Mining Automation Market 2030: Trends Shaping the Future of Mineral Mining

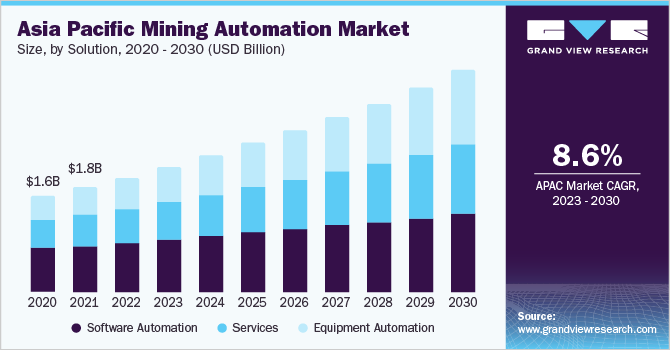

The global mining automation market was valued at USD 4.90 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. This growth is largely fueled by rapid technological advancements, particularly in Artificial Intelligence (AI) and robotics, which have led to a higher adoption of mining automation solutions aimed at enhancing production efficiency. The increasing inclination towards the implementation of innovative technologies is significantly propelling the demand for automated mining systems.

Additionally, the rise of the Internet of Things (IoT) within the mining sector is enabling mine management to access real-time data and analytics, facilitated by advanced visualization tools. Many mining operators are collaborating with technology companies to establish wireless networks in underground environments, which further enhances operational efficiency.

Gather more insights about the market drivers, restrains and growth of the Mining Automation Market

For example, in April 2021, International Business Machines Corp. (IBM) made headlines with its acquisition of myInvenio, an Italian startup specializing in process mining software. This acquisition aims to integrate myInvenio's process and task mining technology into IBM Cloud for Robotization, which is a platform designed to optimize and manage robotic operations. By leveraging this data-driven software and its associated tools, companies can improve tracking across various functions such as sales, production, procurement, and accounting.

Moreover, the growing emphasis on mine and worker safety is also contributing to the expansion of the industry. Traditional mining methods have often compromised the safety of workers, resulting in heightened risks at mining sites. This increasing focus on safety is driving further adoption of automated solutions, which can mitigate hazards and improve working conditions.

Solution Segmentation Insights

The software automation segment led the market in 2022, capturing over 42.10% of the global revenue. This dominance highlights the growing reliance on advanced software solutions within the mining industry. Looking ahead, the equipment automation segment is anticipated to experience considerable growth during the forecast period. This surge is largely driven by the development of advanced technology-based vehicles, including autonomous trucks, remote-controlled machinery, and teleoperated mining equipment, all of which are expected to significantly enhance operational efficiency and safety in mining operations.

Ongoing advancements in hardware automation technology are likely to continue streamlining large-scale mining practices around the world. For instance, Rio Tinto, a U.K.-based mining and metals company known for producing copper, minerals, iron ore, and aluminum, has implemented nearly 400 Autonomous Haulage Systems (AHS)-enabled haul trucks at its Pilbara mine in Australia. The company plans to further expand its driverless truck initiative by retrofitting trucks from Caterpillar Inc. and 29 haul trucks from Komatsu Ltd. for its Brockman 4 mining operation, enabling this site to operate entirely in driverless mode.

In addition to autonomous vehicles, teleoperated mining equipment—comprising wireless sensors, cameras, and Radio Frequency Identification (RFID) technologies—has become increasingly prevalent in the industry. These innovations facilitate more precise monitoring and control of mining operations, contributing to enhanced safety and efficiency on site.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology