The Discrete Semiconductor Market is Estimated To Witness High Growth Owing To Miniaturization Trends

Market Overview:

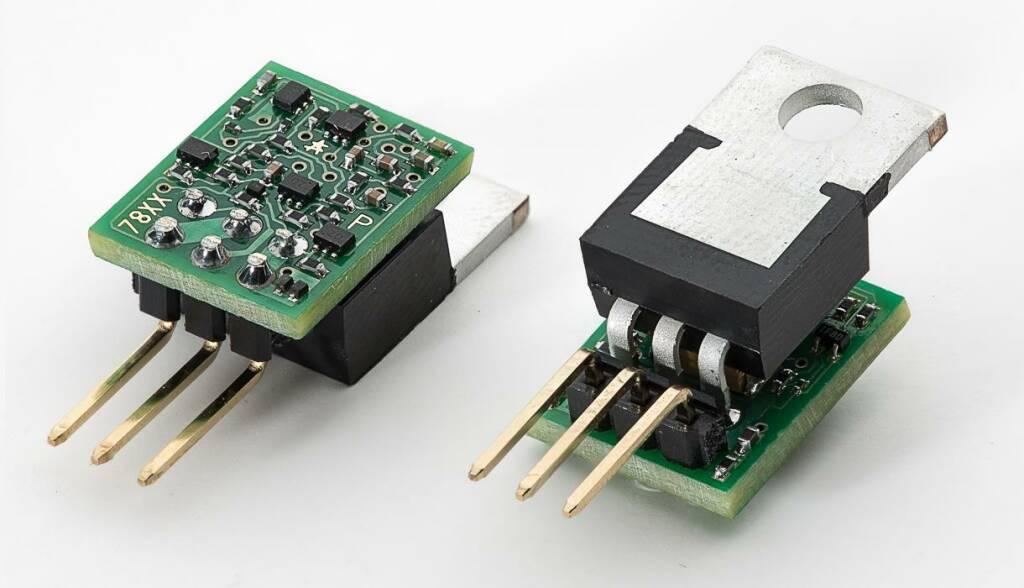

Discrete semiconductors are basic building blocks for electronic components that perform distinct electrical functions such as amplification, switching, rectification and voltage stabilization. They are commonly used in power electronics, consumer electronics and various industrial applications. Miniaturization of discrete semiconductors has enabled their use in smaller devices and complex circuits.

The global Discrete Semiconductor Market is estimated to be valued at US$ 33.12 Bn or Mn in 2023 and is expected to exhibit a CAGR of 4.0% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights.

Market key trends:

One of the key trends witnessed in the discrete semiconductor market is the ongoing trend of miniaturization. This enables manufacturers to embed more functionality into smaller device footprints. Miniaturized discrete components help reduce overall device size and weight, while improving performance. They allow for integration of more semiconductor components in the limited real estate available on circuit boards. Advancements in material science and semiconductor fabrication technologies have facilitated ongoing reduction in component size. Growing demand for compact devices across consumer electronics and other end-use industries is propelling miniaturization of discrete semiconductor components.

Porter’s Analysis

Threat of new entrants: The discrete semiconductor market requires huge R&D investments and manufacturing facilities to produce chips. This makes the entry barriers high for new players.

Bargaining power of buyers: The discrete semiconductor market has numerous large buyers such as automotive, telecommunication, and industrial sectors. However, the switching costs for buyers are relatively low.

Bargaining power of suppliers: Few global companies dominate the raw material supplies for discrete semiconductor manufacturing. This gives significant bargaining power to the suppliers.

Threat of new substitutes: Integrated circuits have emerged as substitutes for discrete semiconductors in certain applications. However, discrete chips still have advantages over ICs in many industrial applications.

Competitive rivalry: Intense competition exists among the top players to gain more market share through new technologies and product innovations.

SWOT Analysis

Strength: Toshiba, Hitachi, and Mitsubishi have strong R&D capabilities and extensive experience in discrete semiconductors.

Weakness: Many smaller players face challenges in scaling manufacturing capacities and maintaining profitability. Higher dependencies on a few key markets.

Opportunity: Growth in industrial automation, electric vehicles, and renewable energy to drive the demand for power discrete devices in the forecast period.

Threats: Trade tensions and geopolitical issues can disrupt global supply chains. Prices of key raw materials are vulnerable to volatile market conditions.

Key Takeaways

The Global Discrete Semiconductor Market Size is expected to witness high growth, exhibiting CAGR of 4.0% over the forecast period, due to increasing demand for electric vehicles. Automakers are incorporating discrete semiconductors into electric powertrains and battery management systems to enable fast charging and extended driving range.

Regional analysis related content comprises Regional analysis related content: North America dominates the global discrete semiconductor market and is expected to maintain its leading position over the forecast period. This is attributed to strong automotive, industrial, and manufacturing base in the US and Canada. Asia Pacific displays the fastest growth in the discrete semiconductor market owing to large production of consumer electronics and presence of discrete semiconductor manufacturing facilities in countries like China, Taiwan and South Korea.

Key players related content comprises Key players operating in the discrete semiconductor market are Toshiba Electronic Devices & Storage Corporation (Toshiba Corp.), Hitachi Power Semiconductor Device Ltd (Hitachi Ltd), Mitsubishi Electric Corporation, Vishay Intertechnology Inc., NXP Semiconductors NV, ON Semiconductor Corporation, Microsemi Corporation (Microchip Technology), Diodes Incorporated, STMicroelectronics NV, Eaton Corporation PLC, ROHM Co. Ltd, Renesas Electronics Corporation, Nexperia BV, Fuji Electric Co. Ltd, Cree Inc., Qorvo Inc., D3 Semiconductor LLC, ABB Limited, Infineon Technologies AG, United Silicon Carbide Inc., Taiwan Semiconductor Co. Ltd, Littelfuse Inc. and General Electric Company.

Get more insights on this topic:

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology