Platinum Group Metals Market Overview: Size, Share, and Industry Projections (2024-2032)

Platinum Group Metals Industry

Summary:

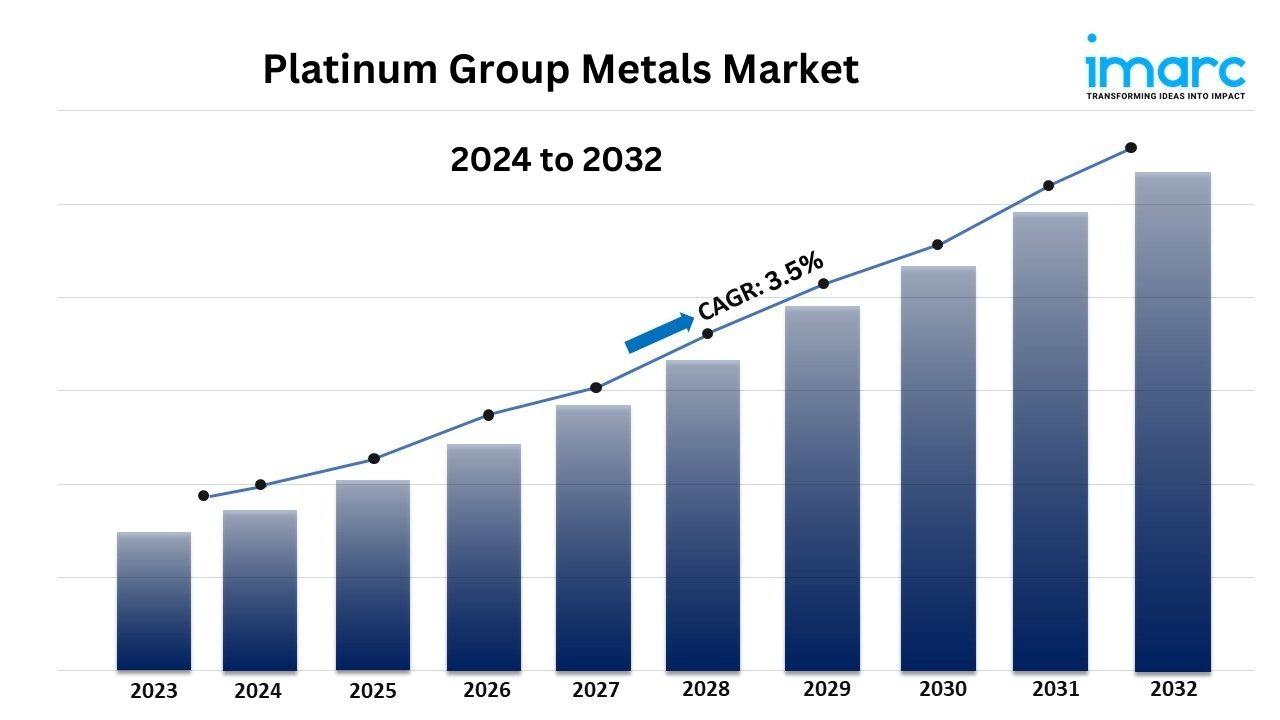

● The global platinum group metals market size reached USD 40.2 Billion in 2023.

● The market is expected to reach USD 55.0 Billion by 2032, exhibiting a growth rate (CAGR) of 3.5% during 2024-2032.

● Region-wise, the market has been divided into North America (the United States, Canada), Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others), Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others), Latin America (Brazil, Mexico, others), Middle East and Africa.

● Based on the metal type, the market has been segmented into platinum, palladium, rhodium, iridium, ruthenium, and osmium.

● On the basis of the application, the market has been segregated into auto catalysts, electrical and electronics, fuel cells, glass, ceramics and pigments, jewellery, medical (dental and pharmaceuticals), chemicals and others.

● The growing demand for automotive catalysts is a primary driver of the platinum group metals market.

● The platinum group metals market growth and forecast highlight a significant rise due to growth of the jewelry sector.

Industry Trends and Drivers:

● Rising Demand for Automotive Catalysts:

The industry is experiencing several platinum group metals market trends such as increasing demand for automotive catalysts, particularly due to stringent emission regulations across various regions. Platinum, palladium, and rhodium are critical components in catalytic converters, which are essential for reducing harmful emissions from internal combustion engines. As countries implement stricter environmental regulations aimed at curbing air pollution, automakers are compelled to incorporate more PGMs in their vehicles to meet these standards. Additionally, the growth of the electric vehicle (EV) market is influencing the PGM sector as manufacturers explore hybrid technologies that still rely on internal combustion engines alongside electric propulsion. This creates a dual demand scenario where PGMs are needed for both traditional gasoline vehicles and transitional hybrid models. Moreover, as governments push for cleaner transportation, there is a renewed interest in refining processes that enhance the efficiency of catalytic converters, further propelling the need for PGMs. The increasing focus on sustainability and compliance with environmental policies suggests that the demand for automotive catalysts will remain a driving force in the market enhancing platinum group metals demand.

● Expansion of the Jewelry Sector:

The platinum group metals market is also seeing growth driven by the expansion of the jewelry sector, where platinum is increasingly valued for its rarity and durability. As consumer preferences shift toward high-quality and luxurious products, the demand for platinum jewelry is on the rise. Platinum's unique properties, including its hypoallergenic nature and resistance to tarnishing, make it an attractive option for fine jewelry pieces, particularly engagement rings and wedding bands. This trend is particularly pronounced in emerging markets, where rising disposable incomes are fueling consumer spending on luxury goods. Additionally, the influence of social media and celebrity endorsements is contributing to the popularity of platinum jewelry, as more consumers seek distinctive and high-value items that symbolize status and personal style. As brands and designers innovate with platinum designs and incorporate PGMs into their offerings, the platinum group metals market share is expected to grow.

● Increasing Use in Electronics and Technology:

The platinum group metals market is witnessing a growing trend toward the increased use of PGMs in electronics and technology applications. As the demand for advanced electronic devices, such as smartphones, laptops, and high-performance computing systems, continues to rise, PGMs are becoming essential materials in various electronic components. Platinum and palladium are used in connectors, capacitors, and circuit boards due to their excellent conductivity and resistance to corrosion. Additionally, the push for miniaturization in electronics is driving manufacturers to seek materials that can maintain performance in smaller sizes, enhancing the appeal of PGMs. Furthermore, the development of new technologies, such as quantum computing and renewable energy systems, is creating additional opportunities for PGMs. For instance, platinum's role in fuel cells and hydrogen production is gaining prominence as industries look for sustainable energy solutions. As innovation in electronics and technology continues to evolve, the demand for platinum group metals is expected to grow, highlighting the expansion of platinum group metals market size.

For an in-depth analysis, you can request a sample copy of the report: https://www.imarcgroup.com/platinum-group-metals-market/requestsample

Platinum Group Metals Market Report Segmentation:

Breakup By Metal Type:

● Platinum

● Palladium

● Rhodium

● Iridium

● Ruthenium

● Osmium

Based on the metal type, the market has been segmented into platinum, palladium, rhodium, iridium, ruthenium, and osmium.

Breakup By Application:

● Auto Catalysts

● Electrical and Electronics

● Fuel Cells

● Glass, Ceramics and Pigments

● Jewellery

● Medical (Dental and Pharmaceuticals)

● Chemicals

● Others

On the basis of the application, the market has been segregated into auto catalysts, electrical and electronics, fuel cells, glass, ceramics and pigments, jewellery, medical (dental and pharmaceuticals), chemicals and others.

Breakup By Region:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

Region-wise, the market has been divided into North America (the United States, Canada), Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others), Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others), Latin America (Brazil, Mexico, others), Middle East and Africa.

Top Platinum Group Metals Market Leaders:

● African Rainbow Minerals Limited

● Anglo American Platinum Limited

● Eastern Platinum Limited

● Glencore plc

● Impala Platinum Holdings Limited

● Johnson Matthey

● Northam Platinum Limited

● Royal Bafokeng Platinum Ltd.

● Sibanye-Stillwater

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology