The global student information system market size was valued at USD 8.05 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 20.3% from 2023 to 2030. The increasing digitalization in the education industry, growing inclination towards e-learning, and improving quality of education are contributing to the growth. The outbreak of the COVID-19 pandemic is expected to drive the demand for Student Information System (SIS) due to the high demand for online education. As per the data published by UNESCO, 1.3 billion learners globally were unable to go to their educational institutes in March 2021 and needed online education to continue with the tuition for the academic year 2020 - 2021. The adoption of eLearning technologies gained traction during the COVID-19 outbreak and is expected to progressively increase post the pandemic to tackle a similar situation in the future.

The market growth is also bolstered by the emergence of the Internet of Things (IoT), edge computing, and 5G telecommunication. The advanced student information systems essentially focus on analytics, mobile analytics, mobile applications, behavior tracking, and cloud accessibility. The explosion of connected mobile devices is facilitating the addition of numerous mobile apps for increased convenience for students and their parents. The ongoing trends like migration to the cloud and mobile accessibility are fostering the integration of artificial intelligence into these applications. Moreover, the growing emphasis of educational institutions on providing quality education and simplifying communication between faculty, students, and parents, for upgrading education infrastructure is expected to proliferate the use of SIS software and services.

Gather more insights about the market drivers, restrains and growth of the Global Student Information System Market

Detailed Segmentation:

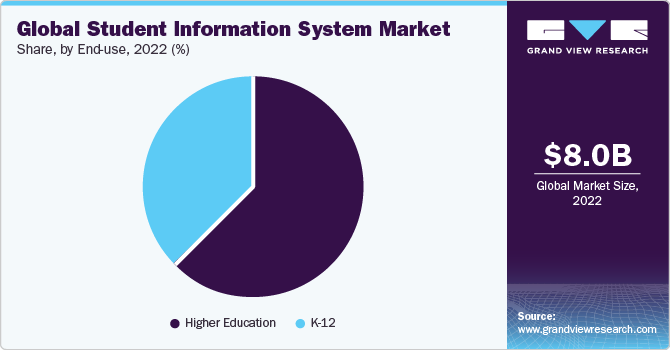

End-use Insights

The higher education segment accounted for the largest revenue share of 63.4% in 2022 and is estimated to register the fastest CAGR of 20.5% over the forecast period. The growth in the number of universities worldwide, the rise in educational hardware (virtual reality headsets, podcasts, and interactive whiteboards), the shift toward digitized learning content, and gamification are driving the growth of the segment. Moreover, the scalability and flexibility offered by online learning platforms are likely to aid segmental growth in the forthcoming years. For instance, in June 2021, the University of Illinois Urbana-Champaign Grainger College of Engineering announced a partnership with the IBM Corporation to strengthen the college's workforce and research development efforts in various fields such as AI/machine learning, quantum information technology, and environmental sustainability.

Component Insights

The software segment led the student information system market with a revenue share of 75.8% in 2022. Educational institutions are increasingly looking for solutions that can easily align with their internal processes and improve their efficiency. With the growing emphasis on operational efficiency, for educational institutions, the demand for student information system software sees a significant uptick. Moreover, institutions are leveraging SIS to enhance education quality while keeping expenditures minimum. These systems provide real-time analytics dashboards and leverage modern best practices and technology to recruit, retain, and develop top faculty and staff. These factors are fostering the growth of the software segment over the forecast period.

Deployment Insights

The cloud segment accounted for the highest revenue share of 62.6% in 2022 and is anticipated to register the fastest CAGR of 22.2% over the forecast period. The growth can be attributed to the increased institutional agility, provision of flexible access to solutions, and reduced costs associated with the storage of solutions and technical staff. Moreover, cloud-based solutions allow effective knowledge delivery to students and efficient management of business processes, resulting in better collaboration among stakeholders, easy access, and data security. Thus, the growing need for a centralized system to manage the competition among institutions and academic processes is creating more growth opportunities for cloud-based student information systems.

Application Insights

The admission & recruitment segment accounted for the highest revenue share of 30.6% in 2022. Several schools and universities are unifying their technology portfolio into one integrated software solution. The software helps institutions with the admission procedure, admission form collection, listing, and admitting the students with the help of a single data entry in the centralized database. However, several students are studying across universities around the globe, which are bound by certain obligations that evaluate student applications based on varying parameters, which can be catered to by the deployment of admission management software, which is one of the major factors driving the segment forward.

Browse through Grand View Research's Technology Industry Research Reports.

- Cognitive Computing Market: The global cognitive computing market size was estimated at USD 50.76 billion in 2024 and is projected to grow at a CAGR of 28.4% from 2025 to 2030.

- Advanced Analytics Market: The global advanced analytics market size was estimated at USD 75.89 billion in 2024 and is anticipated to grow at a CAGR of 26.4% from 2025 to 2030.

Regional Insights

North America held the largest revenue share of 33.4% in 2022 of the global market for student information systems. The growth is propelled by the increasing penetration of emerging technologies including IoT, cloud, big data, and digital transformation. The region is also gaining from the introduction of advanced solutions from leading players and ongoing efforts to upgrade student information system solutions with sophisticated technologies. For instance, in October 2021, Jenzabar, Inc., a U.S.-based higher education software solutions provider, launched Jenzabar Communications, to help institutions eliminate communication silos, and connect multiple departments across campus. A rise in preference for SIS deployment to create a secure and dependable structure between students and school administration in universities, driving the regional market growth.

Key Companies & Market Share Insights

The leading players in the market are undertaking strategies such as product developments, mergers and acquisitions, strategic partnerships, and business expansions to maintain their stronghold on the market.

For instance, in November 2021, Campus Management Corp. (Anthology Inc.) announced a partnership with Together We Rise, a nonprofit organization, to provide service opportunities for Anthology employees and monetary support for Together We Rise initiatives. This partnership includes virtual service opportunities for Anthology employees to build education-related kits for students in foster care, including back-to-school, tech, and STEM packs. Additionally, product differentiation and upgrading in the form of cloud services are expected to pave the way for the growth of companies in the market.

In December 2021, Illuminate Education announced the partnership with the Association of Supervision and Curriculum Development (ASCD), to expand its CaseNEX (an online course powered by Illuminate Education) professional development course offerings with resources from ASCD, such as the ASCD Activate Professional Learning Library. With the help of this partnership, CaseNEX offers professional development opportunities for educators to enhance their skills, maintain certifications, and earn university credits.

Key Student Information System Companies:

- Oracle

- Workday, Inc.

- SAP SE

- Jenzabar, Inc.

- Skyward, Inc.

- Illuminate Education.

- Ellucian Company L.P.

- Anthology Inc.

- Foradian Technologies.

- Beehively

Order a free sample PDF of the Student Information System Market Intelligence Study, published by Grand View Research.