Veterinary CRO and CDMO Market Size, Growth Outlook 2035

Market Overview

The Veterinary CRO and CDMO Market is witnessing significant growth due to the increasing demand for contract research organizations (CROs) and contract development and manufacturing organizations (CDMOs) in the animal health industry. These organizations provide outsourcing solutions for pharmaceutical development, clinical trials, regulatory affairs, and manufacturing of veterinary medicines and vaccines. With the rising prevalence of zoonotic diseases, increasing pet ownership, and growing investment in animal health R&D, the demand for veterinary contract research and manufacturing services is escalating.

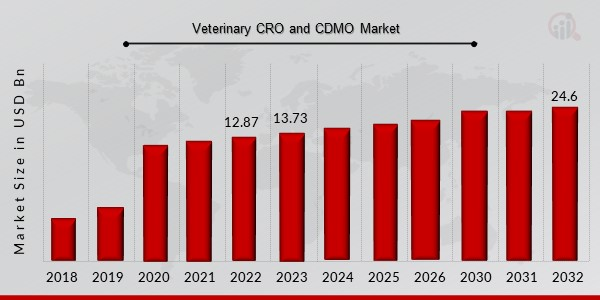

Market Size and Share

The Veterinary CRO and CDMO Market Size was estimated at 6.82(USD Billion) in 2023. The Veterinary CRO and CDMO Market Industry is expected to grow from 7.34(USD Billion) in 2024 to 13.80(USD Billion) by 2032. The Veterinary CRO and CDMO Market CAGR (growth rate) is expected to be around 8.20% during the forecast period (2024 - 2032). North America dominates the market due to the presence of leading veterinary pharmaceutical companies, stringent regulations, and increased spending on pet healthcare. Europe follows closely, while the Asia-Pacific veterinary contract research market is growing rapidly due to expanding livestock industries and increasing demand for animal vaccines and therapeutics.

Market Drivers

- Rising Investment in Animal Health Research: Increased funding for veterinary drug development is boosting market growth.

- Growing Pet Ownership and Livestock Population: The rising demand for companion animal pharmaceuticals and livestock vaccines is fueling the need for veterinary contract development services.

- Regulatory Complexity Driving Outsourcing: Strict regulatory requirements for veterinary drugs have led to increased reliance on veterinary regulatory affairs outsourcing.

- Cost-Effectiveness of Outsourcing Services: Veterinary pharmaceutical companies are turning to CROs and CDMOs to reduce operational costs and accelerate drug development timelines.

Challenges and Restraints

- High Cost of Veterinary Clinical Trials: Conducting animal health clinical trials can be expensive, impacting smaller firms.

- Regulatory Hurdles and Compliance Issues: Strict global regulations for veterinary pharmaceuticals and biologics can slow market growth.

- Limited Availability of Skilled Professionals: The lack of trained personnel for veterinary contract manufacturing and research services is a challenge.

Market Trends

- Increasing Focus on Biologics and Veterinary Vaccines: Companies are expanding their veterinary biologics manufacturing capabilities to meet the rising demand.

- Adoption of Digital Technologies in Veterinary Research: The integration of AI and big data analytics in veterinary clinical trials is improving efficiency.

- Strategic Collaborations and Acquisitions: Companies are engaging in mergers and acquisitions to strengthen their animal health contract services portfolio.

Regional Analysis

- North America: Leading market due to well-established animal health CROs and CDMOs, stringent regulatory frameworks, and high veterinary healthcare spending.

- Europe: Growing demand for veterinary contract services in pharmaceutical and vaccine production.

- Asia-Pacific: Fastest-growing region, driven by increasing livestock production, rising awareness about animal disease prevention, and growing investments in veterinary healthcare.

- Rest of the World: Moderate market growth, with potential expansion in Latin America and the Middle East.

Segmental Analysis

- By Service Type:

- Veterinary Contract Research Services

- Veterinary Contract Development & Manufacturing Services

- Regulatory Affairs & Consulting Services

- By Animal Type:

- Companion Animals (Dogs, Cats, Horses, etc.)

- Livestock Animals (Cattle, Poultry, Swine, etc.)

- By End-User:

- Veterinary Pharmaceutical Companies

- Biotechnology Firms

- Animal Research Institutes

Key Market Players

· IQVIA

· InVentiv Health

· Eurofins Scientific

· Catalent

Recent Developments

- Expansion of Veterinary CDMO Capabilities: Companies like Zoetis and Boehringer Ingelheim are increasing their contract manufacturing capacities for veterinary biologics.

- Launch of AI-Based Veterinary Research Platforms: Advanced AI-driven veterinary clinical trial solutions are improving research accuracy.

- Strategic Mergers and Acquisitions: Key players are acquiring smaller veterinary CROs to strengthen market presence.

For more information, please visit us at marketresearchfuture

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology