How Is the Graphene Market Powering the Next Generation of High Performance Technologies?

Introduction

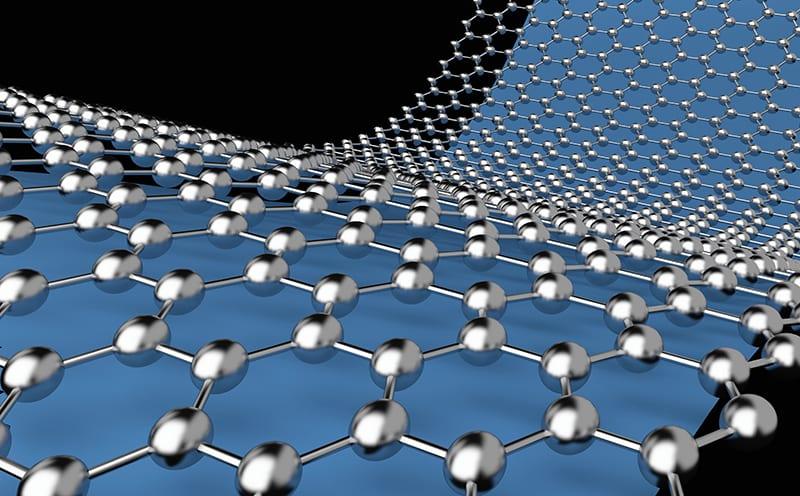

According to the latest Next Move Strategy Consulting report, the Graphene Market has rapidly evolved from a laboratory curiosity to a cornerstone of advanced materials, finding applications across electronics, energy storage, automotive, and biomedical sectors. As industries race to develop lighter, stronger, and more conductive solutions, graphene’s unique two‑dimensional structure and exceptional properties have placed it at the forefront of innovation. The global Graphene Market is projected to expand more than three‑and‑a‑half‑fold to USD 2935 million by 2030, reflecting a robust CAGR of 25.7% from 2025 to 2030.

Market Dynamics: From Electronics to Energy Storage

Graphene’s exceptional electrical conductivity, mechanical strength, and flexibility make it an ideal candidate for a wide range of applications. The surging demand for electronics and energy storage technologies is the primary growth driver:

- Electronics Miniaturization and Performance: Industries are integrating graphene into sensors, transistors, and interconnects to enable finer circuit miniaturization and enhanced signal integrity. For instance, Paragraf launched its graphene‑based Field Effect Transistor (GFET) using a proprietary transfer‑free growth process, delivering contaminant‑free, high‑purity graphene suitable for next‑generation sensor and logic applications

- Advanced Batteries and Supercapacitors: Graphene’s high surface area and conductivity boost charge‑discharge rates and cycle life in batteries and supercapacitors, paving the way for rapid‑charging consumer electronics and grid‑scale energy storage systems

Consumer Electronics: Lightweight, Durable, and Thermally Efficient

As consumers demand thinner, lighter, and longer‑lasting devices, graphene’s properties are becoming indispensable:

- Gaming Laptops and Wearables: In January 2023, Dell introduced a gaming laptop featuring graphene‑enhanced components—resulting in improved thermal conductivity, extended battery life, and a notably lighter chassis without compromising structural integrity

- Smartphones with Graphene Cooling: Realme’s GT Neo 5 flagship phone, launched in the same month, incorporated graphene‑based cooling panels and advanced heat‑dissipation materials, enabling rapid charging and sustained performance under heavy workloads

Automotive and EV Sector: Lightweight Materials and Sensors

The automotive industry’s pivot toward electric vehicles (EVs) and autonomous driving has created new opportunities for graphene:

- Lightweight Composites: Graphene‑reinforced polymers reduce vehicle weight, improving range and energy efficiency.

- Graphene‑Enabled Sensors: High‑sensitivity pressure and chemical sensors based on graphene provide accurate real‑time monitoring of battery health and environmental conditions.

- Industry Investments: Global investments in EV and battery technologies exceeded USD 275 billion in 2022–2023, underscoring the critical role of graphene in enhancing performance and durability of next‑generation vehicles

High Production Costs: The Key Restraint

Despite its promise, graphene production remains costly:

- Scalable Manufacturing Challenges: Processes such as chemical vapor deposition (CVD) and exfoliation must be optimized for yield and purity without prohibitive price tags.

- Market Impact: High manufacturing costs constrain graphene adoption to high‑value or niche applications, delaying broader market penetration

Breakthrough Opportunities: Graphene in DNA Sequencing

A compelling long‑term opportunity lies in biomedical applications:

- Nanopore Sequencing: Graphene’s atom‑thin structure can enable single‑molecule detection in next‑generation DNA sequencing, potentially revolutionizing personalized medicine through rapid, accurate genomic analysis.

- Diagnostic Platforms: Graphene‑based biosensors may provide ultra‑sensitive pathogen detection, supporting point‑of‑care diagnostics and public‑health surveillance

Market Segmentation: Tailoring to Varied Needs

The Graphene Market is segmented to address diverse end‑user requirements:

|

Dimension |

Segments |

|

By Type: |

Monolayer, Few‑layer (FLG), Multi‑layer (MLG), Nanoplatelets (GNP), Reduced Graphene Oxide (rGO), Graphene Oxide (GO) |

|

By Application: |

Biological Engineering, Optical Electronics, Biosensors, Drug Delivery, Others |

|

By End‑User: |

Aerospace & Defense, Medical, Construction, Automotive, Electronics, Semiconductor, Others |

|

By Region: |

North America, Europe, Asia‑Pacific, Rest of World |

Such granularity allows stakeholders to develop targeted strategies—whether prioritizing rGO for cost‑sensitive coatings or monolayer graphene for high‑performance electronics.

Geographic Trends: Asia‑Pacific Leads the Charge

Regional dynamics reveal Asia‑Pacific as the dominant market:

- China and India: Strong government funding under initiatives like “Made in China 2025” and India’s Innovation Centre for Graphene accelerate R&D and commercialization efforts

- Japan: Strategic collaborations—such as Sumitomo Corporation’s partnership with Gerdau Graphene to market graphene‑enhanced plastics—underscore the focus on performance and sustainability.

- North America: While growth is steadier, investments in sustainable technologies—exemplified by Cerebral Energy’s aluminium‑graphene battery contract with AFWERX—highlight emerging use cases in defense and clean energy.

Competitive Landscape: Innovators and Incumbents

Key players span startups to established materials companies:

Applied Graphene Materials, Graphenea, NanoXplore Inc., CVD Equipment Corporation, Directa Plus S.p.A., Grolltex Inc., Haydale Graphene Industries plc, ACS Material, Graphene Manufacturing Group Ltd., Talga Group, First Graphene, Versarien plc, 2D Carbon Graphene Material Co., Ltd., Grafoid Inc., Thomas Swan & Co. Ltd.

These firms differentiate through proprietary production methods, strategic partnerships (e.g., Haydale’s “Hot Seat” graphene‑heated automotive system), and targeted expansions such as NanoXplore’s Quebec facility upgrade for sheet‑molding compounds

Future Outlook and Strategic Imperatives

To harness graphene’s full potential, industry stakeholders should:

- Scale Cost‑Effective Production: Invest in scalable, high‑yield manufacturing techniques—such as roll‑to‑roll CVD—to lower unit costs.

- Deepen Cross‑Sector Partnerships: Collaborate with electronics OEMs, automotive manufacturers, and biotech firms to co‑develop tailored graphene solutions.

- Accelerate Regulatory Approvals: Work with standards bodies to establish safety and performance benchmarks, particularly for biomedical and aerospace applications.

- Expand R&D in Sequencing and Biosensing: Prioritize research into graphene nanopores and biosensor platforms to capitalize on the next wave of personalized medicine.

- Embed Sustainability Metrics: Leverage graphene’s potential for energy efficiency gains in devices and systems, aligning product roadmaps with global ESG objectives.

By executing these imperatives, the Graphene Market can transition from a high‑value niche to a mainstream materials powerhouse—fueling breakthroughs across industries and solidifying graphene’s role as an essential enabler of next‑generation technology.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology