Peer-to-Peer Lending Market Overview:

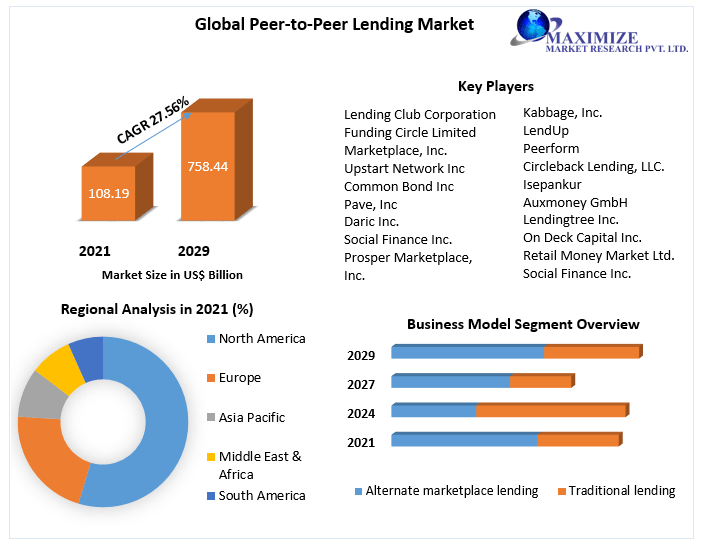

The "Global Peer-to-Peer Lending Market Analysis" is a detailed and specialised analyses of the Peer-to-Peer Lending market, with a focus on global market trends and analysis. The goal of this research is to provide a broad overview of the Peer-to-Peer Lending market as well as detailed market segmentation by connection type, end-use, and geography. The Peer-to-Peer Lending market is expected to grow substantially throughout the forecast period. The study includes crucial data on the market positions of the leading Peer-to-Peer Lending players, as well as relevant industry trends and opportunities.

For further information, click the following link@ https://www.maximizemarketresearch.com/request-sample/54358

Market Scope:

The research uses a PESTLE analysis to evaluate the strengths and weaknesses of the market's leading players. The researcher undertakes a complete examination of the Peer-to-Peer Lending Market size, share, trends, total earnings, gross revenue, and profit margin in order to accurately forecast the market and provide investors with expert advice on market changes.

The report also includes company biographies, product images and specs, capacity, production, pricing, cost, revenue, and contact information for the Global Peer-to-Peer Lending market's leading industry players. The Peer-to-Peer Lending Market Trends, Volume, and Value at the Global, Regional, and Company Levels are investigated in this report. By examining historical data and forecasts, this study examines the overall Peer-to-Peer Lending Market Size from a worldwide viewpoint.

Market Dynamics:

The study on the worldwide peer-to-peer lending market offers a thorough examination of the market's prospects for expansion as well as its obstacles and limiting factors. The market is expanding due to a rise in the use of online applications and a need for traditional banking systems that are powered by technology. P2P lending has several advantages, including better returns for investors, easier access to capital, and cheaper interest rates, all of which are anticipated to fuel industry expansion. Additionally, compared to other lending platforms, peer-to-peer lending provides greater flexibility.

Market Segmentation:

by Business Model

• Alternate marketplace lending

• Traditional lending

In 2021, the market was led by the traditional lending segment based on company model. It is the most typical kind of loan that small and medium-sized businesses receive. Traditionally, P2P lending is handled by the platform, which also handles transactions, marketing, and debt collection for both lenders and borrowers. The market is expanding because of the straightforward and understandable method. Furthermore, the P2P lending sector is growing thanks to the advantages that traditional lending gives, like greater loan quality, increased transparency, easy and uncomplicated financing, and always direct investment structure. Furthermore, growth in the alternate marketplace financing area is anticipated over the predicted period.

by End User

• Small business loans

• Consumer credit loans

• Real estate loans

• Student loans

Small business loans, as perceived by end users, have dominated the market in recent years and are predicted to continue to do so at a CAGR of xx% throughout the projection period. Small business loans are necessary for new ventures in order to finance infrastructure upgrades, machinery upgrades, operations expansion, inventory maintenance, and working capital increases—all of which are factors contributing to the market's expansion.

To know about the Research Methodology :- Request Free Sample Report

Peer-to-Peer Lending Market Key Players:

Major breakthroughs in the Peer-to-Peer Lending industry are discussed, as well as organic and inorganic growth plans. Various companies are focusing on organic growth strategies such as new product releases, product approvals, and other items such as patents and events. Inorganic growth strategies used in the industry included acquisitions, partnerships, and collaborations. Industry participants in the Peer-to-Peer Lending market are projected to benefit from strong growth opportunities in the future as a result of growing demand. A few companies active in the Peer-to-Peer Lending industry are listed below.

• Lending Club Corporation

• Funding Circle Limited

• Marketplace, Inc.

• Upstart Network Inc

• Common Bond Inc

• Pave, Inc

• Daric Inc.

• Social Finance Inc.

• Prosper Marketplace, Inc.

• Daric Social Finance, Inc.

• Zopa Limited

• Avant, Inc.

• onDeck Capital, Inc.

• RateSetter

• Kabbage, Inc.

• LendUp

• Peerform

• Circleback Lending, LLC.

• Isepankur

• Auxmoney GmbH

• Lendingtree Inc.

• On Deck Capital Inc.

• Retail Money Market Ltd.

• Social Finance Inc.

• Zopa Limited

Regional Analysis:

The Peer-to-Peer Lending study goes into great detail about the market area, which is divided into sub-regions and countries. Profit estimates as well as market share in each country are included in this portion of the research. This section of the report examines the share and growth rate of each region, country, and sub-market region during the forecasted period.

After assessing political, economic, social, and technical variables affecting the Peer-to-Peer Lending market in various regions, the research presents a comprehensive PESTLE analysis for all five regions: North America, Europe, Asia Pacific, Middle East and Africa, and South America.

COVID-19 Impact Analysis on Peer-to-Peer Lending Market:

As a result of the COVID-19 outbreak, customer behaviour has changed in all spheres of society. Industries, on the other hand, will have to adjust their strategies to accommodate changing market supplies. This study will help you build your company in compliance with the new industry standards by providing an overview of the COVID-19's impact on the Peer-to-Peer Lending market.

The Peer-to-Peer Lending Market Report includes a 360-degree overview of the COVID-19 pandemic, including the flexible supply chain, import and fare control, provincial government policies, and future influence on the company. The market situation (2024-2030), venture rivalry example, advantages and disadvantages of huge business products, industry development patterns (2024-2030), territorial modern format characteristics and macroeconomic approaches, and mechanical arrangement have all been included in itemized research.

For further information, click the following link@ https://www.maximizemarketresearch.com/request-sample/54358

Key questions answered in the Peer-to-Peer Lending Market are:

- What is Peer-to-Peer Lending?

- What was the Peer-to-Peer Lending market size in 2022?

- What is the growth rate of the Peer-to-Peer Lending Market?

- Which are the factors expected to drive the Peer-to-Peer Lending market growth?

- What are the different segments of the Peer-to-Peer Lending Market?

- What growth strategies are the players considering to increase their presence in Peer-to-Peer Lending?

- What are the upcoming industry applications and trends for the Peer-to-Peer Lending Market?

- What are the recent industry trends that can be implemented to generate additional revenue streams for the Peer-to-Peer Lending Market?

- What major challenges could the Peer-to-Peer Lending Market face in the future?

- What segments are covered in the Peer-to-Peer Lending Market?

- Who are the leading companies and what are their portfolios in Peer-to-Peer Lending Market?

- What segments are covered in the Peer-to-Peer Lending Market?

- Who are the key players in the Peer-to-Peer Lending market?

Key Offerings:

- Past Market Size and Competitive Landscape (2019 to 2023)

- Past Pricing and price curve by region (2019 to 2023)

- Market Size, Share, Size & Forecast by different segment | 2024−2030.

- Market Dynamics – Growth Drivers, Restraints, Opportunities, and Key Trends by Region

- Market Segmentation – A detailed analysis by segment with their sub-segments and Region

- Competitive Landscape – Profiles of selected key players by region from a strategic perspective

- Competitive landscape – Market Leaders, Market Followers, Regional player

- Competitive benchmarking of key players by region

- PESTLE Analysis

- PORTER’s analysis

- Value chain and supply chain analysis

- Legal Aspects of Business by Region

- Lucrative business opportunities with SWOT analysis

- Recommendations

More Related Reports:

Global Hardware Security Module Market https://www.maximizemarketresearch.com/market-report/global-hardware-security-module-market/55244/

Global Graphene Nanoplatelets Market https://www.maximizemarketresearch.com/market-report/global-graphene-nanoplatelets-market/103666/

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, IndiaC

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656