Clinical Decision Support Systems Market Expansion: Opportunities in Telehealth Solutions

The global market for clinical decision support systems (CDSS) was estimated at USD 5.30 billion in 2023 and is forecasted to grow at a compound annual growth rate (CAGR) of 10.79% from 2024 to 2030. Over the past few decades, CDSSs have evolved significantly, becoming essential tools that help healthcare professionals make better, evidence-based decisions in patient care. These systems have shown great promise in improving patient outcomes and reducing overall healthcare costs.

Artificial intelligence (AI) and machine learning (ML) are reshaping the CDSS landscape by introducing advanced capabilities such as predictive analytics, pattern recognition, and personalized recommendations. AI-driven CDSSs can analyze large datasets, recognize patterns, predict outcomes, and suggest optimal treatment options. For instance, in December 2022, researchers at the Dell Medical School, University of Texas at Austin, developed an AI-powered CDSS to assist clinicians in discussing nutrition and guiding patients on improving their diets.

Gather more insights about the market drivers, restrains and growth of the Global Clinical Decision Support Systems Market

The growing trend towards personalized medicine has seen CDSS play a pivotal role. By analyzing patient data, including genetic information and medical history, these systems help tailor treatment plans to individual patients, improving treatment efficacy and minimizing the risk of adverse reactions. This trend is expected to drive market growth.

Governments worldwide are promoting the adoption of CDSS and other healthcare IT solutions through regulations and incentives. These policies aim to enhance patient safety, improve interoperability between systems, and boost the quality of care, which compels healthcare organizations to adopt CDSS to meet regulatory standards and qualify for incentives.

The COVID-19 pandemic has accelerated the adoption of CDSS, as these systems played a crucial role in resource allocation and real-time clinical diagnosis and patient triage. Countries providing online services further contributed to market growth. For example, Epocrates introduced a CDSS tool in May 2022 for managing long COVID-19, expanding clinical decision support capabilities. This increase in CDSS adoption during the pandemic has driven market growth.

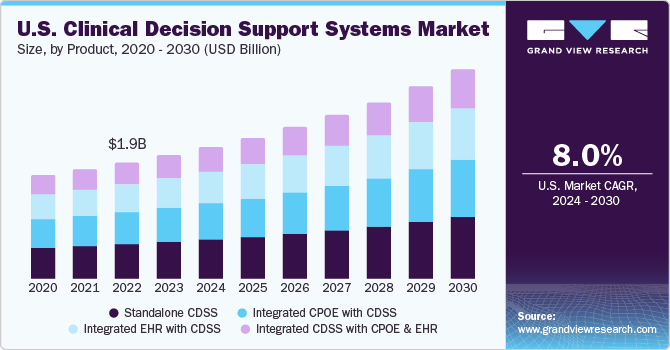

Product Insights

The standalone CDSS segment led the market with over 30.0% of total revenue in 2023 due to its low cost and simplicity. These systems are widely used in hospitals and clinical settings as they do not require standardization or in-depth clinical expertise and can function without patient data, making them user-friendly and easy to implement.

The integrated Electronic Health Records (EHR) with CDSS segment is anticipated to grow at the fastest CAGR during the forecast period, owing to the increasing adoption of EHRs in multi-specialty healthcare facilities. Integrated systems give CDSSs access to patient databases and medical histories, helping to automate clinical workflows. In April 2023, the U.S. government proposed a rule that would allow healthcare providers more comprehensive access to information within their EHR systems, supporting CDSS evaluation and outcomes. This integration is expected to boost growth as more CDSS functions are incorporated into EHRs.

Delivery Mode Insights

On-premise CDSS solutions dominated the market in 2023 with a revenue share of 42.35%. These systems are favored by large healthcare organizations and multi-specialty hospitals because they offer more flexibility for customization and can be integrated with existing healthcare systems and workflows, providing better control over data within their infrastructure. This integration allows for seamless data flow and improved decision support.

Cloud-based CDSS solutions are expected to experience the fastest growth during the forecast period. These systems offer significant advancements in IT, providing reliability, cost-effectiveness, and accessibility through mobile platforms. They also feature robust data protection mechanisms, which, along with their independence from web browsers, make them highly secure and user-friendly.

Application Insights

The drug allergy alerts segment held the largest revenue share of over 25.0% in 2023. CDSSs are extensively used to enhance patient safety by preventing adverse drug reactions (ADRs). These systems allow for the customization of alerts based on individual patient profiles and specific allergy information. Healthcare providers can adjust alert thresholds and preferences to ensure they are relevant and actionable for each patient. The growing prevalence of drug allergies is boosting the adoption of CDSS in this segment. For example, the CDC reports that around 10% of the U.S. population is allergic to penicillin.

The clinical guidelines segment is expected to grow at the fastest rate during the forecast period. CDSSs provide clinical guidelines to assist in diagnosis and treatment, delivering critical real-time information at the point of care. These systems automate routine tasks, alert clinicians to potential issues, and offer recommendations, enhancing both clinical decision-making and patient outcomes. As defined by the American Medical Informatics Association (AMIA), CDSS is a tool to empower clinicians, patients, and stakeholders, improving healthcare services and decision-making.

Component Insights

The services segment led the market in 2023, accounting for a revenue share of 42.49%. This segment offers a wide range of services, including implementation, training, support, customization, and consulting, helping healthcare organizations to maximize the value of their CDSS software and optimize clinical decision-making. The need for ongoing technical support and training to ensure CDSS functionality and effective utilization has contributed to this segment's dominance.

The software segment is projected to grow at the fastest CAGR during the forecast period. CDSS software, when integrated with computerized provider order entry (CPOE) and EHR systems, provides enhanced decision support with personalized results for individual patients. Innovations in technical support, software interoperability, and more efficient outcomes are expected to drive growth in this segment. For example, in February 2024, Elsevier Health launched ClinicalKey AI, the first clinical decision support tool in the U.S. to combine current medical content with generative AI, aiding clinicians at the point of care.

Order a free sample PDF of the Clinical Decision Support Systems Market Intelligence Study, published by Grand View Research.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology