POS Payment Market Innovations: Shaping the Future of Transactions with Cutting-Edge Technology and Solutions

The POS payment market has seen a remarkable evolution over the past few years. As consumer behaviors and technological advancements continue to transform the way payments are processed, innovations in POS systems are crucial for businesses to remain competitive. These innovations have changed how businesses engage with customers, making transactions more efficient, secure, and seamless. This article explores some of the most significant advancements in the POS payment market.

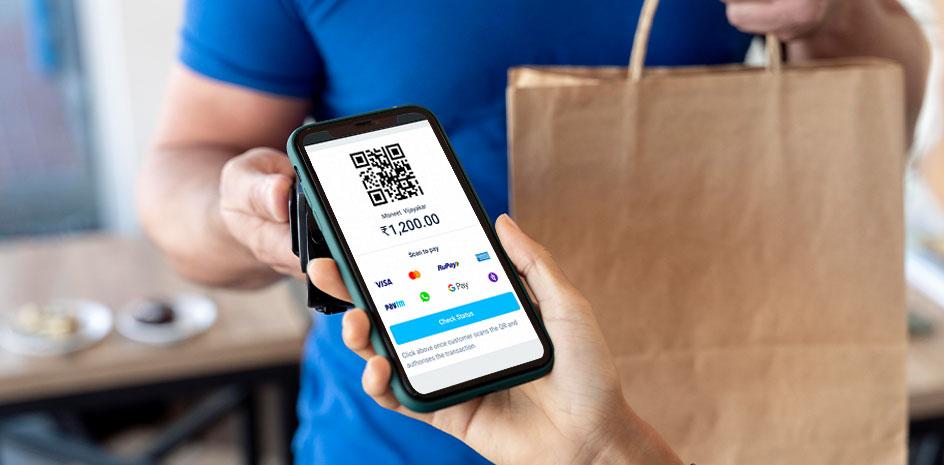

The Rise of Contactless Payments

One of the most significant innovations in the POS payment market is the rise of contactless payments. Contactless payment systems allow customers to make transactions by simply tapping their card or mobile device on a POS terminal, eliminating the need for physical contact or swiping a card. This technology offers increased convenience, speed, and security, making it particularly popular in today’s fast-paced world. The COVID-19 pandemic further accelerated the adoption of contactless payments, as consumers and businesses sought ways to minimize physical contact during transactions.

Mobile Payment Solutions

Mobile payment solutions such as Apple Pay, Google Pay, and Samsung Pay have also played a pivotal role in revolutionizing the POS payment market. These solutions enable consumers to make secure payments directly from their smartphones, using near-field communication (NFC) technology. As mobile phones become ubiquitous, these systems provide an added layer of convenience, allowing customers to carry their payment methods digitally and eliminating the need for physical wallets. Mobile payment systems have also been instrumental in integrating loyalty programs, offering discounts, and providing personalized shopping experiences for consumers.

Integrated POS Systems

Today’s POS payment systems are no longer just tools for processing payments. With advancements in cloud technology and data analytics, integrated POS systems have become multifunctional business solutions. Modern POS systems offer businesses the ability to manage inventory, track customer data, and generate detailed sales reports all from a single interface. This integration enhances business operations, provides valuable insights, and helps businesses offer personalized services to customers. Furthermore, these systems support a variety of payment methods, from traditional card payments to digital wallets, ensuring that businesses can cater to every customer preference.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) have entered the POS payment market, further driving its evolution. AI-powered POS systems can analyze customer data to predict purchasing behavior, optimize inventory levels, and offer personalized promotions. Machine learning algorithms can also detect fraudulent activities, reducing the risk of payment fraud and improving security. AI technologies are continuously evolving, offering POS providers new ways to enhance the customer experience and streamline business operations.

Blockchain and Cryptocurrency Integration

Blockchain technology and cryptocurrency have also found their way into the POS payment market. As more businesses begin to accept cryptocurrency payments, the need for POS systems capable of processing these transactions has grown. Blockchain, known for its transparency and security features, enhances the security of cryptocurrency transactions, making it an appealing option for businesses and consumers alike. While cryptocurrency adoption in mainstream businesses is still in its early stages, the potential for POS systems to integrate these digital currencies offers a glimpse into the future of payments.

Security Enhancements

As digital payments become more prevalent, the need for enhanced security measures has never been greater. Innovations in encryption and tokenization are providing better protection for consumers' sensitive financial data. Tokenization, for example, replaces sensitive card information with a unique identifier or token, ensuring that the actual payment data is not exposed during the transaction. Additionally, biometric authentication methods, such as facial recognition or fingerprint scanning, are becoming more common, offering an extra layer of security during payment processes. These advancements are crucial in building consumer trust and ensuring the safety of digital transactions.

The Future of POS Payment Market Innovations

Looking ahead, the POS payment market is poised for continued innovation. The ongoing development of 5G networks, the expansion of AI and machine learning, and the integration of augmented reality (AR) are expected to bring even more advancements to the POS landscape. As businesses adopt these technologies, the experience of shopping and making payments will become more seamless and integrated into the everyday lives of consumers. From faster transactions to more personalized shopping experiences, the future of POS payments is both exciting and transformative.

Conclusion

The POS payment market has evolved significantly, with innovations ranging from contactless payments to AI-driven systems and cryptocurrency integration. These innovations not only enhance the convenience and speed of transactions but also offer new opportunities for businesses to engage with customers and streamline operations. As technology continues to advance, the future of POS payments promises even more exciting developments that will shape the way we shop and pay for goods and services.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology