Component Insights: What Shapes the Anti-Money Laundering Market?

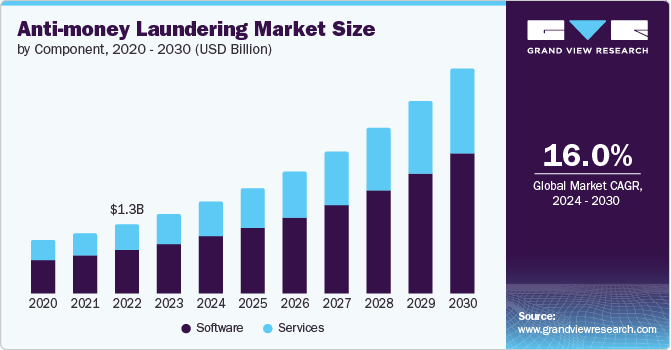

The global anti-money laundering market was valued at USD 1.51 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 16.0% from 2024 to 2030. This growth is largely fueled by increasingly stringent regulatory requirements and the necessity for financial institutions to comply with international standards. Regulatory agencies worldwide, including the Financial Action Task Force (FATF), have been intensifying their efforts to combat money laundering and the financing of terrorism. This heightened regulatory pressure obliges financial institutions to implement advanced anti-money laundering solutions to ensure compliance and avoid significant penalties. Consequently, there has been a notable surge in the demand for robust anti-money laundering solutions, driving continuous development and enhancement of technology-driven innovations within this sector. Additionally, the rising complexity of financial crimes highlights the urgent need for sophisticated tools that can effectively monitor and analyze financial transactions.

Furthermore, the substantial growth in online businesses and electronic transactions in recent years has emerged as a key driver of the anti-money laundering market. The swift expansion of online marketplaces is primarily attributed to the convenience they offer to consumers. Additionally, an increasing number of financial institutions are launching innovative online banking services and digital transaction options, which further stimulate the growth of online commerce. Factors such as advancements in digital technology and the rising popularity of mobile payment solutions are expected to accelerate the adoption of online transactions. By utilizing non-cash transactions, organizations can enhance transparency and more effectively monitor for any suspicious activities.

Gather more insights about the market drivers, restrains and growth of the Anti-Money Laundering Market

Component Insights

In terms of components, the software segment led the market in 2023, accounting for 63.1% of the global revenue. This segment's growth can be largely attributed to the increasing demand for anti-money laundering software among banks and payment solution providers. Such software plays a crucial role in detecting suspicious activities and minimizing the number of legitimate transactions that are incorrectly declined. Moreover, advanced technologies like artificial intelligence, machine learning, and big data analytics are being integrated into anti-money laundering software. These integrations allow for real-time analysis of extensive data sets, significantly enhancing the effectiveness of anti-money laundering programs while simultaneously reducing the operational costs linked to manual compliance processes.

On the other hand, the services segment is projected to experience substantial growth from 2024 to 2030. This segment is gaining momentum as financial institutions seek expert guidance and support to effectively navigate the complexities associated with anti-money laundering (AML) compliance. Many companies worldwide are focusing on the development and launch of AI-powered anti-money laundering services aimed at helping banks mitigate AML risks. For example, in April 2024, Oracle introduced an AI-powered cloud service known as the Oracle Financial Services Compliance Agent. This service is designed to assist banks in addressing AML risks more effectively. It facilitates scenario testing, helps identify suspicious activities, and optimizes transaction monitoring systems. By leveraging artificial intelligence and machine learning, this tool enhances the overall effectiveness of AML programs, contributing to cost reduction and improved decision-making capabilities.

Order a free sample PDF of the Anti-Money Laundering Market Intelligence Study, published by Grand View Research.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology