Impact Investing Market size is expected to be worth around USD 1,131.0 Billion

Posted 2025-06-25 05:31:29

0

5

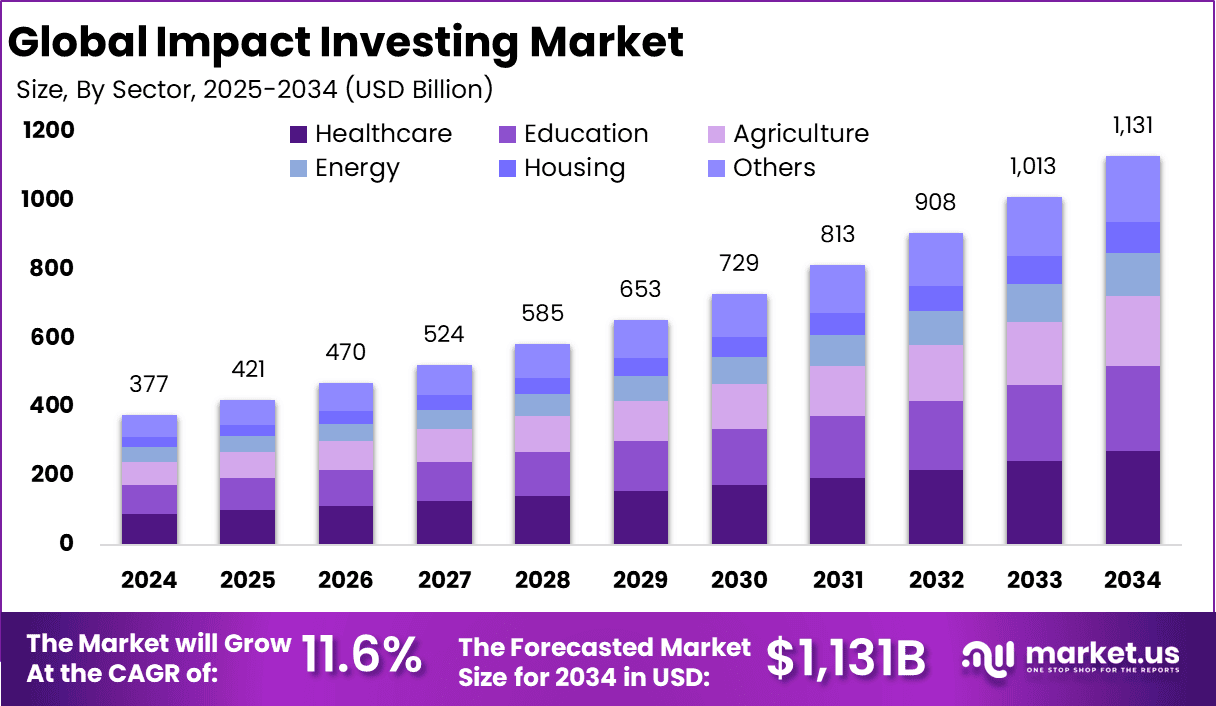

The Global Impact Investing Market size is expected to be worth around USD 1,131.0 Billion By 2034, from USD 377 billion in 2024, growing at a CAGR of 11.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38% share, holding USD 143.2 Billion revenue. In the United States, the market is valued at USD 136.0 Billion in 2024 and is projected to grow at a CAGR of 9.7% during the forecast period.

Impact investing is a strategy that seeks to generate both financial returns and positive social or environmental outcomes. It’s about putting money into companies, organizations, or funds that aim to tackle issues like climate change, poverty, or education while still aiming for a profit. Unlike traditional investing, which focuses solely on financial gains, impact investing measures success by the tangible good it creates alongside the returns. It’s a growing field, appealing to those who want their investments to reflect their values, whether they’re individuals, institutions, or foundations. This approach spans various sectors like renewable energy, healthcare, and affordable housing, making it a versatile way to drive change.

The impact investing market refers to the global ecosystem where these investments take place. It’s a dynamic space, encompassing a range of players like pension funds, private equity firms, and high-net-worth individuals, all channeling capital into projects that align with social or environmental goals. The market is evolving rapidly, with increasing participation from mainstream financial institutions and a growing emphasis on measurable outcomes. It’s not just a niche anymore; it’s becoming a significant part of the global investment landscape, driven by a collective desire to address pressing challenges while maintaining financial viability.

A key driver of this market is the rising awareness of global issues like climate change and social inequality. Investors are increasingly drawn to opportunities that align with their ethical priorities, pushing demand for investments that deliver both impact and profit. Supportive government policies and incentives, especially in regions like Europe, also fuel growth by encouraging sustainable finance. Additionally, the recognition that impact investments can yield competitive returns without sacrificing purpose is shifting perceptions, making this approach more mainstream.

Zoeken

Categorieën

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology

Read More

https://www.facebook.com/BrunoMaleEnhancementAustraliaPrice/

Bruno Male Enhancement Australia is what?

One nutritional supplement meant especially for...

Trace Mineral Supplements Market USD 5.91 billion by 2029

The Trace Mineral Supplements Market sector is undergoing rapid transformation, with...

Seaweed Extracts Biostimulant Market Size, Share, Trends, Growth Opportunities and Competitive Outlook

"Global Seaweed Extracts Biostimulant Market Report has been crafted with the vigilant efforts of...

Unlock Exclusive Rewards at the Monopoly GO Gold Card Event: Collect Stickers and Win Big!

Unlock Exclusive Rewards at the Monopoly GO Gold Card Event: Collect Stickers and Win Big!

The...

Unlock Free Pickaxe Links in Monopoly Go: Upcoming Sticker Boost and Monopoly Figures Guide

Unlock Free Pickaxe Links in Monopoly Go: Upcoming Sticker Boost and Monopoly Figures Guide...