U.S. E-cigarette & Vape Market Strengthened by Innovation in Heat-Not-Burn Devices

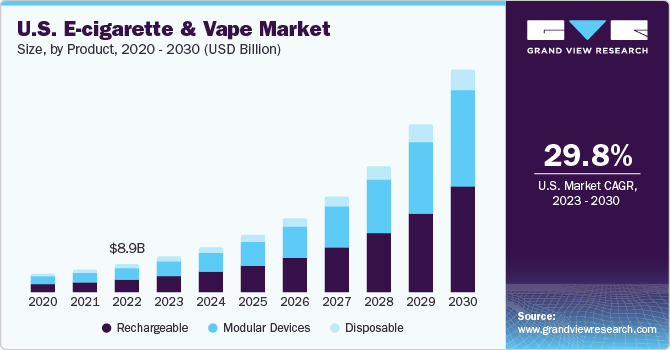

The U.S. e-cigarette and vape market was valued at USD 8.98 billion in 2022. It is projected to grow at a compound annual growth rate (CAGR) of 29.8% from 2023 to 2030. This growth is largely driven by rising awareness of safer alternatives to traditional tobacco products. Electronic cigarettes and vape mods have gained significant popularity as substitutes for conventional tobacco. These advanced devices are engineered to deliver nicotine—the addictive component in tobacco cigarettes—without exposing users to harmful tobacco smoke. Consumers are increasingly adopting personalized vaporizers, which enhance the vaping experience and meet the preferences of both regular and highly engaged users. Growing health concerns around smoking have elevated this issue to a priority for governments and health organizations alike. This heightened awareness is expected to continue fueling market growth over the forecast period.

The adoption of e-cigarettes and vape mods is rising rapidly, primarily because these products do not contain tobacco. A significant portion of the U.S. population views these devices as a pathway to quitting smoking. Many are switching to e-cigarettes and vape mods as a smoking alternative. Additionally, these products are available in both nicotine and non-nicotine variants, further reinforcing their perception as a healthier option among consumers.

Multiple studies conducted by medical associations have indicated that e-cigarettes and vape mods are safer alternatives to traditional cigarettes. Moreover, growing awareness among younger demographics is contributing to market expansion. Vendors are also focusing on product customization and continuous innovation, both of which are anticipated to drive further growth. The affordability of these devices has also played a role in boosting consumer acceptance.

However, strict government regulations in the U.S. have posed challenges for market growth. Agencies such as the U.S. Centers for Disease Control and Prevention (CDC) and the U.S. Food and Drug Administration (FDA) have been actively investigating incidents of severe respiratory illnesses linked to vaping products. Additionally, production was temporarily halted by vendors due to COVID-19 lockdowns, while logistics disruptions affected product distribution domestically and internationally.

Product Insights

In 2022, the rechargeable segment led the market, accounting for 45.8% of U.S. revenue. The lower cost of rechargeable e-cigarettes is a key factor driving their adoption. Rechargeable devices are battery-powered, reusable, and refillable, and they feature interchangeable cartridges, allowing users to experiment with different flavors.

The modular devices segment is projected to grow at the fastest CAGR of 31.2% over the forecast period. Consumers are increasingly favoring these devices due to their larger batteries and higher e-liquid capacity. These devices also offer features such as voltage, wattage, and temperature control. Additionally, battery monitoring features provide users with real-time insights into remaining battery life.

Get a preview of the latest developments in the U.S. E-cigarette & Vape Market! Download your FREE sample PDF today and explore key data and trends

Distribution Channel Insights

The retail store segment dominated the market in 2022, capturing over 82.9% of the total market share. Retail stores offer customers the opportunity to sample various e-liquid flavors and explore different vaporizer options firsthand. The ability to try products before purchasing has contributed to the growing popularity of retail stores across multiple U.S. states.

Key Companies & Market Share Insights

Market players are prioritizing inorganic growth strategies such as mergers, acquisitions, and collaborations to expand their market presence. For example, in July 2023, Japan Tobacco Inc. launched a new heated tobacco brand called “with,” accompanied by a new device, “with 2,” which heats tobacco capsules without combustion.

Leading U.S. E-cigarette and Vape Companies:

-

Reynolds American Inc.

-

Imperial Brands

-

Altria Group, Inc.

-

Japan Tobacco Inc.

-

Philip Morris International

-

International Vapor Group

-

British American Tobacco

-

NicQuid

-

Shenzhen IVPS Technology Co., Ltd.

-

Shenzhen KangerTech Technology Co., Ltd.

Gather more insights about the market drivers, restrains and growth of the U.S. E-cigarette & Vape Market

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology