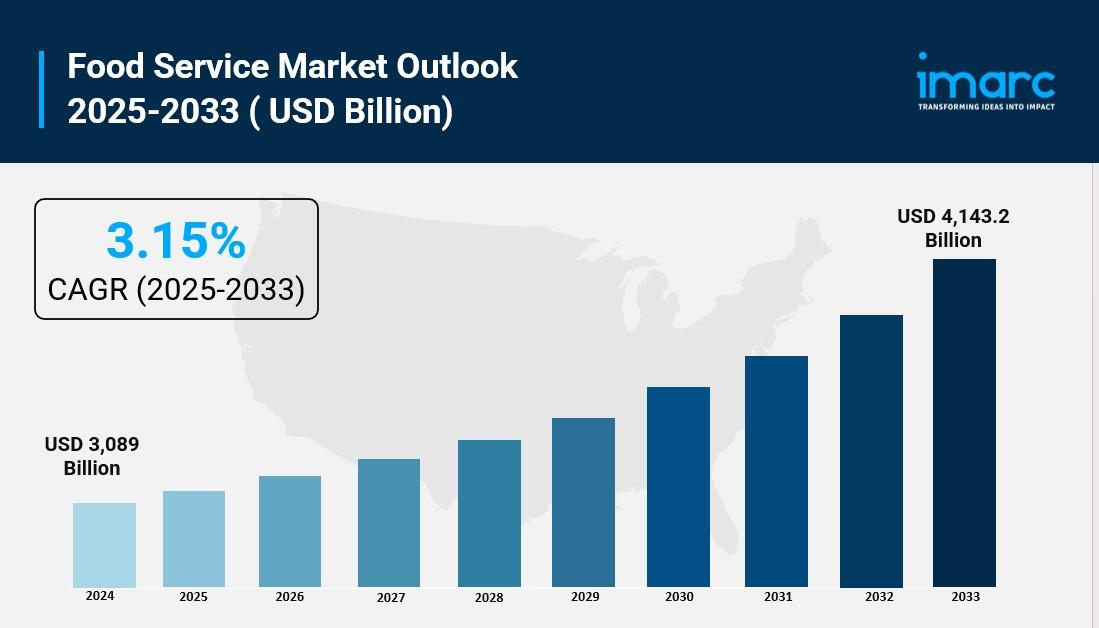

Food Service Market is Expected to Grow USD 4,143.2 Billion by 2033 | At CAGR 3.15%

Food Service Market Size and Outlook 2025 to 2033

The global food service market has established itself as one of the world's largest and most dynamic industries, encompassing everything from quick-service restaurants to fine dining establishments and institutional catering services. The global food service market size reached USD 3,089 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4,143.2 Billion by 2033, exhibiting a growth rate (CAGR) of 3.15% during 2025-2033. Asia Pacific currently leads the market, accounting for the largest food service market share due to rising demand for diverse food products and growing preferences for dining out among the masses. The market is experiencing stable growth driven by increasing health-consciousness among individuals, rising number of online food delivery platforms offering enhanced convenience, and increasing focus on health and wellness to maintain active lifestyles.

Key Stats for Food Service Market:

- Food Service Market Value (2024): USD 3,089 Billion

- Food Service Market Value (2033): USD 4,143.2 Billion

- Food Service Market Forecast CAGR: 3.15%

- Leading Segment in Food Service Market in 2024: Commercial Sector (Majority Share)

- Key Regions in Food Service Market: Asia Pacific, North America, Europe, Latin America, Middle East and Africa

- Top companies in Food Service Market: Chipotle Mexican Grill Inc., Costa Limited, Domino's Pizza Inc., Jollibee Foods Corporation, KFC Corporation, McDonald's Corporation, Restaurant Brands International Inc., Starbucks Corporation, Subway IP LLC, Supermac's, Tim Hortons Inc., Wendy's International LLC, Yum! Brands Inc., etc.

Request to Get the Sample Report: https://www.imarcgroup.com/food-service-market/requestsample

Why is the Food Service Market Growing?

The food service industry is experiencing robust expansion driven by fundamental shifts in consumer behavior, technological advancement, and evolving dining preferences that reflect changing lifestyles and increased disposable income across global markets.

The growing demand for nutritious and balanced meal options due to rising health consciousness among individuals is offering a positive market outlook. Food service providers are adopting innovative solutions to cater to health-conscious consumers, with restaurants and establishments offering menu items that address various dietary needs including vegetarian, gluten-free, and low-calorie choices. These establishments are prioritizing fresh and locally sourced ingredients to meet demand for healthier and sustainable food options.

The increasing number of online food delivery platforms across the globe is propelling market growth significantly. Online food delivery platforms and mobile apps are making it easier for consumers to place orders, make reservations, and pay for their meals. The rising focus on off-premises dining and takeout orders is bolstering market expansion, with data analytics and customer relationship management tools enabling organizations to personalize marketing efforts and improve customer experiences.

Digital transformation is revolutionizing the food service landscape. The integration of technology, including automation and kitchen management systems, assists in streamlining operations, improving efficiency, and reducing errors in food preparation and order fulfillment. The worldwide AI market is expected to grow to over $631 billion by 2028 from $235 billion in 2024, with significant growth anticipated in the restaurant industry based on current adoption trends.

Rising awareness about maintaining healthy mind and body is contributing to market growth. People are becoming more health-conscious and seeking food options that align with their dietary goals and lifestyles. The increasing demand for plant-based and vegetarian options among masses worldwide is strengthening market growth, with many food service providers introducing meatless alternatives and plant-based proteins to cater to growing vegan consumer bases.

Regional market dynamics create substantial growth opportunities. The U.S. food service market size reached USD 1,515.5 billion in 2024 and is expected to reach USD 2,613.0 billion by 2033 at a growth rate of 6.24%. India's food service market reached USD 50.99 billion in 2024 and is projected to reach USD 123.5 billion by 2033, demonstrating the explosive growth potential in emerging markets.

Culinary diversity trends are driving expansion as increasing preferences for various flavors and fusion cuisine incorporation into menus impels market growth. The rising demand for themed restaurants and pop-up food events showcasing diverse culinary traditions, as consumers become more willing to explore international cuisines, strengthens market development.

AI Impact on the Food Service Market:

Artificial intelligence is revolutionizing the food service industry by enabling personalized dining experiences, optimizing operations, and transforming how restaurants interact with customers while improving efficiency and profitability across all segments of the market.

AI technology is transforming restaurant operations through intelligent menu optimization, predictive analytics, and automated customer service systems. AI can analyze past orders, dietary restrictions, and even weather data to curate personalized menus for individual customers, while optimizing kitchen operations by predicting peak times and suggesting ingredient preparation based on real-time data.

Customer engagement and personalization represent major AI applications in food service. In 2024, elevated customer engagement and frictionless user experiences became top priorities, with AI systems understanding customer behaviors and preferences to tailor optimal experiences for frequent visitors. Up to 46% of restaurant owners are already automating customer communications to streamline business operations, with this percentage expected to rise significantly.

Predictive analytics and demand forecasting powered by AI help restaurants optimize inventory management, reduce food waste, and improve supply chain efficiency. Machine learning algorithms analyze historical sales data, seasonal patterns, and external factors like weather or events to predict demand accurately and adjust purchasing and preparation accordingly.

Kitchen automation and food preparation systems enhanced by AI are streamlining food production processes. Smart kitchen appliances, automated cooking systems, and robotic food preparation equipment are becoming more sophisticated, enabling consistent quality while reducing labor costs and human error in food preparation.

AI-driven pricing optimization systems analyze competitor pricing, demand patterns, and customer behavior to recommend optimal menu pricing strategies that maximize revenue while maintaining customer satisfaction. These systems can adjust prices dynamically based on time of day, demand levels, and other market factors.

Quality control and food safety applications use AI-powered sensors and monitoring systems to track food temperatures, storage conditions, and preparation processes, ensuring compliance with food safety regulations while reducing the risk of foodborne illnesses.

Voice-activated ordering systems and chatbots enhanced by natural language processing are improving customer service efficiency while reducing wait times and order errors. These AI systems can handle complex orders, answer menu questions, and process payments seamlessly.

Get Discount On The Purchase Of This Report: https://www.imarcgroup.com/checkout?id=1310&method=1670

Segmental Analysis:

Analysis by Sector:

- Commercial

- Non-Commercial

Commercial accounts for the majority of the market share, involving restaurants, cafes and coffee shops, fast food chains, food trucks, and fine dining establishments. Commercial operations serve diverse consumer needs ranging from quick convenience to sophisticated dining experiences.

Analysis by Systems:

- Conventional Foodservice System

- Centralized Foodservice System

- Ready Prepared Foodservice System

- Assembly-Serve Foodservice System

Conventional foodservice system holds the largest market share, involving preparation of meals from raw ingredients in on-site kitchens. This system offers high customization and freshness, commonly used by restaurants, fine dining establishments, and cafes for made-to-order dishes.

Analysis by Types of Restaurants:

- Fast Food Restaurants

- Full-Service Restaurants

- Limited Service Restaurants

- Special Food Services Restaurants

Full-service restaurants represent the leading market segment, offering comprehensive dining experiences with table service, extensive menus, and attentive customer service throughout the dining experience, popular for special occasions and leisurely dining.

Analysis by Region:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

Asia Pacific leads the market, accounting for the largest food service market share due to rising demand for wide range of food products, growing preferences for dining out, and rapid adoption of food delivery apps and automation in food preparation and delivery.

What are the Drivers, Restraints, and Key Trends of the Food Service Market?

Market Drivers:

The food service market benefits from several powerful growth drivers transforming dining and hospitality experiences globally. Technology integration creates substantial opportunities, with AI technology rapidly making restaurants more efficient, profitable, and customer-centric through automated systems and data-driven decision making.

Health consciousness trends drive significant market expansion as consumers prioritize nutritious dining options. Restaurants are responding by offering healthier menu alternatives, reducing unhealthy ingredients, providing smaller portion sizes, and offering detailed nutritional information to help customers make informed choices.

Digital delivery platforms create new revenue streams and customer touchpoints. The United States online food delivery market size valued at USD 31.91 billion in 2024 is expected to reach USD 74.03 billion, demonstrating the massive growth potential in digital food service channels.

Urbanization and lifestyle changes support continued market growth as busy lifestyles increase demand for convenient food service options. The rise in dual-income households, longer working hours, and urban living patterns create sustained demand for restaurant meals and food delivery services.

Innovation in food service concepts attracts diverse consumer segments. Food trucks, pop-up restaurants, ghost kitchens, and specialized dining experiences cater to consumers seeking unique culinary adventures and convenient access to diverse food options.

Market Restraints:

Despite strong growth prospects, the food service market faces several challenges that could impact expansion rates. Labor shortages and rising wage costs pressure profit margins, particularly in markets where minimum wage increases outpace productivity improvements.

Supply chain disruptions and ingredient cost volatility create operational challenges for food service providers. Fluctuating commodity prices, transportation costs, and supply availability can significantly impact menu pricing and profitability.

Regulatory compliance requirements around food safety, labor laws, and health regulations increase operational complexity and costs, particularly for smaller establishments lacking dedicated compliance resources.

Market saturation in mature markets limits growth opportunities, forcing operators to compete intensively on price, quality, and customer experience to maintain market share.

Economic sensitivity affects consumer spending on discretionary dining, with economic downturns typically reducing frequency of restaurant visits and average spending per customer.

Market Key Trends:

Several transformative trends are reshaping the food service industry landscape. Restaurant technology trends in 2024 focus on enhancing efficiency through hardware and software innovations, with smart kitchen appliances, POS systems, and self-service kiosks streamlining operations.

Sustainability initiatives are becoming competitive differentiators as consumers increasingly prefer environmentally responsible food service providers. Restaurants are adopting eco-friendly packaging, reducing food waste, sourcing locally, and implementing energy-efficient equipment.

Ghost kitchens and virtual restaurants represent rapidly growing market segments, enabling food service providers to expand their reach without traditional brick-and-mortar investments while serving delivery-only customers.

Personalization and customization options appeal to consumers seeking individualized dining experiences. AI-powered recommendation systems, customizable menu options, and dietary accommodation services enhance customer satisfaction and loyalty.

Contactless service technologies gained permanent adoption following pandemic-driven changes, with QR code menus, mobile payment systems, and automated ordering becoming standard features across various restaurant segments.

Hybrid dining models combining dine-in, takeout, and delivery services allow restaurants to maximize revenue streams while serving diverse customer preferences and adapting to changing market conditions.

Social media integration and influencer marketing are becoming essential components of restaurant marketing strategies, with Instagram-worthy food presentation and viral social media campaigns driving customer discovery and engagement.

Leading Players of Food Service Market:

According to IMARC Group's latest analysis, prominent companies shaping the global food service landscape include:

- Chipotle Mexican Grill Inc.

- Costa Limited

- Domino's Pizza Inc.

- Jollibee Foods Corporation

- KFC Corporation

- McDonald's Corporation

- Restaurant Brands International Inc.

- Starbucks Corporation

- Subway IP LLC

- Supermac's

- Tim Hortons Inc.

- Wendy's International LLC

- Yum! Brands Inc.

These industry leaders are driving innovation through strategic investments in technology integration, menu diversification, sustainable practices, and global expansion initiatives to meet evolving consumer preferences across diverse markets and demographic segments.

Key Developments in Food Service Market:

-

2024: Major restaurant chains accelerated AI adoption for customer service automation, with 46% of restaurant owners implementing automated customer communications to streamline operations and improve customer satisfaction through faster response times.

-

2024: Technology integration reached new heights as restaurants invested in smart kitchen appliances, cloud-based POS systems, and self-service kiosks to enhance operational efficiency and reduce labor dependencies while improving customer experiences.

-

2024: Sustainability initiatives became mainstream competitive differentiators, with leading food service providers adopting eco-friendly packaging, implementing food waste reduction programs, and sourcing locally to meet environmentally conscious consumer demands.

-

2024: Ghost kitchen concepts expanded rapidly across major markets, enabling restaurants to serve delivery-only customers while reducing overhead costs and expanding market reach without traditional dining space investments.

-

2024: Personalization technology advanced significantly, with AI-powered recommendation systems analyzing customer preferences, dietary restrictions, and ordering history to create customized menu suggestions and targeted promotional offers.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=1310&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology