Key End-Uses Driving Growth in the Minimally Invasive Surgical Instruments Market

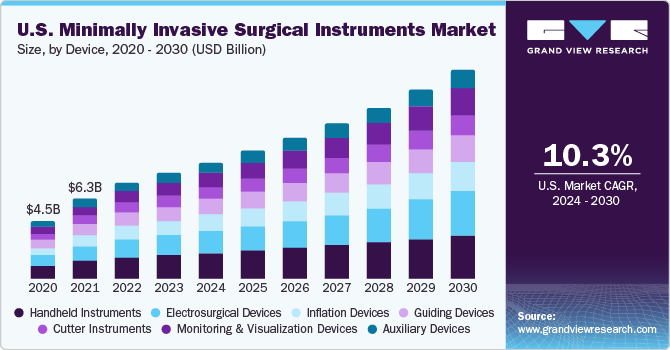

The global minimally invasive surgical instruments market was valued at USD 31.65 billion in 2023 and is projected to grow at a CAGR of 10.4% from 2024 to 2030. One of the primary catalysts for this growth is the advent of surgical robots, which have significantly transformed the field of minimally invasive surgeries (MIS). The increasing acceptance of these robotic systems by surgeons worldwide is indicative of their effectiveness and potential to enhance surgical outcomes.

A noteworthy advantage of MIS procedures is their cost-effectiveness compared to traditional open surgeries. The expenses associated with MIS are considerably lower, leading to equal or improved patient outcomes. This affordability translates into enhanced value for both patients and insurance providers, making minimally invasive options more appealing. As healthcare systems and providers seek ways to optimize costs while delivering quality care, the trend towards MIS is expected to gain momentum in the coming years.

The market is also witnessing an increasing number of new product launches and growing product approvals from various industry players, all vying for a larger share of this lucrative market. For example, in December 2022, Abbott announced the launch of Navitor, an advanced transcatheter aortic valve implantation system designed for aortic stenosis management. Such innovations highlight the continuous advancements in minimally invasive technologies, which not only enhance procedural efficiency but also expand the range of conditions that can be treated using these techniques.

Gather more insights about the market drivers, restrains and growth of the Minimally Invasive Surgical Instruments Market

End-Use Insights

The global minimally invasive surgical instruments market is further segmented based on end-use, primarily into hospitals and ambulatory surgical centers (ASCs). In 2023, the hospitals segment captured the largest revenue share at 68.8%. This dominance can be attributed to the increasing prevalence of chronic disorders among the aging population, which leads to a higher number of hospital admissions for chronic disease treatments. Hospitals play a crucial role in managing complex health conditions, necessitating the use of advanced surgical instruments for effective treatment.

Conversely, the ASCs segment is projected to experience the fastest growth rate from 2024 to 2030. According to a report by Becker's ASC Review published in 2019, there are over 5,480 Medicare-certified ambulatory surgery centers in the U.S. These centers are becoming increasingly popular due to their ability to provide efficient and cost-effective surgical procedures. The availability of reimbursement policies for ambulatory surgical procedures is a significant factor driving growth in this segment. ASCs offer a convenient alternative for patients who require surgery but prefer a less complex hospital environment, thus enhancing the accessibility of surgical care.

Technological Advancements

Technological advancements are key drivers in the minimally invasive surgical instruments market. Innovations in robotic surgery, 3D imaging, and augmented reality are continuously enhancing the precision and efficacy of surgical procedures. These advancements not only improve surgical outcomes but also reduce recovery times and hospital stays, further increasing the attractiveness of minimally invasive options for both patients and healthcare providers.

Additionally, ongoing research and development efforts are leading to the introduction of new materials and instruments that improve patient safety and outcomes. Enhanced visualization tools and sophisticated surgical instruments enable surgeons to perform complex procedures with greater accuracy and less trauma to surrounding tissues.

Challenges and Considerations

Despite the promising growth of the minimally invasive surgical instruments market, there are challenges to consider. High costs associated with advanced surgical instruments and robotic systems can be a barrier for some healthcare facilities, particularly in developing regions. Additionally, the need for specialized training for surgeons and operating room staff is crucial for the successful implementation of these technologies. As healthcare providers strive to keep up with technological advancements, investments in training and education will be necessary to ensure optimal outcomes.

Order a free sample PDF of the Minimally Invasive Surgical Instruments Market Intelligence Study, published by Grand View Research.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology