United States IPTV Market Size, Share & Industry Outlook | 2033

Market Overview 2025-2033

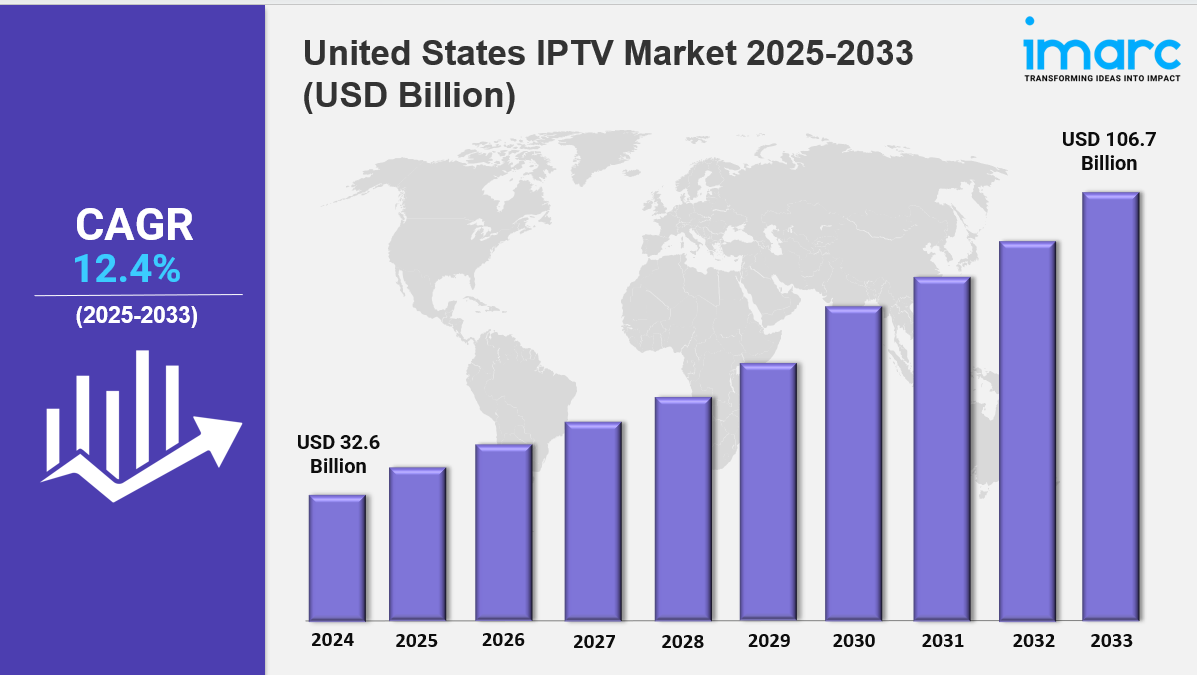

United States IPTV market size reached USD 32.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 106.7 Billion by 2033, exhibiting a growth rate (CAGR) of 12.4% during 2025-2033. The market is expanding due to increasing demand for on-demand content, widespread broadband access, and the shift away from traditional cable services. Growth is driven by technological advancements, personalized viewing experiences, and the rise of streaming platforms, making the industry more dynamic, user-centric, and competitive.

Key Market Highlights:

✔️ United States IPTV Market is witnessing steady growth due to rising demand for on-demand content and high-speed internet access.

✔️ Cord-cutting trends are accelerating IPTV adoption across households.

✔️ Market players are investing in personalized, ad-supported IPTV platforms.

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-iptv-market/requestsample

United States IPTV Market Trends and Drivers:

The United States IPTV Market is undergoing a major transformation as viewers continue to move away from traditional cable TV in favor of streaming platforms that offer more control and personalization. Consumers now expect content that aligns with their specific interests—whether it's niche sports, international films, or true crime documentaries. In response, services like YouTube TV and Sling TV are offering customizable features such as tailored channel lineups, social viewing options, and interactive tools like multi-angle live event coverage. These changes in viewing habits are a key force behind the evolving IPTV landscape.

At the same time, data privacy has become a growing concern. As IPTV platforms collect more user information to refine recommendations and target ads, viewers are demanding more transparency about how their data is used. Despite these concerns, convenience still drives subscription choices. Bundled services like Hulu + Live TV, which allow add-ons for premium content, remain popular because they offer flexibility without requiring users to manage multiple apps or logins.

On the technology side, faster internet speeds from 5G and expanded fiber networks are fueling United States IPTV Market Growth. With stronger infrastructure from providers like Verizon and AT&T, streaming high-resolution content—including 4K live broadcasts—has become more reliable across devices. In fact, nearly 70% of IPTV users now stream shows on smartphones, often switching to tablets or smart TVs seamlessly. Some new home builders are even integrating IPTV-ready smart TVs and voice-activated systems into their properties, showing how deeply IPTV is embedding itself into modern lifestyles.

However, challenges remain. High internet costs and limited broadband availability in rural areas continue to slow adoption in certain regions. Programs like the federal BEAD initiative aim to close that digital divide, but progress is gradual. Another obstacle for the United States IPTV Market is content fragmentation. With top shows spread across platforms like Netflix, Peacock, and Disney+, many users feel overwhelmed by the number of subscriptions required to watch their favorite content.

To simplify the experience, platforms like FuboTV and Philo have started bundling services and billing into single packages, reducing user friction and subscription fatigue. Meanwhile, free ad-supported streaming TV (FAST channels) is gaining momentum. These platforms attract viewers who prefer not to pay monthly fees. In 2024, ad revenue from FAST channels surged by over 20%, driven by a growing appetite for no-cost, high-quality streaming. Niche providers like YuppTV, which cater to specific cultural audiences, are also expanding their presence, though licensing hurdles continue to be a sticking point.

The United States IPTV Market Forecast points to steady long-term growth. As of 2024, more than 40% of U.S. households have already cut the cord, and IPTV subscriptions are expected to reach around 140 million by 2033. Younger audiences—especially Gen Z—are leading this shift, favoring on-demand access and cross-device compatibility. To meet this demand, platforms are adapting with flexible pricing models, including pay-per-view options, tiered subscriptions, and interactive ads.

Smart home integration is another driver of market expansion. Roughly one-third of IPTV users now interact with services through voice assistants like Amazon Alexa or Google Home. Some providers are even experimenting with AR and VR features to deliver immersive experiences for live sports and concerts. Regulatory developments could also shape the future. The FCC’s renewed focus on net neutrality and ongoing legal efforts to combat piracy—particularly of live sports—may influence how IPTV services operate in the coming years.

Sustainability is also entering the spotlight. The data centers powering IPTV consume substantial energy—around 3% of global electricity use. In response, major companies such as Amazon and Apple are making efforts to reduce emissions and transition to greener operations.

All things considered, the United States IPTV Market Outlook remains optimistic. As long as providers can deliver high-quality content, maintain user trust, embrace emerging technologies, and operate sustainably, IPTV is on track to become the dominant way Americans watch television and movies in the years ahead.

United States IPTV Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Subscription Type:

-

Subscription Based IPTV

-

Subscription Free IPTV

Breakup by Transmission Type:

-

Wired

-

Wireless

Breakup by Device Type:

-

Smartphones and Tablets

-

Smart TVs

-

PCs

-

Others

Breakup by Streaming Type:

-

Video IPTV

-

Non-Video IPTV

Breakup by Service Type:

-

In-House Service

-

Managed Service

Breakup by End User:

-

Residential

-

Enterprises

Breakup by Region:

-

Northeast

-

Midwest

-

South

-

West

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology