India Electric Insulator Market Growth, Size & Trends Forecast 2025-2033

Market Overview 2025-2033

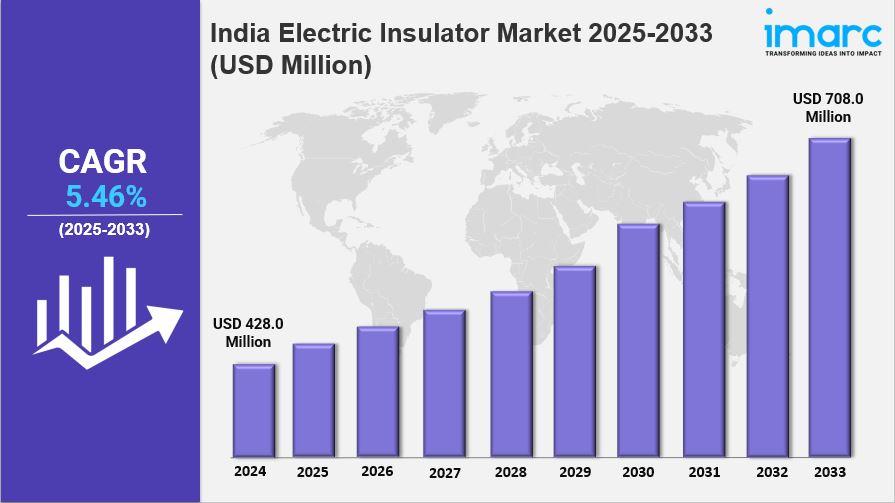

The India electric insulator market size reached USD 428.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 708.0 Million by 2033, exhibiting a growth rate (CAGR) of 5.46% during 2025-2033. The India electric insulator market is experiencing significant growth, driven by the expansion of the power sector, increasing electricity consumption, and the need for reliable infrastructure.

Key trends include a rising demand for advanced materials and technologies, with major players prioritizing durability and efficiency in their product offerings. Additionally, the integration of smart grid solutions is enhancing the focus on high-performance insulators that can withstand extreme conditions and support renewable energy initiatives.

Key Market Highlights:

✔️ Robust growth fueled by increasing electricity demand and infrastructure development across urban and rural areas.

✔️ Government policies promoting renewable energy projects and enhancing power transmission networks to improve reliability and efficiency.

✔️ Emphasis on research and development, with manufacturers adopting innovative materials and technologies to create high-performance insulators suitable for diverse applications.

Request for a sample copy of the report: https://www.imarcgroup.com/india-electric-insulator-market/requestsample

India Electric Insulator Market Trends and Driver:

The India electric insulator market is poised for significant transformation, driven by several emerging trends that are reshaping the industry landscape. As the demand for electricity continues to rise, the market size is expected to expand, reflecting the increasing investments in power generation and transmission infrastructure. With a projected market size of approximately USD 1.5 billion by 2025, the sector is witnessing a surge in the adoption of advanced insulator technologies that enhance performance and safety.

One of the key trends is the growing emphasis on sustainability and eco-friendly materials. Manufacturers are increasingly focusing on developing composite and polymer insulators that not only offer superior durability but also minimize environmental impact. This shift aligns with global sustainability goals and responds to the rising consumer demand for greener solutions. By 2025, it is anticipated that these innovative materials will capture a significant share of the India electric insulator market share, reflecting a broader commitment to sustainable practices within the industry.

Additionally, the integration of smart grid technologies is transforming how electric insulators are designed and utilized. The need for reliable and efficient energy management systems is driving manufacturers to create insulators that can handle higher voltage levels and provide better insulation properties. As smart grids become more prevalent, the demand for high-performance insulators is expected to increase, further contributing to the market's growth trajectory. By 2025, this trend is likely to play a crucial role in shaping the competitive dynamics of the market.

Furthermore, government initiatives aimed at boosting domestic manufacturing capabilities are fostering a conducive environment for market expansion. Policies that promote local production of electric insulators are reducing import dependency and encouraging innovation within the sector. As these initiatives gain momentum, they will not only enhance the overall market size but also strengthen the position of Indian manufacturers in the global electric insulator market. This collaborative approach between industry and government is set to drive substantial growth in the coming years, making the India electric insulator market a focal point for investment and development.

India Electric Insulator Market Segmentation: The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Material:

- Ceramic/Porcelain

- Glass

- Composites

- Others

Breakup by Voltage:

- Low

- Medium

- High

Breakup by Category:

- Bushings

- Other Insulators

Breakup by Installation:

- Distribution Networks

- Transmission Lines

- Substations

- Railways

- Others

Breakup by Product:

- Pin Insulator

- Suspension Insulator

- Shackle Insulator

- Others

Breakup by Rating:

- <11 kV

- 11 kV

- 22 kV

- 33 kV

- 72.5 kV

- 145 kV

- Others

Breakup by Application:

- Transformer

- Cable

- Switchgear

- Busbar

- Surge Protection Device

- Others

Breakup by End Use Industry:

- Utilities

- Industries

- Others

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- India_electric_insulator_market

- India_electric_insulator_market_size

- India_electric_insulator_market_share

- India_electric_insulator_market_trends

- India_electric_insulator_market_demand

- India_electric_insulator_market_growth

- India_electric_insulator_market_outlook

- India_electric_insulator_market_forecast

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology