Contactless Payment Market Research | Comprehensive Market Analysis and Trends

Contactless Payment 2024

In recent years, contactless payment technology has transformed the way consumers engage in everyday transactions, offering a faster, more convenient, and secure alternative to traditional payment methods. From tapping a card or smartphone to making purchases with wearable devices, the rise of contactless payments has been fueled by advancements in digital technology and increasing consumer demand for seamless, touch-free transactions. As businesses and customers alike adapt to these innovations, the Contactless Payment Market Growth has seen a significant boost, positioning it as a critical component of the global payments ecosystem.

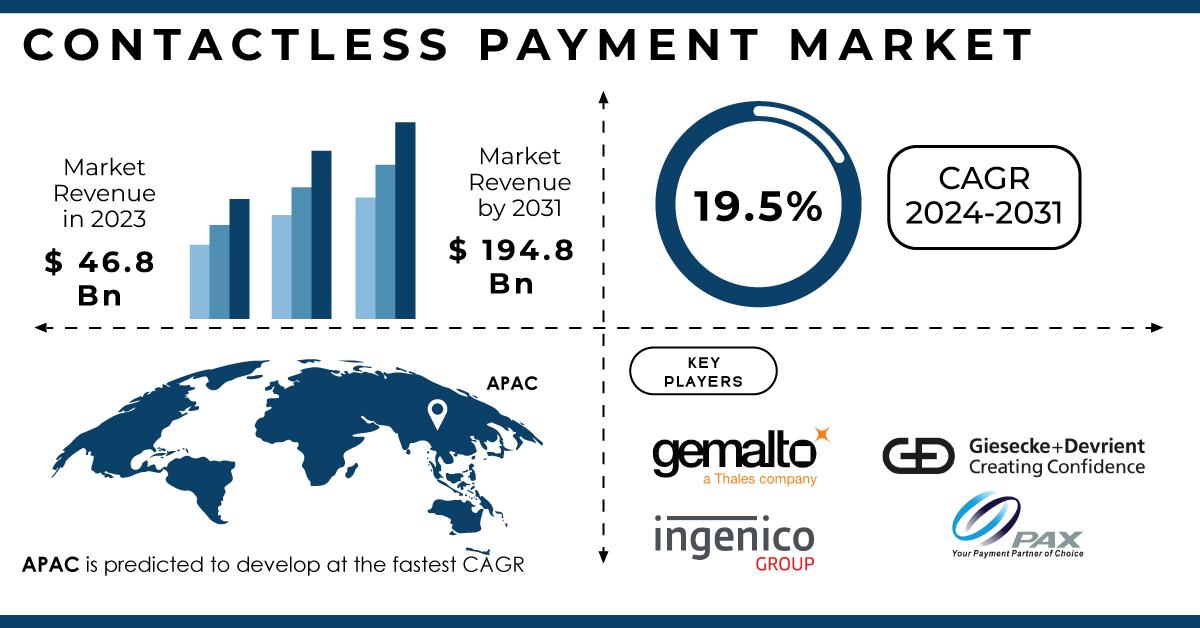

The COVID-19 pandemic further accelerated the adoption of contactless payments, as health concerns prompted businesses and consumers to minimize physical contact during transactions. Beyond hygiene, the technology offers other substantial benefits, such as enhanced security through encryption, improved efficiency by reducing transaction time, and the ability to integrate with various digital platforms like mobile wallets. These features have solidified contactless payments as the preferred method for millions around the globe. Contactless Payment Market was valued at USD 20.21 Billion in 2023 and is expected to reach USD 440 Billion by 2032, growing at a CAGR of 41.31% over the forecast period 2024-2032.

Key Growth Drivers of Contactless Payments

Several factors are driving the rapid growth of the contactless payment market. The global shift toward digitalization is a leading catalyst, as more businesses invest in the infrastructure needed to facilitate digital transactions. From small retailers to large enterprises, the adoption of contactless point-of-sale (POS) systems is on the rise, allowing customers to make quick and secure payments without the need for physical cash or inserting a card.

Another key driver is the growing consumer preference for convenience. Contactless payment methods eliminate the need for PIN entry or signatures for small transactions, making the checkout process faster and more efficient. Additionally, the rise of mobile wallets, such as Apple Pay, Google Pay, and Samsung Pay, has empowered users to link multiple payment options to their smartphones, providing an even more versatile payment experience. This trend is expected to continue as more consumers become accustomed to the convenience of mobile-based, tap-to-pay technologies.

Security and Efficiency in the Digital Age

Security remains a top priority in the contactless payment space. The technology is equipped with multiple layers of security, including tokenization and encryption, which protect cardholder information during transactions. Unlike traditional magnetic stripe or chip-based card payments, where sensitive data could potentially be compromised, contactless payments generate unique transaction codes for each purchase, significantly reducing the risk of fraud.

Additionally, the integration of near-field communication (NFC) technology in contactless payment systems ensures that transactions are conducted within close proximity, adding another layer of security. These advancements reassure both businesses and consumers that contactless payments are not only more efficient but also a safer alternative to cash or chip-based card transactions.

The Global Impact of Contactless Payments

As contactless payment solutions expand globally, their impact is particularly notable in regions such as North America, Europe, and Asia-Pacific. North America continues to lead the market due to the widespread adoption of advanced payment technologies and the presence of key players. However, Asia-Pacific is experiencing rapid growth, driven by increasing smartphone penetration, the rise of e-commerce, and the adoption of mobile wallets. Countries like China, India, and Japan are witnessing a surge in contactless transactions, further fueling the market’s expansion.

In Europe, contactless payments are becoming a standard feature across multiple industries, from retail to public transport. Governments and financial institutions are playing a crucial role in promoting the adoption of this technology, encouraging a cashless society where digital payments are the norm. As more regions implement supportive regulatory frameworks and technological infrastructure, the contactless payment market will likely continue to thrive globally.

Future Outlook for Contactless Payments

Looking ahead, the future of contactless payments is expected to be defined by continued innovation and expansion. Emerging technologies like blockchain, biometrics, and artificial intelligence (AI) are poised to enhance the functionality and security of contactless transactions. These advancements will likely pave the way for new payment methods and applications, including the integration of cryptocurrencies and AI-powered fraud detection systems.

Furthermore, as the Internet of Things (IoT) grows, we can expect contactless payment capabilities to extend beyond smartphones and cards to a wider range of connected devices, such as smart appliances, wearables, and even autonomous vehicles. This evolution will unlock new opportunities for businesses and consumers alike, creating a more interconnected and efficient payments ecosystem.

Conclusion

The contactless payment market is experiencing unprecedented growth, driven by technological advancements, consumer demand for convenience, and the need for secure, efficient transactions. As the global market continues to expand, businesses that embrace contactless payment solutions will be well-positioned to meet the evolving needs of today’s digital consumers, making this technology a cornerstone of future payment systems.

Contact Us:

Akash Anand – Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

About Us

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Our Other Reports:

- Contactless_Payment_Market

- Contactless_Payment_Market_Size

- Contactless_Payment_Market_Share

- Contactless_Payment_Market_Growth

- Contactless_Payment_Market_Trends

- Contactless_Payment_Market_Report

- Contactless_Payment_Market_Analysis

- Contactless_Payment_Market_Forecast

- Contactless_Payment_Industry

- Contactless_Payment_Market_Research

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology