The global hydraulic cylinder market was valued at USD 15.32 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 4.2% from 2022 to 2030. The increased adoption of hydraulic cylinders across diverse industries—including material handling, construction and infrastructure, marine, and earthmoving—is driving this growth. However, the COVID-19 pandemic introduced considerable volatility in global commodity prices, disrupting raw material supply and demand. Lockdown restrictions imposed to limit virus spread led to a significant economic downturn, deeply impacting production activities and, in turn, the demand for hydraulic cylinders.

In North America, the United States faced the highest number of COVID-19 cases, followed by Canada and Mexico. The pandemic negatively impacted supply chains and distribution networks, hindering market growth across the region. To counter these challenges, the U.S. government has been investing heavily in sectors such as construction, infrastructure, energy, and electric vehicle (EV) infrastructure. A notable example is the bipartisan infrastructure plan passed in November 2021, totaling over USD 1 trillion, which is expected to boost the demand for hydraulic cylinders.

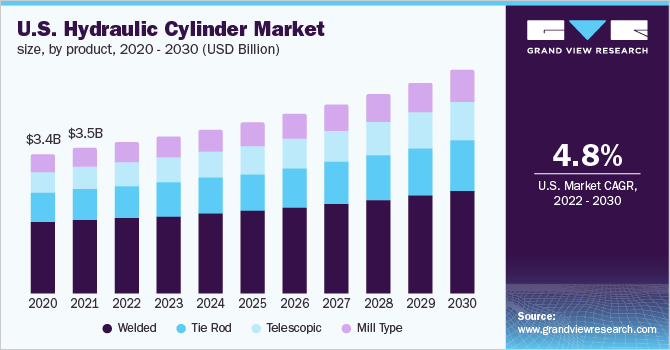

The United States is a significant market for hydraulic cylinders globally, largely due to the presence of a substantial number of machinery and equipment manufacturers. The U.S. economy continues to expand due to steady growth in goods and services production. However, factors like geopolitical tensions from the Russia-Ukraine conflict, rising inflation, and lingering effects of COVID-19 pose economic challenges.

Gather more insights about the market drivers, restrains and growth of the Global Hydraulic Cylinder Market

Function Insights

In 2021, double-acting hydraulic cylinders dominated the market, accounting for over 70% of global revenue. These cylinders are widely used in large-scale engines and equipment, such as ship engines, steam engines, industrial furnaces, and earthmoving and construction machinery. Growing demand for these applications is expected to further drive the market for double-acting hydraulic cylinders over the forecast period.

Single-acting hydraulic cylinders are projected to grow at a CAGR of 3.9% over the forecast period. Commonly used in hydraulic jacks, factory automation, package and material handling, clamping, handheld drilling, and punching, the expansion of these applications is anticipated to increase the adoption of single-acting hydraulic cylinders.

Product Insights

The welded hydraulic cylinder segment led the market in 2021, accounting for over 50% of global revenue. These cylinders are utilized across several industries, including construction, oil and gas, mining, waste management, and material handling, as well as heavy equipment. The rising use of welded hydraulic cylinders in these sectors is expected to drive the growth of this segment.

The telescopic cylinder segment is projected to grow at a notable CAGR of 5.3% over the forecast period. Available as both single-acting and double-acting models, telescopic cylinders offer versatile application in material handling, waste management, construction trucks, and agriculture, contributing to segment growth.

Mill-type hydraulic cylinders are also widely used in industries such as energy, oil and gas, mining, defense, automotive, primary metal refining, rubber and tire processing, and plastic molding. Growing investments in these industries are expected to boost demand for mill-type hydraulic cylinders over the forecast period.

Tie rod hydraulic cylinders are used in applications such as clamping, bending, shearing, forging, pressing, and counterbalancing. Their popularity is attributed to their short delivery times and cost-effectiveness, both of which are expected to support growth in this segment.

Application Insights

The mobile application segment led the market in 2021, capturing over 50% of global revenue. Hydraulic cylinders are widely employed in mobile applications such as loaders, excavators, cranes, and telescopic loaders. Increased investments by both governmental and private entities in these industries are driving demand for hydraulic cylinders in mobile applications.

In industrial applications, hydraulic cylinders are integral to processes such as forging, milling, drilling, casting, pressing, and shearing. They are commonly used in steel plant machinery, pulp and paper equipment, presses, and forklifts.

Demand for hydraulic cylinders is also rising in the energy and power sector, particularly in applications involving wind turbines, gate actuation, and valve actuation. As global energy consumption grows, new power projects are anticipated to drive demand for hydraulic cylinders in this sector.

Hydraulic cylinders have other significant applications, notably in aerospace, defense, and agriculture. In aerospace and defense, they are used in aircraft brakes, wheels, engine systems, flight controls, and armored personnel carriers. The anticipated growth in aircraft production and increased defense spending are expected to further propel demand for hydraulic cylinders in the coming years.

Order a free sample PDF of the Hydraulic Cylinder Market Intelligence Study, published by Grand View Research.