Vector Launch, Inc

Nanosatellite And Microsatellite Market Segmentation

Grand View Research has segmented the global nanosatellite and microsatellite market based on mass, application, end-use, and region:

Nanosatellite And Microsatellite Mass Outlook (Revenue, USD Million, 2017 - 2030)

-

- Nanosatellites

- Microsatellites

Nanosatellite And Microsatellite Application Outlook (Revenue, USD Million, 2017 - 2030)

-

- Communication & Navigation

- Earth Observation/Remote Sensing

- Scientific Research

- Technology & Academic Training

Nanosatellite And Microsatellite End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

- Government

- Defense & Security

- Commercial

- Civil

Nanosatellite And Microsatellite Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- Asia Pacific

- China

- India

- Japan

- Latin America

- Brazil

- Mexico

- Middle East & Africa

Order a free sample PDF of the Nanosatellite And Microsatellite Market Intelligence Study, published by Grand View Research.

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Explore Horizon, the world's most expansive market research database

- nanosatellite_and_microsatellite

- nanosatellite_and_microsatellite_Market

- nanosatellite_and_microsatellite_Market_Size

- nanosatellite_and_microsatellite_Market_Share

- nanosatellite_and_microsatellite_Market_Growth

- nanosatellite_and_microsatellite_Market_Trends

- nanosatellite_and_microsatellite_Market_Analysis

- nanosatellite_and_microsatellite_Market_Forecasts

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology