Neobanking Market Regional Outlook, Key Players Analysis

Neobanking 2024

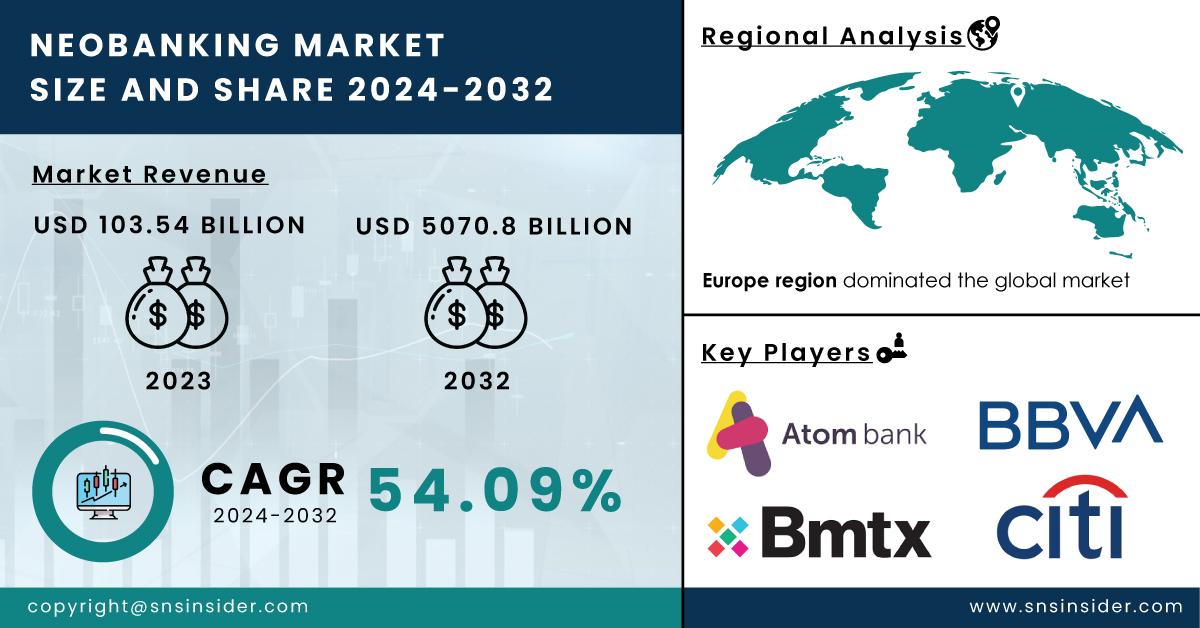

Neobanking, a term that refers to fully digital banks operating without physical branches, is reshaping the landscape of financial services. These tech-driven institutions provide banking services exclusively through mobile apps and online platforms, making banking more accessible and user-friendly. The Neobanking Market Growth reflects this transformation, with the market valued at USD 103.54 billion in 2023 and projected to grow to USD 5070.8 billion by 2032, experiencing a remarkable CAGR of 54.09% over the forecast period from 2024 to 2032.

Understanding Neobanking

Unlike traditional banks that rely on a network of physical branches, neobanks are designed to meet the evolving needs of tech-savvy consumers who prioritize convenience and efficiency. They leverage technology to offer a wide range of services, including account management, money transfers, and financial advice, all at the fingertips of users. This approach eliminates many of the hassles associated with conventional banking, such as long wait times and extensive paperwork.

Neobanks typically partner with existing financial institutions or use innovative technology solutions to provide their services. This allows them to operate with lower overhead costs, enabling them to pass on savings to their customers in the form of lower fees or higher interest rates on deposits.

User-Centric Features and Innovation

One of the standout features of neobanking is its focus on user experience. Neobanks design their platforms with intuitive interfaces and seamless navigation, ensuring that customers can easily access their accounts and conduct transactions. This user-centric approach is essential in a competitive market where customer expectations are rapidly evolving.

Neobanks also offer innovative features that are often lacking in traditional banking. These may include budgeting tools, real-time transaction notifications, and integrated financial planning services. By providing customers with insights into their spending habits and financial goals, neobanks empower users to make informed financial decisions.

Additionally, many neobanks are built on a foundation of data analytics and artificial intelligence. This technology enables personalized financial services, allowing banks to tailor offerings based on individual customer preferences and behaviors. For instance, a neobank may analyze a user's spending patterns to suggest appropriate savings plans or investment opportunities.

Targeting Specific Market Segments

Neobanks have also carved out niche markets by focusing on specific demographics or financial needs. For example, some neobanks cater specifically to freelancers and gig economy workers, offering features that facilitate expense tracking and tax preparation. Others may target millennials and Gen Z consumers with attractive rewards programs or sustainability-focused initiatives.

By honing in on these market segments, neobanks create tailored experiences that resonate with their target audience. This strategic positioning allows them to build strong customer loyalty and differentiate themselves from traditional banks.

Challenges and Regulatory Landscape

Despite their rapid growth and popularity, neobanks face several challenges. One major concern is regulatory compliance. As they operate in a heavily regulated industry, neobanks must navigate complex financial regulations and ensure adherence to consumer protection laws. The need for transparency and accountability in financial services is paramount, and neobanks must demonstrate their commitment to these principles.

Additionally, as neobanks expand their services, they must address cybersecurity threats. Digital banking is not immune to fraud or data breaches, making it essential for neobanks to invest in robust security measures to protect customer data and maintain trust.

Future Outlook of Neobanking

The future of neobanking looks promising, with an increasing number of consumers embracing digital financial services. The COVID-19 pandemic accelerated the shift towards digital banking, as people sought safe and convenient ways to manage their finances without stepping into physical branches.

As technology continues to evolve, neobanks are well-positioned to adapt and innovate. Advancements in blockchain technology, biometrics, and AI will further enhance the security and efficiency of neobanking services. Moreover, the ongoing integration of fintech solutions will lead to even more personalized and streamlined banking experiences.

Conclusion

Neobanking represents a significant shift in the financial services industry, driven by technology and consumer demand for convenience. By offering user-friendly, innovative services and targeting specific market segments, neobanks are redefining what it means to bank in the digital age. As the Neobanking Market Growth suggests, the future of banking is not just about traditional institutions; it is about adapting to new technologies and evolving consumer needs to create a more inclusive and efficient financial landscape.

Contact Us:

Akash Anand – Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

About Us

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Our Other Reports:

Insurance Telematics Market Trends

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology