Paint Protection Film Market 2030: The Shift Toward Eco-Friendly Solutions

Paint Protection Film Market Size & Trends

The global paint protection film market size was estimated at USD 499.7 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.9% from 2024 to 2030. The shift in consumer preference toward keeping the finish of their vehicles intact, coupled with the rising awareness among them for ensuring proper maintenance of their automobiles, is expected to fuel the demand for paint protection films worldwide.

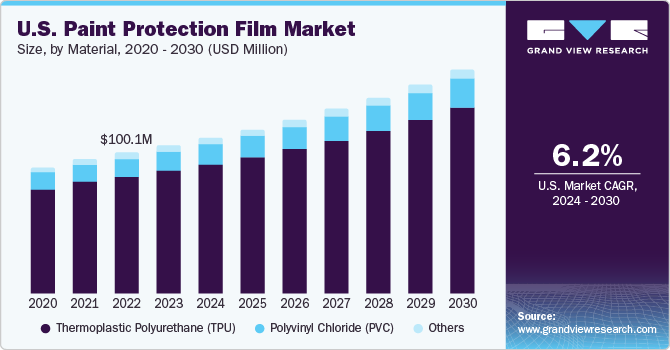

The U.S. is one of the leading automotive markets in the world. As such, the country is expected to witness significant demand for paint protection films throughout the forecast period. The presence of major paint protection film (PPF) manufacturers and many of their installers in the U.S. is anticipated to further boost the market growth for these films in the country from 2024 to 2030. Increasing awareness among consumers regarding the benefits of paint protection films is expected to surge the consumption of these films in the U.S. during the next few years.

Gather more insights about the market drivers, restrains and growth of the Global Paint Protection Film Market

Material Insights

Based on material, the global market is segmented into thermoplastic polyurethane (TPU), polyvinyl chloride (PVC), and others. PPFs are high-grade thermoplastic polyurethane films that are either colored or translucent and are professionally applied to the uppermost layer of the vehicle's paint.

Application Insights

The automotive & transportation application segment held a 72.7% share of the overall market, in terms of revenue, in 2023. Increasing sales in countries such as India, China, and the U.S., are expected to augment the product demand during the next seven years. For instance, according to the Society of Indian Automobile Manufacturers (SIAM), sales of passenger cars increased from 1.46 million units to 1.75 million units in 2022 compared to the previous year.

Regional Insights

Based on region, Europe held the largest revenue share of 31.6% of the market in 2023. Europe has a robust automotive sector. According to the European Commission, the automotive sector in Europe represents more than 7% share of the European Union GDP and is linked with upstream and downstream industries such as textiles, chemicals, steel & mobility, repair, and ICT.

Browse through Grand View Research's Paints, Coatings & Printing Inks Industry Research Reports.

- Industrial Coatings Market Size, Share & Trends Analysis Report By Technology (Water-borne, Solvent-borne), By Product (Acrylic, Polyurethane), By End-use (Marine, General Industrial), By Region, And Segment Forecasts, 2025 - 2030

- Powder Coatings Market Size, Share & Trends Analysis Report By Resin (Epoxy, Polyester, Acrylic, Other Resins), By Application (Architectural, Automotive, Consumer Goods), By Region, And Segment Forecasts, 2024 - 2030

Key Companies & Market Share Insights

Some of the key players operating in the market include 3M and XPEL, Inc.

- 3M is engaged in providing adhesives, sealants, consumer goods, tapes, films, and other allied products. The key business divisions of the company include safety & industrial, healthcare, transportation & electronics, and consumer. Paint protection films are manufactured by the company through its films segment under the safety & industrial business division. 3M produces automotive films, electronics films, paint protection films, window films, and architectural finishes under the brand name Scotchgard. The Scotchgard Paint Protection Film Pro Series offers superior protection to automotive surfaces against weathering, chips, and scratches. Internationally, 3M operates 89 manufacturing facilities in 30 countries.

- XPEL, Inc. manufactures, distributes, and installs aftermarket automotive products in the U.S., Canada, and the UK. In the U.S., Canada, and parts of Europe, the company operates primarily by selling complete paint protection film solutions directly to independent installers and car dealerships with the products including XPEL protection films, installation training, and access to the company’s proprietary design software, marketing support, and lead generation. The company operates six company-owned installation centers in the U.S. and one installation center each in the UK, and the Netherlands, which serve the wholesale and retail customers. It operates through third-party distributors in the rest of the world, who operate under contracts with the company to distribute and install the company’s products. The product portfolio of XPEL Technologies Corp. includes paint protection films, automotive window films, flat glass window films, and plotters.

Key Paint Protection Film Companies:

- 3M

- XPEL Inc.

- Schweitzer-Mauduit International, Inc.

- Eastman Chemical Company

- Avery Dennison Corporation

- Saint-Gobain S.A.

- RENOLIT SE

- Ziebart International Corporation

- Hexis S.A.S

- Garware Hi-Tech Films Ltd.

- Paint Protection Film Market Segmentation

Grand View Research has segmented the global paint protection film market report based on material, end-use, and region:

Paint Protection Film Material Outlook (Volume, Thousand Sq. Meters; Revenue, USD Million, 2018 - 2030)

- Thermoplastic Polyurethane (TPU)

- Polyvinyl Chloride (PVC)

- Others

Paint Protection Film End-use Outlook (Volume, Thousand Sq. Meters; Revenue, USD Million, 2018 - 2030)

- Automotive & Transportation

- Electrical & Electronics

- Aerospace & Defence

- Others

Paint Protection Film Regional Outlook (Volume, Thousand Sq. Meters; Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Norway

- Netherlands

- Russia

- Asia Pacific

- China

- Japan

- India

- Australia

- Thailand

- South Korea

- Indonesia

- Malaysia

- Central & South America (MEA)

- Brazil

- Argentina

- Middle East and Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

Order a free sample PDF of the Paint Protection Film Market Intelligence Study, published by Grand View Research.

Recent Developments:

- In May 2023, Covestro AG, a Germany-based company, announced the launch of its new production line in Taiwan for the manufacturing of high-performance TPU suited for paint protection film grades. The company also introduced a new series of paint protection film, Desmopan UP TPU, designed for the automotive and wind sectors.

- In October 2022, XPEL, Inc. acquired the paint protection film business of Car Care Products Australia. The Car Care Products Australia is a distributor of automotive protective films with a strong presence in Australia. This acquisition can enable XPEL, Inc. to expand its reach in Australia.

- In July 2022, XPEL, Inc. was selected as the exclusive supplier to Rivian Automotive LLC for its new paint protection film (PPF) factory. The companies will cooperatively develop paint protection films and offer factory direct PPF options for the R1S and R1T vehicle models.

- In February 2022, XPEL, Inc. launched ULTIMATE FUSION, its newest paint protection film offering protection against light scratches, bird droppings, bug acids, and rock chips. ULTIMATE FUSION will be available globally in the second quarter of 2022.

- In June 2022, HEXIS S.A.S. introduced three new paint protection films series under the HEXIS BODYFENCE range. The new film series launched were BFWIDE, DFENCEXTRM, and BODYFENCEXM. The self-healing properties of these films will enable HEXIS S.A.S. to expand its product reach in automobile industry.

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Explore Horizon, the world's most expansive market research database

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology