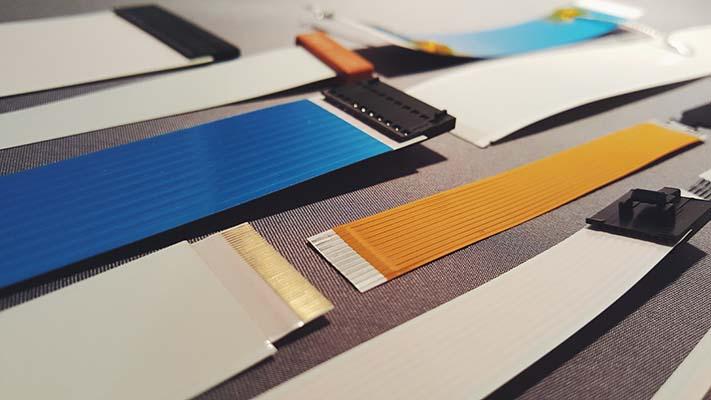

Flat flex cables or flexible flat cables (FFCs) are thin, lightweight, small-sized flexible electrical interconnects that are used to connect printed circuit boards, displays, and other electronic devices. They consist of a thin polyimide film with embedded electrical conductors that provide flexibility and reduce space requirements. Flat flex cables are widely used in computers, televisions, wireless devices, consumer electronics, medical devices, automobiles, industrial machinery and more owing to their lightweight, compact nature and ability to withstand repeated flexing.

The Global Flat Flex Cable Market is estimated to be valued at US$ 567.6 Bn in 2024 and is expected to exhibit a CAGR of 26.% over the forecast period 2024 to 2030.

Key advantages of flat flex cables include reduced weight, thinness, flexibility, robustness, resistance to vibration and shocks, tight bend radius, long flex life and ability to accommodate high-density connections in compact spaces. These properties have increased their adoption in automotive control systems, vehicle infotainment units, door modules, advanced driver-assistance systems and electric vehicle components. Their use in automobiles helps design compact and space-saving interiors while enabling significant wiring harness space and weight savings.

Key Takeaways

Key players operating in The Flat Flex Cable Market are DNV GL, SGS SA, Bureau Veritas, TÃœV NORD GROUP, Intertek Group plc. Flat flex cables are finding increased demand owing to growing sales of consumer electronics such as smartphones, tablets, laptops, gaming consoles and wearable devices. Continued technological advancements such as development of Ultra-thin flat flex cables with bend radius of less than 0.5mm and tin-plated copper circuits for reduced impedance and better conductor integrity are expected to further augment the market growth.

Market trends

Miniaturization of devices is a major trend driving demand for flat flex cables as they maximize device internal space while accommodating high-density wiring requirements. More advanced flex circuits with embedded passives are gaining popularity as they help reduce component counts and board space. Increased focus on lightweight vehicle design underpins strong growth opportunities for FFCs in automotive applications.

Market Opportunities

Rising electric and hybrid vehicle sales present significant growth prospects for flat flex cables used in battery management systems, on-board chargers and other power electronics. Expanding market for IoT devices and 5G infrastructure also offers lucrative opportunities for flat flex cables to connect various compact sensors and networking components.

Impact of COVID-19 on Flat Flex Cable Market Growth

The COVID-19 pandemic has significantly impacted the growth of the flat flex cable market. During the initial lockdown phase in 2020, the production and supply chain activities came to a halt. This disrupted the supply of flat flex cables across industries like automotive, consumer electronics and healthcare sectors. The demand from end-use industries also declined sharply due to reduced manufacturing activities. However, with relaxed lockdown measures and resumption of economic activities from late 2020, the market is witnessing signs of recovery.The automotive and healthcare sectors have boosted the demand for flat flex cables as electronic assembly activities have picked up pace. Increased production of medical devices, diagnostic equipment and ventilators has emerged as a major growth driver during the pandemic. Meanwhile, shifting consumer preferences towards in-home entertainment and remote working have augmented the demand from consumer electronics. Going forward, rising penetration of electronics in automotive and strict hygiene standards in the healthcare sector will accelerate the adoption of flat flex cables. Original equipment manufacturers are embracing digital transformation strategies to enhance efficiency. This will open new avenues for flat flex cable manufacturers in the post-COVID period.

In terms of geography, Asia Pacific accounts for the largest market share in value terms for flat flex cables. Being the manufacturing hub of consumer electronics and automotive industries, countries like China, South Korea, Taiwan and India provide immense opportunities for flat flex cable suppliers. North America is another major revenue generator, driven by the expanding automotive production base and recovering consumer sentiment. Europe holds significant growth potential backed by automotive industry revamp, while RoW regions are expected to offer remunerative prospects over the forecast period.

Asia Pacific: Fastest Growing Region for Flat Flex Cable Market

The Asia Pacific region is poised to witness the fastest growth in the flat flex cable market during the forecast years. This can be attributed to the expansionary growth strategies adopted by electronics giants as well as new players entering the industry. China continues to be the factories of the world manufacturing a bulk of electronic gadgets, medical devices, automotive components and industrial equipment. It accounts for the largest share of flat flex cable consumption with affordable manufacturing costs and growing technical expertise. Other Asian countries including South Korea, Taiwan, India and Vietnam are emerging as key electronics production hubs. Their investments in special economic zones and favorable policies are attracting investments across the value chain. This will significantly spur the demand for flat flex cables from Asia Pacific in the coming years. Meanwhile, rapid urbanization, rising living standards and growing health awareness are fueling domestic demand as well. The region's electronics export powerhouse status and demographic dividends make it the most lucrative market globally for players in the flat flex cable industry.

Get more insights on Flat Flex Cable Market