Digital Lending Market Drivers and Challenges

Digital lending refers to the process of obtaining loans through online platforms that connect borrowers directly with lenders, effectively bypassing traditional brick-and-mortar banks. This innovative approach to borrowing offers a streamlined and efficient experience, often revolutionizing the way individuals and businesses secure financial assistance.

The digital lending market encompasses a wide array of loan types, including personal loans, business loans, student loans, and mortgages. Each category serves distinct purposes and customer needs, providing tailored solutions for various financial requirements. With advancements in technology and the rising popularity of fintech companies, the digital lending sector has experienced remarkable growth in recent years, fundamentally transforming the accessibility and delivery of financial services.

One of the standout advantages of digital lending is its speed and convenience. Unlike traditional lending methods, which often involve extensive paperwork, in-person meetings, and prolonged approval processes, digital lending enables borrowers to complete applications online in a matter of minutes. Many platforms utilize advanced algorithms and data analytics to assess creditworthiness swiftly, allowing for instant approval and rapid disbursement of funds. This increased efficiency not only alleviates the stress of financing but also empowers borrowers to address their financial needs more promptly.

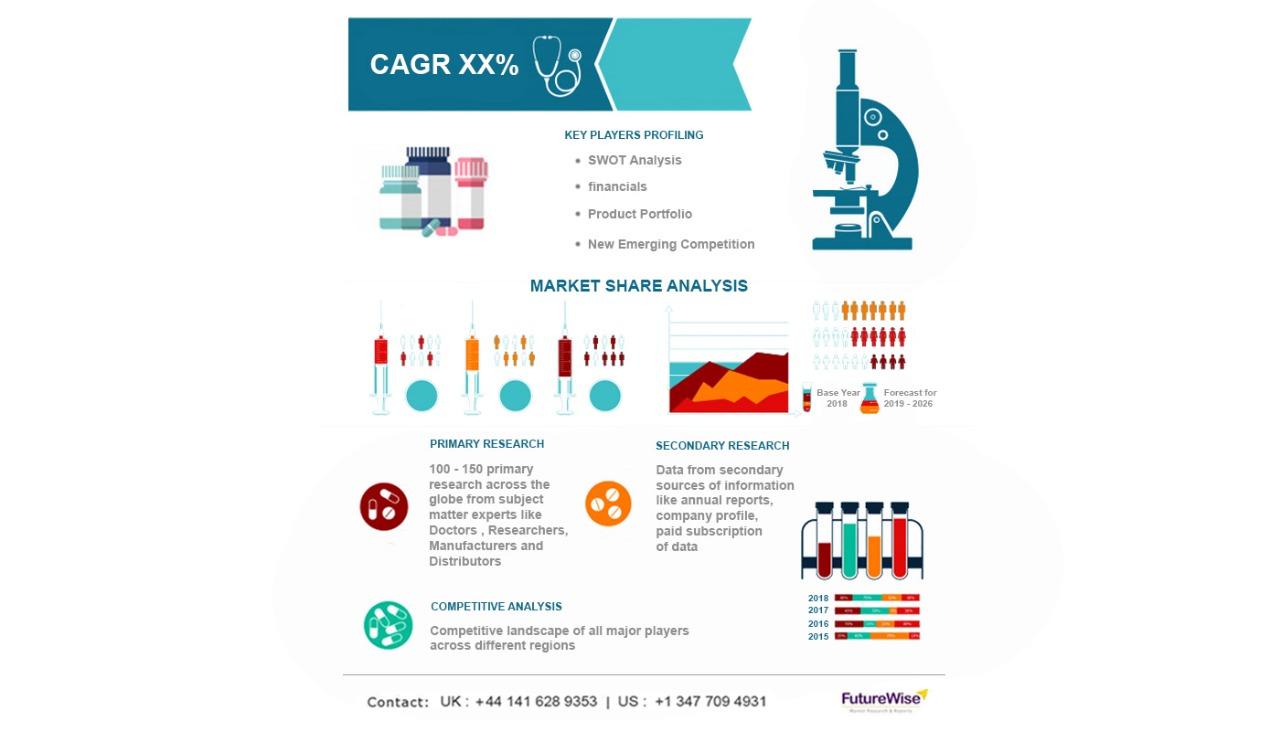

The report begins with an outline of the business environment and then explains the commercial summary of the chain structure.

The report also includes data on the overview of the competitive situation among different companies, including an analysis of the current market situation and prospects for growth. This report provides insights on the general market's profit through graphs, an in-depth SWOT analysis of the trends in this business space alongside regional proliferation.

Full Report @ https://futuremarketanalytics.com/report/digital-lending-market/

Digital Lending Market Segmentation:

By Offering

- Solutions

- Digital Lending Platforms

- Point Solutions

- Loan Origination

- Loan Servicing

- Loan/Debt Collection

- Limit and Collateral Management

- P2P Lending Software

- Others (Digital KYC, Analytics, and ECM)

- Services

- Consulting

- Implementation

- Support and Maintenance

By Deployment Mode

- Cloud

- On-premises

By End User

- Banks

- Credit Unions

- Non-banking Financial Companies (NBFCs)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Competitive Landscape in the Digital Lending Market:

Major market players enclosed within this market are

- Fiserv

- Ice Mortgage Technology

- Fis

- Newgen Software

- Nucleus Software

- Temenos

- Pega

- Intellect Design Arena

- Tavant

- Sigma Infosolutions

- Docutech

- CU Direct

- Abrigo

- Wizni

- Built Technologies

- Turnkey Lenders

- Finastra

- Rupeepower

- Roostify

- Juristech

(Note: The lists of the key players are going to be updated with the most recent market scenario and trends)

Future Market Analytics Focus Points:

- SWOT Analysis

- Key Market Trends

- Key Data -Points Affecting Market Growth

- Revenue and Forecast Analysis

- Growth Opportunities for New Entrants and Emerging Players

- Key Player and Market Growth Matrix

Objectives of the Study:

- To provide a comprehensive analysis on the Digital Lending Market By Offering,By Deployment Mode,By End User and By Region

- To cater extensive insights on factors influencing the market growth (drivers, restraints, industry-specific restraints, business expansion opportunities)

- To anticipate and analyse the market size expansion in key regions- North America, Europe, Asia Pacific, Latin America and Middle East and Africa

- To record and evaluate competitive landscape mapping- strategic alliances and mergers, technological advancements and product launches, revenue and financial analysis of key market players

Flexible Delivery Model:

- We have a flexible delivery model and you can suggest changes in the scope/table of content as per your requirement

- The customization services offered are free of charge with purchase of any license of the report.

- You can directly share your requirements/changes to the current table of content to: enquiry@futuremarketanalytics.com

About Future Market Analytics:

We at Future Market Analytics are capable of understanding consumer and market mindsets. Based on a precise current and forecast data analysis, we offer the most pertinent insights to organizations by implementing the latest market research methodologies. Studying high-growth niche markets like shipping and transportation, blockchain, energy, and sustainability, providing customized solutions to our clients, assuring agility, and flexibility in report delivery are parts of our business model which makes us stand out within our competition.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology