Bitcoin Miner Market Outlook 2025–2030: Technology Trends and Competitive Landscape

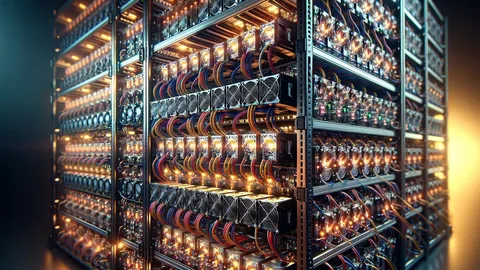

The Global Bitcoin Miner Market has undergone a dramatic transformation over the last decade, moving from small-scale, hobbyist-driven operations to highly advanced industrial-scale mining farms powered by cutting-edge technology. As Bitcoin continues to dominate the cryptocurrency landscape, the demand for efficient, scalable, and sustainable mining hardware and solutions is intensifying. The period between 2025 and 2030 will likely define the trajectory of the Bitcoin miner market, as key players balance innovation, energy consumption, decentralization, and regulatory compliance.

This article explores the market dynamics, technology advancements, efficiency strategies, sustainability initiatives, and competitive outlook of the Bitcoin miner industry, while highlighting the opportunities and challenges that lie ahead.

Click here to download the sample report

Market Overview

Bitcoin mining is the process of validating transactions and securing the blockchain network by solving complex mathematical problems using specialized hardware called miners. In exchange, miners receive Bitcoin rewards, making the mining process an essential element of the cryptocurrency ecosystem.

The Bitcoin miner market includes hardware manufacturers, software optimization providers, cooling system developers, and mining pool operators. Its growth is directly tied to three major factors:

- Bitcoin price volatility – directly influencing mining profitability.

- Energy efficiency of mining hardware – impacting cost optimization.

- Global regulations – shaping mining operations across regions.

As Bitcoin adoption expands into mainstream finance, institutional investors, and even nation-state reserves, the role of miners will remain central to the sustainability and security of the ecosystem.

Key Technology Segments in Bitcoin Miner Market

1. Application-Specific Integrated Circuits (ASICs)

ASIC miners dominate the Bitcoin mining landscape due to their unparalleled performance and efficiency. Compared to GPUs and CPUs, ASICs are purpose-built to execute Bitcoin’s SHA-256 hashing algorithm. The focus for 2025–2030 will be:

- Increasing hash rates per unit of energy.

- Reducing power consumption per terahash.

- Enhancing chip cooling systems for longer operational lifespans.

2. Graphics Processing Units (GPUs)

Although GPUs are no longer the primary choice for Bitcoin mining due to efficiency constraints, they remain relevant for altcoin mining and hybrid operations. Some Bitcoin mining operations still utilize GPUs for flexibility across blockchain protocols.

3. Field-Programmable Gate Arrays (FPGAs)

FPGAs offer customizable mining capabilities and sit between ASICs and GPUs. While their share in Bitcoin mining is limited, their adaptability positions them as a niche solution for specialized mining environments.

4. Immersion Cooling and Advanced Thermal Management

Heat dissipation remains one of the biggest challenges in mining farms. The emergence of liquid cooling, immersion cooling tanks, and AI-driven cooling systems is expected to shape the operational landscape of Bitcoin mining between 2025 and 2030.

Market Drivers

- Institutional Investment in Mining Infrastructure

Hedge funds, venture capitalists, and large-scale investors are increasingly backing mining firms, fueling hardware demand and energy infrastructure development. - Global Digital Asset Adoption

As Bitcoin gains recognition as a digital gold and inflation hedge, mining activity will remain robust, sustaining demand for efficient miners. - Energy Efficiency and Sustainability

The need to reduce energy consumption per transaction is driving innovation in ASIC design, renewable energy integration, and hybrid mining solutions. - Decentralization and Security Needs

Mining is crucial for maintaining blockchain security. Increased transaction volumes will demand higher computational power, boosting miner market growth. - Government and Corporate Blockchain Projects

Bitcoin mining indirectly benefits from broader blockchain adoption as enterprises and states explore Bitcoin reserves, custodial services, and mining policies.

Market Challenges

- High Energy Consumption

Mining consumes significant electricity, raising sustainability concerns and regulatory scrutiny. Efficient cooling and renewable energy integration are crucial. - Hardware Obsolescence

Rapid innovation cycles in ASICs mean older hardware becomes unprofitable within 18–24 months, creating challenges in capital expenditure planning. - Regulatory Uncertainty

Governments worldwide are divided—some embracing mining as an economic opportunity, while others impose strict restrictions due to environmental or monetary concerns. - Geopolitical Shifts in Mining Hubs

Following China’s crackdown, mining power shifted to North America, Central Asia, and Europe. Future shifts will depend on energy policies and regulation. - Bitcoin Halving Events

Halving cycles (occurring every 4 years) reduce mining rewards, pressuring miners to adopt more efficient technologies to remain profitable.

Regional Outlook

North America

- The largest hub for industrial mining farms.

- Strong emphasis on renewable energy-powered operations (wind, solar, hydro).

- Growth driven by policy support in certain states.

Asia-Pacific

- Kazakhstan, Russia, and emerging Southeast Asian countries remain mining hotspots.

- Energy subsidies and availability of stranded natural gas are key drivers.

- However, regulatory uncertainty poses risks.

Europe

- Europe emphasizes green mining solutions, with operations integrating renewable grids and carbon-neutral mining strategies.

- Growing focus on small, distributed mining farms.

Latin America

- Countries like El Salvador are experimenting with volcano-powered Bitcoin mining.

- Latin America may become an innovation hub for sustainable mining.

Middle East & Africa

- Investment in solar-powered mining farms is gaining traction, leveraging abundant renewable energy sources.

Future Trends (2025–2030)

- Shift to Renewable Energy-Powered Mining

Large-scale miners will increasingly partner with renewable energy providers to reduce operational costs and carbon footprints. - Integration of AI and Automation

AI-driven systems will optimize energy usage, predict hardware failures, and enhance cooling efficiency. - Immersion Cooling Adoption

By 2030, immersion cooling will become mainstream for industrial farms, enabling higher density mining rigs. - Mining as a Service (MaaS)

Cloud-based mining models will expand, allowing individuals and smaller firms to participate without hardware ownership. - Global Decentralization Push

Governments and communities will encourage decentralized mining to prevent centralization of Bitcoin’s hash power. - Convergence with Financial Institutions

Traditional banks and financial service providers may partner with miners for custody and transaction verification.

Competitive Landscape

The Bitcoin miner market is highly competitive, with constant innovation cycles. Major players include:

- Bitmain Technologies Ltd.

- MicroBT

- Canaan Creative

- Ebang International Holdings

- Bitfury Group

- WhatsMiner

- StrongU

- Innosilicon

- ASICminer

- Spondoolies-Tech

These companies compete on hashing efficiency, energy optimization, pricing, and availability. Collaborations with renewable energy providers and cooling solution innovators are becoming key differentiators.

Sustainability and the Road Ahead

The sustainability debate surrounding Bitcoin mining will remain central. Between 2025 and 2030, the industry will likely transition toward:

- Carbon-neutral operations powered by solar, wind, hydro, and geothermal.

- Recycling of heat waste for industrial and residential purposes.

- Government incentives for green mining.

This sustainability-driven transformation will determine not only the public perception of Bitcoin mining but also its regulatory standing across key markets.

Conclusion

The Bitcoin miner market is poised for a transformative decade between 2025 and 2030. With growing pressure on energy efficiency, regulatory compliance, and hardware innovation, the industry will continue to adapt, innovate, and scale.

While challenges such as high energy consumption and hardware obsolescence remain, opportunities lie in AI integration, renewable-powered mining farms, decentralized models, and cooling innovations. For stakeholders, success will depend on embracing technological upgrades, sustainability practices, and adaptive business models that align with the evolving global digital economy.

The Bitcoin miner market will not only power the world’s largest cryptocurrency but also serve as a blueprint for future blockchain infrastructure sustainability and efficiency.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology