Food Enzymes Market Size, Share Growth & Trends

IMARC Group, a leading market research company, has recently released a report titled “Food Enzymes Market Report by Type (Carbohydrase, Protease, Lipase, and Others), Source (Microorganisms, Plants, Animals), Formulation (Powder, Liquid, and Others), Application (Beverages, Processed Foods, Dairy Products, Bakery Products, Confectionery Products, and Others), and Region 2024-2032”. The study provides a detailed analysis of the industry, including the global food enzymes market share, trends, size, and industry trends forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

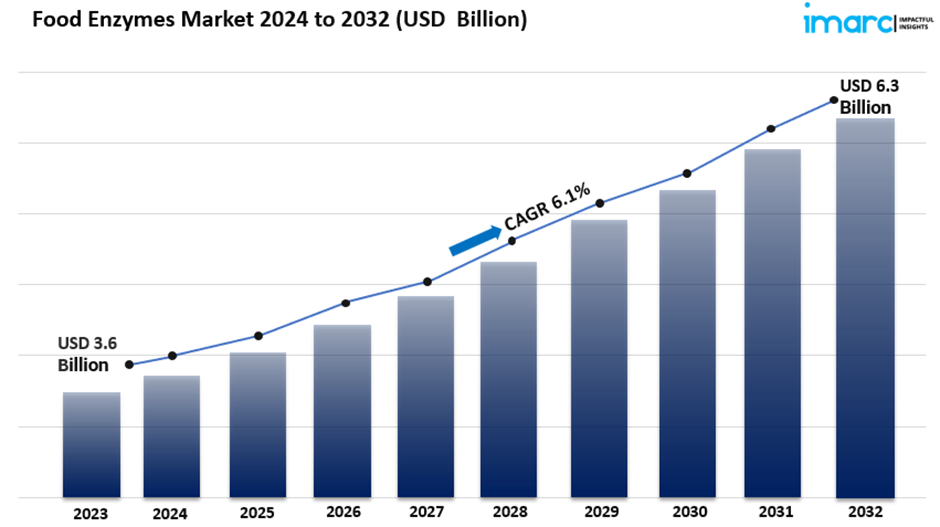

The global food enzymes market size reached US$ 3.6 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 6.3 Billion by 2032, exhibiting a growth rate (CAGR) of 6.1% during 2024-2032.

Request to Get the Sample Report:

https://www.imarcgroup.com/food-enzymes-market/requestsample

Food Enzymes Market Trends in 2024

The food enzymes market is evolving. It's responding to consumer demands and innovations. By 2024, the health trend will increase the use of food enzymes, especially in products with simple labels. Consumers will demand more transparency in ingredient sourcing.

This, in turn, will push manufacturers to highlight the natural benefits of food enzymes. Meanwhile, biotechnology advances will create more efficient enzymes for various food uses. The rise in functional foods will also increase demand. Consumers want products that support health, not just meet hunger. Health foods will need enzymes for better quality and nutrition. Also, companies will focus on eco-friendly methods. In 2024, the food enzymes market will emphasize innovation, health, and sustainability.

Market Dynamics of Food Enzymes Market

Rising Demand for Clean Label Products

The food enzymes market is shifting. It's driven by a growing demand for clean label products. Consumers now prefer foods with few artificial additives. They are more health-conscious and ingredient-aware. Food enzymes, which boost food production and quality, fit this trend. Bakers, dairy producers, and beverage makers use these enzymes. They enhance texture, flavor, and shelf life without lowering quality. The clean label movement pushes manufacturers to showcase food enzymes. This highlights them as natural alternatives to synthetic additives.

It also promotes transparency in ingredient sourcing. Enzymes like amylases, proteases, and lipases are becoming popular. Consumers see these as healthier options. So, companies are now focusing on marketing clean label benefits. This strategy is driving the demand for food enzymes in the food and beverage industry.

Advancements in biotechnology and enzyme production

Biotechnology is transforming the food enzymes market. It enables more efficient and sustainable enzyme production. Genetic engineering and fermentation have created specialized enzymes for food processing. For example, recombinant DNA technology makes enzymes that work better at lower temperatures or pH levels. This reduces energy costs and improves efficiency. Such advancements also enhance product quality and cut waste.

As sustainability becomes vital, demand for renewable enzymes is rising. Companies aim to meet regulatory standards and consumer expectations for sustainable practices. This shift is expected to boost the food enzymes market. In short, biotech advances are making the food enzymes market more innovative and resilient.

Growth in Functional Foods and Beverages

The demand for food enzymes is rising due to the popularity of functional foods and drinks. Manufacturers aim to boost their products' health benefits. Meanwhile, consumers seek foods that improve digestion, enhance nutrient uptake, and support immunity. Food enzymes are key to these benefits. They break down complex nutrients and increase their availability. For instance, lactase is added to make dairy products lactose-free. It helps those with lactose intolerance.

Similarly, proteases in protein drinks make them easier to digest. The market for functional foods is growing. Health trends and consumer preferences are driving it. This will likely increase the demand for food enzymes. Manufacturers will probably invest in research to find new enzyme uses in functional foods. This growth reflects a broader shift toward health-focused eating, transforming the food industry.

Food Enzymes Market Report Segmentation:

By Type:

Carbohydrase

· Amylase

· Cellulase

· Lactase

· Pectinase

· Others

Protease

Lipase

Others

Carbohydrase holds the majority of the market share due to their pivotal role in breaking down complex carbohydrates into simpler sugars, crucial for enhancing flavor, texture, and nutritional profiles in a wide array of processed foods, thereby driving their extensive use in the food industry.

By Source:

Microorganisms

· Plants

· Animals

Microorganisms accounted for the largest market share due to their scalability, cost-effectiveness, and ability to produce a diverse range of enzymes suitable for various food processing applications.

By Formulation:

Powder

· Liquid

· Others

Powder represented the largest segment because it offers ease of handling, stability, and uniform dispersion in food processing applications.

By Application:

Beverages

· Processed Foods

· Dairy Products

· Bakery Products

· Confectionery Products

· Others

Processed foods hold the majority of the market share, driven by urbanization, busy lifestyles, and increasing consumer preference for convenience.

Regional Insights:

North America

· Europe

· Asia Pacific

· Middle East and Africa

· Latin America

North America's dominance in the market is attributed to high consumer demand for innovative and healthier food products, stringent food safety regulations encouraging enzyme usage, and robust investments in food technology and research.

Competitive Landscape with Key Players:

The competitive landscape of the food enzymes market size has been studied in the report with the detailed profiles of the key players operating in the market.

Some of These Key Players Include:

DuPont de Nemours, Inc.

· Amway

· BASF

· DSM

· Novozymes

· Chr. Hansen

· Kerry Group

· Biocatalysts

· Puratos Group

· Advanced Enzyme Tech

· Sequence Biotech

· Amano Enzyme

· Aum Enzymes

· Bioseutica

· Dyadic International Inc.

Ask Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=1624&flag=C

Key Highlights of the Report:

· Market Performance (2018-2023)

· Market Outlook (2024-2032)

· Market Trends

· Market Drivers and Success Factors

· Impact of COVID-19

· Value Chain Analysis

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Website: imarcgroup.com

Email: sales@imarcgroup.com

Americas: +1-631-791-1145 | Europe & Africa: +44-753-713-2163 | Asia: +91-120-433-0800

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology