Orthopedic Devices Market: The Role of 3D Printing in Production

The global orthopedic devices market was valued at approximately USD 60.4 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.3% from 2024 to 2030. This growth is driven by factors such as the high prevalence of orthopedic disorders, an aging global population, rising cases of degenerative bone diseases, and an increase in road accidents. Additionally, sedentary lifestyles and obesity contribute to the early onset of musculoskeletal disorders, further fueling market demand.

Rising Musculoskeletal Disorders

A report from The Lancet Rheumatology highlights a significant increase in musculoskeletal disorders, from 221 million cases in 1990 to 494 million in 2020, marking a 123.4% rise. By 2050, this number is projected to grow by 115%, reaching 1,060 million cases. These statistics emphasize the growing need for advanced orthopedic solutions to address the escalating burden of such disorders.

The adoption of robotic technology in orthopedic surgeries is a key growth driver. Stryker UK Limited reports that 13,000 patients undergo Mako robotic arm surgeries monthly worldwide. Robotics enhances precision through advanced imaging and real-time feedback, reducing tissue disruption and speeding up recovery. These technologies facilitate personalized treatment plans, improving patient outcomes and minimizing complications.

Gather more insights about the market drivers, restrains and growth of the Global Orthopedic Devices Market

Innovations and Minimally Invasive Techniques

The availability of advanced orthopedic devices and the rapid evolution of healthcare infrastructure globally contribute to market expansion. Minimally invasive surgical techniques, known for their multiple benefits, are gaining popularity. Sports-related injuries, especially among children, further drive demand for these devices. Over 3.5 million children aged 14 and under are injured annually while participating in sports, with 775,000 treated in emergency rooms for such injuries, according to the American Academy of Pediatrics and the National SAFE KIDS Campaign.

The aging global population is a critical factor in orthopedic market growth. Bone density declines significantly with age, especially after 55, creating increased demand for orthopedic solutions. By 2030, one in six individuals globally will be aged 60 or older, with this figure expected to double to 2.1 billion by 2050.

Technological innovations are accelerating the adoption of orthopedic devices. For example, researchers at UCLA School of Dentistry introduced a UV light-based dental implant technology in November 2023. This technique reduces post-treatment complications, showcasing how advancements are enhancing the effectiveness and safety of orthopedic implants.

Orthopedic Devices Market Regional Insights

North America Market Trends

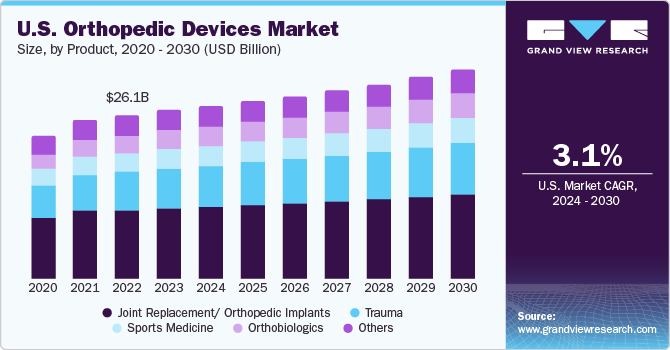

In 2023, North America held a dominant 45% revenue share in the global orthopedic devices market. This dominance is attributed to advanced healthcare infrastructure, major industry players, comprehensive reimbursement systems, and a rise in trauma cases. The U.S. accounted for 93.3% of North America’s market share due to high rates of joint surgeries, technological advancements, and the prevalence of orthopedic disorders. Companies are driving growth through mergers, acquisitions, and product innovations.

Canada

Canada is projected to register the fastest CAGR during the forecast period. Companies like Tyber Medical LLC have been focusing on research and development and expanding product offerings, as evidenced by its clearance for an anatomical plating system in Canada in February 2024.

Asia Pacific Market Trends

The Asia Pacific region is anticipated to be the fastest-growing market due to developing healthcare infrastructure, growing medical tourism, and an increasing prevalence of chronic orthopedic conditions. China is leading with significant growth, driven by an aging population, rising middle class, and enhanced healthcare facilities. However, high costs and stringent regulations remain challenges.

Europe Market Trends

Europe is expected to register a significant CAGR, fueled by rising healthcare spending and an aging population. Osteoarthritis and other bone-related disorders are prevalent among the elderly, driving demand for orthopedic solutions. Germany and the UK are key contributors, with Germany seeing a high number of knee osteoarthritis cases and the UK focusing on supply chain reconfiguration and product innovations.

Browse through Grand View Research's Medical Devices Industry Research Reports.

- Orthopedic Navigation Systems Market: The global orthopedic navigation systems market size was estimated at USD 2.85 billion in 2024 and is expected to grow at a CAGR of 13.9% from 2025 to 2030.

- Bone Grafts And Substitutes Market: The global bone grafts and substitutes market size was estimated at USD 3.16 billion in 2024 and is estimated to grow at a CAGR of 6.6% from 2025 to 2030.

Key Company Insights:

Major players in the orthopedic devices market are focusing on strategies such as product portfolio expansions, mergers, partnerships, and collaborations to strengthen their positions. Companies are leveraging innovation and advanced technologies to meet the growing demand, ensuring sustained market growth.

Key Orthopedic Devices Companies:

- Medtronic

- Stryker

- Zimmer Biomet

- DePuy Synthes

- Smith+Nephew

- Aesculap, Inc. - a B. Braun company

- CONMED Corporation

- NuVasive, Inc. (mergerd with Globus Medical)

- Enovis (formerly known as DJO)

Order a free sample PDF of the Orthopedic Devices Market Intelligence Study, published by Grand View Research.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology