Electronics Adhesives Market Innovation Trends Across APAC Region Discussed

The electronics adhesives market is undergoing a profound transformation, particularly within the Asia-Pacific (APAC) region, where innovation and volume growth are redefining global competitiveness. APAC continues to outpace other regions in both consumption and production of electronics, making it the primary frontier for adhesives innovation. Countries such as China, South Korea, Japan, Taiwan, and India are driving technological advancements across various sub-segments, including semiconductors, consumer electronics, automotive electronics, and 5G infrastructure. These trends are prompting global adhesives manufacturers to focus their research and development activities in APAC, aligning with the region’s dynamic market shifts and policy incentives.

China, the world’s largest electronics manufacturing hub, plays a dominant role in this transformation. Its rapid expansion in smartphones, electric vehicles, and smart appliances has led to a parallel rise in the demand for electronics adhesives that can perform under complex operational and environmental conditions. Chinese manufacturers are increasingly focusing on localized sourcing of adhesives to streamline supply chains and reduce import dependencies. As a result, domestic adhesive producers are investing in new product lines tailored to high-temperature resistance, dielectric strength, and flexibility required in flexible printed circuit boards (FPCBs) and high-frequency chipsets.

Japan and South Korea, both recognized for their precision manufacturing and innovation leadership, are leveraging electronics adhesives to push forward miniaturization, wearable technologies, and smart displays. Japanese firms, for instance, are advancing UV-curable and optically clear adhesives used in OLED displays and camera modules. These adhesives ensure high transparency, low shrinkage, and resistance to yellowing—features essential for today’s high-performance electronics. South Korean companies, meanwhile, are focusing on chip-scale packaging and memory integration where adhesives serve as underfill, encapsulants, and thermal interface materials. These developments are essential for high-density and low-profile component design demanded in next-gen smartphones and tablets.

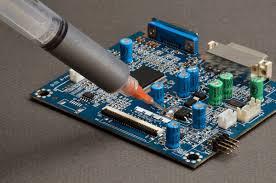

Taiwan’s innovation in semiconductor fabrication and printed circuit board production is another pillar of APAC’s adhesives momentum. Taiwanese EMS (Electronics Manufacturing Services) providers and IC design houses are adopting hybrid adhesive technologies to support 2.5D and 3D IC integration. These packaging formats require adhesives with highly specialized properties such as thermal conductivity, low ionic contamination, and long-term reliability under temperature cycling. This demand is reshaping the adhesive formulation landscape, pushing manufacturers to engineer materials that meet exacting criteria set by top-tier chipmakers.

India, although a relatively new entrant in high-tech manufacturing, is making notable strides in electronics innovation through its "Make in India" and "Digital India" programs. With the rising domestic production of smartphones, solar inverters, medical electronics, and defense equipment, India presents a fertile market for advanced adhesives. Local manufacturers are increasingly collaborating with global adhesive suppliers to co-develop cost-effective, high-performance adhesives suitable for harsh climatic and operational conditions unique to the Indian subcontinent. There is also growing interest in developing eco-friendly and solvent-free adhesives in India, reflecting a regional trend toward sustainability.

Across the broader APAC region, a strong push toward 5G infrastructure is catalyzing new innovations in electronics adhesives. 5G base stations, antenna modules, and high-frequency PCBs demand adhesives that can withstand increased thermal loads, provide electromagnetic shielding, and remain stable under fluctuating weather conditions. Singapore, Malaysia, and Vietnam—countries building strong positions in the 5G supply chain—are adopting adhesives that meet these technical demands while ensuring ease of integration with automated assembly systems.

Sustainability is becoming another key innovation theme in APAC. As environmental regulations tighten across China, South Korea, and other countries, manufacturers are prioritizing low-VOC, halogen-free, and bio-based adhesives. There is a growing focus on reducing hazardous emissions during electronics manufacturing while maintaining high bonding performance. R&D centers in Japan and Taiwan are actively testing adhesives derived from renewable feedstocks and biodegradable resins that meet both technical and environmental standards.

Another aspect driving innovation is the rising importance of wearable and flexible electronics in APAC. From smartwatches and health monitors to e-textiles and flexible displays, these products require adhesives that are not only stretchable but also skin-compatible, breathable, and resilient to mechanical fatigue. South Korea and Japan are spearheading this segment, with adhesive formulators working closely with OEMs to develop elastomeric and conductive adhesives that can seamlessly integrate into flexible substrates and curved surfaces.

The innovation landscape is also being shaped by digitalization of production processes. Smart factories across APAC are increasingly adopting robotics, machine learning, and real-time process control to optimize adhesive dispensing, curing, and inspection. These technologies enable consistent performance and minimal waste, which is critical for high-volume consumer electronics manufacturing. Adhesive manufacturers are incorporating AI-driven formulation design and simulation tools to fast-track product development cycles tailored to regional customer needs.

In conclusion, the electronics adhesives market in the APAC region is a hotbed of innovation, driven by a potent mix of industrial expansion, regulatory evolution, and technology convergence. From semiconductors and smartphones to EVs and 5G devices, every aspect of electronics production in APAC demands next-generation adhesives. With governments offering strong policy support and private enterprises ramping up R&D investments, the region is expected to continue leading the charge in redefining what adhesives can achieve in electronic systems. Global stakeholders seeking sustained competitiveness in electronics manufacturing cannot afford to overlook the innovation pulse of APAC.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology