Formic Acid Is Estimated To Witness High Growth Owing To Rising Demand From Rubber Industry

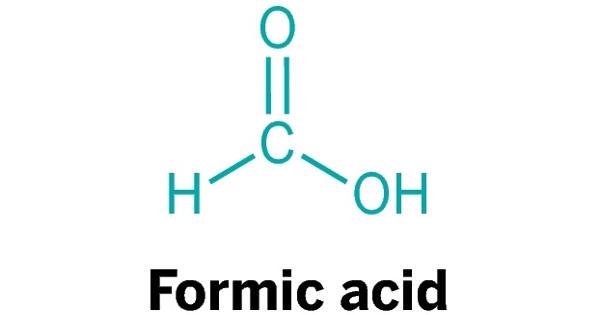

Formic acid is a colorless solution with a sharp, pungent odor. It is widely used as a preservative and an antibacterial agent in agriculture, especially in silage production for livestock. As an essential raw material, formic acid is also used in the production of pharmaceuticals and polymers. The increasing demand from rubber industry where it is used for coagulation of natural and synthetic rubbers and as a curing agent for rubber compounds is driving its market growth.

The global Formic Acid Market is estimated to be valued at US$ 1.76 Bn in 2023 and is expected to exhibit a CAGR of 4.9% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights.

Market Dynamics:

One of the key drivers for the growth of the global formic acid market is the rising demand from the rubber industry. Formic acid is extensively used in the production of various types of synthetic and natural rubber such as nitrile rubber, butyl rubber, ethylene propylene diene monomer rubber. It acts as a catalyst as well as coagulant in the rubber manufacturing process. According to data by India Brand Equity Foundation, the global rubber industry was valued at over USD 50 billion in 2020 and is growing at a rate of over 4% annually. The rubber industry's increasing consumption of formic acid as a raw material is expected to propel the market growth over the forecast period. Furthermore, increasing usage of silage preservatives in cattle feed industry is also boosting the market as formic acid prevents aerobic decomposition of forage crops in silage.

SWOT Analysis

Strength: Formic acid is widely used as an agricultural preservative and silage agent due to its anti-bacterial and anti-fungal properties. It is effective in preserving the nutritional value of silage for feeding livestock. Formic acid also acts as an effective animal repellent and pesticide due to its strong odour and acidity. Further, it has applications in leather tanning, textile dyeing and process manufacturing which ensures stable demand from various end-use industries.

Weakness: Being a highly corrosive acid, formic acid requires specialized storage tanks and transportation tankers made from corrosion resistant materials like stainless steel. This significantly increases capital investment and operating costs for companies. There are also health and safety concerns during production and handling of formic acid due to risk of burns if it comes in contact with skin.

Opportunity: Growing meat consumption and rising focus on feed additives to improve livestock health are promoting demand for high-quality silage globally. As formic acid effectively prevents spoilage of silage, its usage is expected to ramp up in the animal feed industry. Expanding textile industry in developing nations also provides new avenues as formic acid is used to dye nylon and other synthetic fabrics.

Threats: Stringent environment regulations imposed by various governments on VOC emissions during formic acid production may increase compliance costs for manufacturers. Substitutes like propionic acid and organic acids also pose competition threat especially in applications where cost is a major purchasing factor. Volatility in raw material prices can impact stability of profit margins.

Key Takeaways

The Global Formic Acid Market Size sssis expected to witness high growth over the forecast period supported by factors like rising meat consumption globally and growth of industrial sectors that use formic acid. The market size is projected to reach US$ 1.76 billion by 2023.

Regional analysis: Asia Pacific currently dominates the formic acid market and the trend is expected to continue. This is attributed to large production capacities and rapidly growing meat and textile industries in China and India. These factors are fueling greatest demand growth for formic acid in Asia Pacific region.

Key players: Key players operating in the formic acid market are BASF SE, Eastman Chemical Company, Shandong Acid Technology Co. Ltd, Gujarat Narmada Valley Fertilizers & Chemicals Limited, LUXI GROUP, Perstorp Holdings ABPOLIOLI SpA, PT Pupuk Kujang, Rashtriya Chemicals and Fertilizers Limited, and Wuhan Ruisunny Chemical Co. Ltd. These leading companies are actively expanding production capacities and developing novel application areas to consolidate their position in the industry.

Get more insights on this topic:

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology