Air and Missile Defense Radar Market Analysis with Israel–Hamas War Impact on Business Growth, and Forecast 2024-2032

Air and Missile Defense Radar (AMDR) Market to Reach USD 13.4 Billion by 2032, Driven by Increasing Geopolitical Tensions and Technological Advancements

The Air and Missile Defense Radar (AMDR) market is experiencing significant growth due to escalating geopolitical tensions and the need for advanced defense systems.

The SNS Insider report indicates that the Air and Missile Defense Radar (AMDR) Market was valued at USD 7.67 billion in 2023 and is projected to grow to USD 13.4 billion by 2032, achieving a CAGR of 6.34 % over the forecast period from 2024 to 2032.

The increasing need for robust air and missile defense systems is largely influenced by global security concerns and rising defense budgets across nations. Countries are actively enhancing their military capabilities to counter potential threats from hostile nations and non-state actors. The market for AMDR is expanding due to advancements in radar technologies, including phased-array radars, which provide greater accuracy and quicker response times. Moreover, the rise in demand for integrated defense systems is propelling market growth as nations look for comprehensive solutions that can provide real-time situational awareness and threat detection. These systems can significantly enhance operational efficiency by utilizing Artificial Intelligence (AI) and machine learning to analyze vast amounts of data from various sources, thereby improving decision-making processes. In addition to national security, defense organizations are increasingly focusing on modernization programs to replace aging systems with cutting-edge technology that meets contemporary operational requirements. This trend is particularly prevalent in countries like the United States, China, and India, which are investing heavily in their military infrastructure.

Book Your Sample Report @ https://www.snsinsider.com/sample-request/2240

Key Players:

- Thales

- SAAB

- Rockwell Collins

- Raytheon

- Northrop Grumman

- Lockheed Martin

- Israel Aerospace Industries

- Honeywell International

- Boeing

- BAE Systems

Several factors are contributing to the growth of the Air and Missile Defense Radar market. The increasing frequency of military conflicts and the rise of asymmetric warfare tactics necessitate enhanced surveillance and interception capabilities. Governments are responding by investing in advanced radar technologies to safeguard their airspace and critical infrastructure. Technological advancements also play a vital role in the expansion of the AMDR market. Innovations in radar signal processing, target tracking, and data fusion capabilities enhance the performance of defense systems. Additionally, government initiatives aimed at boosting domestic defense production and collaboration between military and industry stakeholders further drive investments in radar systems.

Segmentation analysis

By Platform

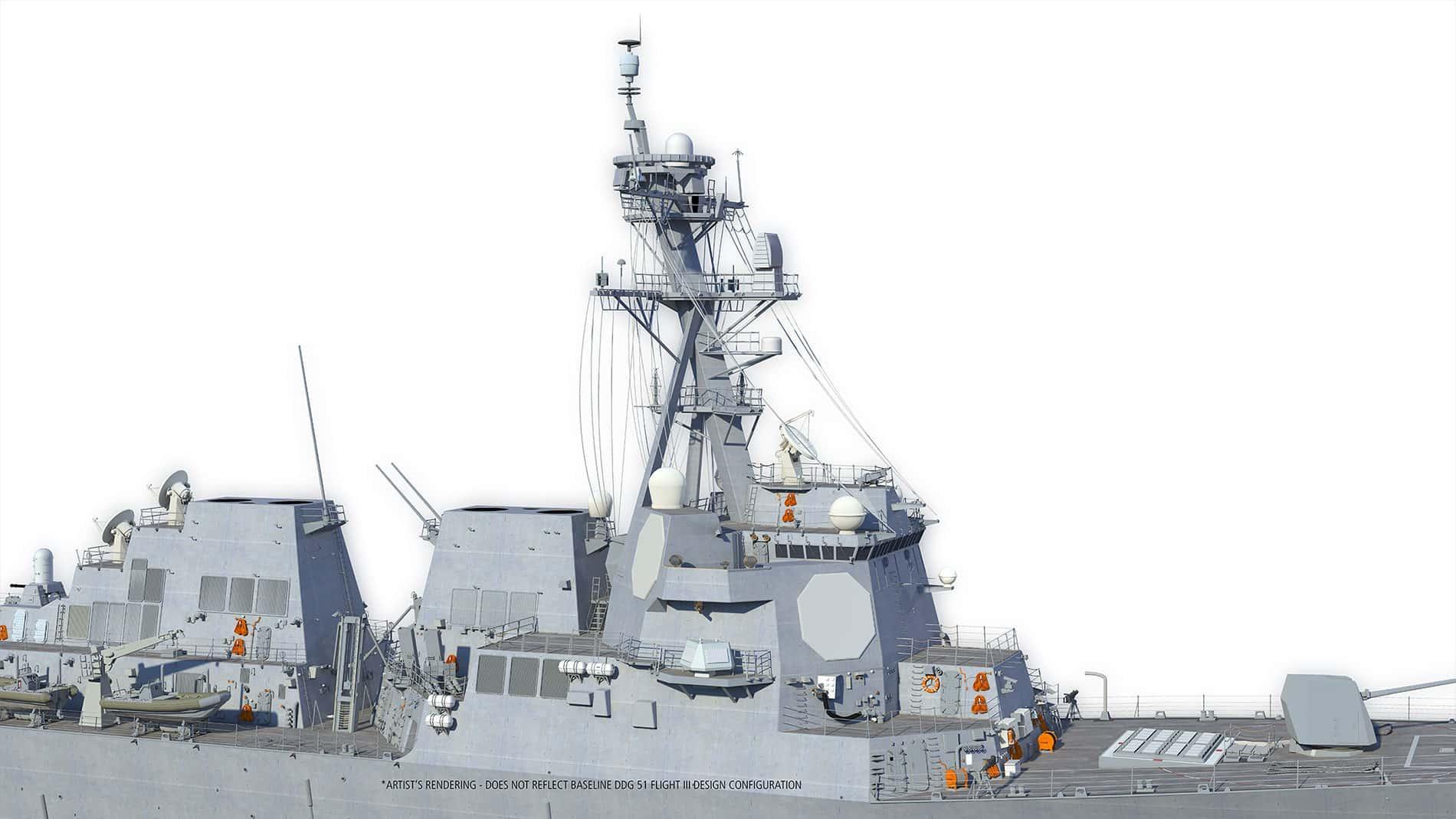

In 2023, the naval segment dominated the air and missile defense radar market, capturing the largest share. Land-based radars are anticipated to experience the fastest growth during the forecast period, fueled by rising demand from countries such as Canada, Taiwan, Japan, and India. Meanwhile, the airborne segment is expected to see moderate growth due to increasing demand for new fighter jets and the modernization of onboard radars globally.

By Application

The ballistic missile defense segment is projected to experience the highest CAGR from 2024 to 2032, fueled by advancements in ballistic missile technology and the growing deployment of such weapons. In March 2022, the U.K. announced a USD 700 million contract for the acquisition of an S-band ballistic missile defense radar from the U.S. In contrast, conventional radars are expected to see moderate growth, bolstered by increased investments from defense agencies globally. For instance, in the aftermath of the Russia-Ukraine war, several European nations have accelerated their procurement of air defense systems. Germany became the first country to acquire an Arrow 3 missile interceptor from Israel following the conflict, while the Czech Republic and other countries are also looking to purchase the Iron Dome system from Israel.

Regional Landscape

North America is expected to be the largest market, with land-based radars in the region projected to experience the fastest growth. Canada has committed to a USD 4.9 billion investment aimed at upgrading its radar defense systems. The naval segment is expanding due to increased investments from the U.S. Navy in the procurement and modernization of its fleet of destroyers. In April 2022, the U.S. Navy announced plans to equip every warship with SPY-6 radars for effective tracking of missiles and aircraft.

The Asia Pacific market is forecasted to grow the fastest, driven by rising defense expenditures in countries such as China, India, and Japan. Escalating defense budgets, along with heightened cross-border tensions between China and Taiwan, India and China, and South and North Korea, are likely to propel market growth throughout the forecast period. In August 2022, Taiwan signed a USD 83 million contract with the U.S. for the Patriot 3 air defense system, which includes upgrading existing systems from Patriot-2 to Patriot-3, equipped with long-range missiles.

The European market is estimated to be the second largest in 2021 and is anticipated to witness considerable growth due to increased radar procurements as a precautionary measure against scenarios similar to the Russia-Ukraine conflict. In March 2022, France awarded Indra a contract to provide PSR2 radars for three air bases within the country. The PSR2 is an S-band radar designed to function effectively in rugged terrain and adverse weather conditions.

Recent Developments

In November 2022, TenneT, a leading transmission system operator in the Netherlands and Germany, announced its order for advanced high-voltage gas-insulated switchgear to bolster its power substations. This state-of-the-art equipment will be supplied by Hitachi Energy by the end of 2023 and will operate without using the environmentally harmful gas sulfur hexafluoride (SF6).

In March 2022, General Electric Renewable Energy Grid Solutions launched its latest series of high-voltage switchgear globally. The innovative 420 kV fully g3 gas-insulated switchgear (GIS), featuring a new g3 circuit breaker, is expected to enter the commercial market by the end of 2023.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Our staff is dedicated to giving our clients reliable information, and with expertise working in the majority of industrial sectors, we're proud to be recognized as one of the world's top market research firms. We can quickly design and implement pertinent research programs, including surveys and focus groups, and we have the resources and competence to deal with clients in practically any company sector.

Office No.305-B, Arissa Avenue, Fountain Road, Kharadi, Pune, Maharashtra 411014

Contact Us:

Akash Anand – Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

- Air_and_Missile_Defense_Radar_Market

- Air_and_Missile_Defense_Radar_Market_Size

- Air_and_Missile_Defense_Radar_Market_Share

- Air_and_Missile_Defense_Radar_Market_Growth

- Air_and_Missile_Defense_Radar_Market_Trends

- Air_and_Missile_Defense_Radar_Market_Analysis

- Air_and_Missile_Defense_Radar_Market_Forecast

- Air_and_Missile_Defense_Radar_Market_Industry

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology