Medical Tubing Market Landscape: Key Trends and Future Directions

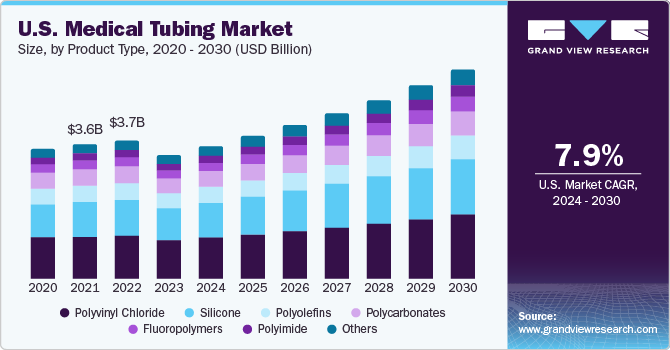

The global medical tubing market size is anticipated to reach USD 19.5 billion by 2030, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 8.5% from 2024 to 2030. The prevalence of respiratory diseases such as asthma, lung cancer, and pulmonary fibrosis worldwide is anticipated to fuel the global demand for medical tubing, as it is essential component of respiratory devices such as ventilators and nebulizers.

Growing awareness among the masses about hospital-acquired diseases and surging concerns about the spread of such infections are projected to drive demand for disposable medical devices. According to the World Health Organization (WHO), the incidences of ICU-acquired infections are 2 to 3 times higher in low- and middle-income countries than in high-income countries, while device-associated infections are approximately 13 times higher in these countries than in the U.S.

Governments, predominantly in emerging economies, are investing in their medical infrastructure and insurance to help the masses afford proper healthcare when required to prevent the occurrence of chronic diseases in them. Additionally, as these countries are growing economically, the standard of living of their population is also improving, which makes it possible for them to have access to advanced healthcare. These factors are anticipated to fuel the growth of medical tubing product demand over the forecast period.

Gather more insights about the market drivers, restrains and growth of the Global Medical Tubing Market

According to a report by the Australian Government Department of Health, approximately 47% of the Australian population, or 11.6 million people, will have one or more of the 10 selected chronic conditions such as back pain, cancer, chronic obstructive pulmonary diseases, mental health conditions, diabetes, asthma, and arthritis by 2020–2021. Thus, the occurrence of life-threatening diseases and chronic diseases is anticipated to be one of the major factors boosting market growth.

Medical tubing manufacturers are seeking collaborations, mergers, and acquisitions to develop advanced and innovative solutions. In addition, manufacturers are also adopting several strategies, like new product development, and geographical expansion, to enhance their market penetration and cater to end-use industries. For instance, Nordson Corporation acquired NDC Technologies. The aim behind the acquisition is to expand the former’s test and inspection platform into new end markets and adjacent technologies.

Medical Tubing Market Report Highlights

- The demand for silicone product type segment accounted for 25.7% of the global revenue share in 2023. Silicone is widely used in medical applications as it is not toxic to living tissues and is unlikely to yield an allergenic response. Silicon tubing used in medical devices is usually of higher grade and is manufactured using a continuous vulcanization and extrusion process

- The demand for bulk disposable tubing segment accounted for a 34.8% share of the global revenue in 2023. Bulk disposable devices include surgical instruments, urological products, syringes, and needles among others. Increasing emphasis on preventing the spread of infection from one patient to another is expected to drive the segment over the forecast period

- The drug delivery systems by material segment accounted for a 25.2% share of the global revenue in 2023. Manufacturers of drug delivery systems are significantly utilizing silicone for developing their products so that they can release ions of active additives or components. Some clinically successful drug delivery systems that use silicone are Femring (Warner Chilcott; Rockaway, NJ) and Norplant (Wyeth Pharmaceuticals; Madison, NJ)

- North America accounted for 35.6% of the global revenue share in 2023. Factors such as technological advancements, and increasing healthcare spending coupled with government policies are likely to propel the market demand. For instance, in 2021, according to NHE (National Health Expenditure Data) U.S. medicare spending increased by 8.4% USD 900 billion and medicaid increased by 9.2% USD 734 billion compared to 2020

- In May 2022, Freudenberg launched HelixFlex TPE tubing for bioprocessing applications and pharmaceuticals. This helped the company to extend company’s product portfolio

Browse through Grand View Research's Plastics, Polymers & Resins Industry Research Reports.

- Medical Plastic Compounds Market: The global medical plastic compounds market size was valued at USD 74.57 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030.

- Compostable Packaging Market: The global compostable packaging market size was estimated at USD 74.01 billion in 2023 and is expected to grow at a CAGR of 6.5% from 2024 to 2030.

Medical Tubing Market Segmentation

Grand View Research has segmented the global medical tubing market based on product, application, and region:

Medical Tubing Product Outlook (Revenue, USD Billion; 2018 - 2030)

- Silicone

- Polyolefins

- Polyimide

- Polyvinyl Chloride

- Polycarbonates

- Fluoropolymers

- Polytetrafluoroethylene (PTFE)

- Fluorinated ethylene propylene (FEP)

- Others

Medical Tubing Application Outlook (Revenue, USD Billion; 2018 - 2030)

- Bulk disposable tubing

- Silicone

- Polyolefins

- Polyimide

- Polyvinyl Chloride

- Polycarbonates

- Fluoropolymers

- Polytetrafluoroethylene (PTFE)

- Fluorinated ethylene propylene (FEP)

- Others

- Drug delivery systems

- Silicone

- Polyolefins

- Polyimide

- Polyvinyl Chloride

- Polycarbonates

- Fluoropolymers

- Polytetrafluoroethylene (PTFE)

- Fluorinated ethylene propylene (FEP)

- Others

- Catheters

- Silicone

- Polyolefins

- Polyimide

- Polyvinyl Chloride

- Polycarbonates

- Fluoropolymers

- Polytetrafluoroethylene (PTFE)

- Fluorinated ethylene propylene (FEP)

- Others

- Biopharmaceutical laboratory equipment

- Silicone

- Polyolefins

- Polyimide

- Polyvinyl Chloride

- Polycarbonates

- Fluoropolymers

- Polytetrafluoroethylene (PTFE)

- Fluorinated ethylene propylene (FEP)

- Others

- Others

- Silicone

- Polyolefins

- Polyimide

- Polyvinyl Chloride

- Polycarbonates

- Fluoropolymers

- Polytetrafluoroethylene (PTFE)

- Fluorinated ethylene propylene (FEP)

- Others

Medical Tubing Region Outlook (Revenue, USD Billion; 2018 - 2030)

- North America

- S.

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Netherlands

- Russia

- Spain

- UK

- Asia Pacific

- China

- India

- Japan

- Australia

- Singapore

- South Korea

- Central & South America

- Brazil

- Middle East & Africa

- South Africa

Order a free sample PDF of the Medical Tubing Market Intelligence Study, published by Grand View Research.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology