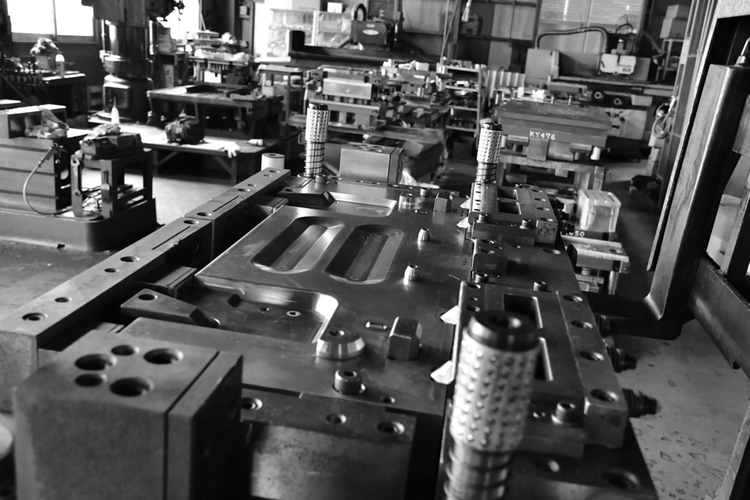

Crafting Success: Trends and Innovations in the Metal Stamping Market

In the ever-evolving metal stamping industry, staying abreast of emerging trends and innovations is paramount for sustained success.

Market Drivers

The metal stamping industry continues to be driven by a multitude of factors, including the increasing demand for lightweight and durable components across various sectors. Advancements in material science, coupled with growing environmental concerns, are influencing the adoption of sustainable stamping practices. Furthermore, the rise of electric vehicles and renewable energy technologies is driving innovation in metal stamping processes to meet evolving industry requirements.

The Metal Stamping Market is estimated to be valued at USD 222.14 Bn in 2024 and is expected to reach USD 290.36 Bn by 2031, growing at a compound annual growth rate (CAGR) of 3.9% from 2024 to 2031.

PEST Analysis

A PEST analysis provides valuable insights into the external factors influencing the metal stamping industry. Political stability and trade policies impact the flow of raw materials and finished products, affecting market dynamics. Economic factors such as inflation rates and consumer purchasing power influence market demand and investment decisions. Social trends towards automation and digitalization are reshaping manufacturing processes, while technological advancements drive innovation and competitiveness in the industry.

SWOT Analysis

Conducting a SWOT analysis reveals the industry's inherent strengths, weaknesses, opportunities, and threats. Strengths lie in the precision and efficiency offered by metal stamping processes, enabling the production of complex components with high accuracy. However, weaknesses such as reliance on skilled labor and susceptibility to market fluctuations pose challenges. Opportunities abound in emerging markets and the development of advanced materials and technologies, while threats include intense competition and regulatory compliance issues.

Segment Analysis

Segment analysis uncovers distinct categories within the metal stamping industry based on factors such as material type, technology, end-user industry, and geographic region. Different materials such as steel, aluminum, and alloys cater to diverse application requirements, while advancements in stamping technologies offer enhanced capabilities and efficiency. Automotive, aerospace, electronics, and consumer goods are among the key end-user segments driving demand for metal stamping solutions.

Key Takeaways

Several key takeaways emerge from the analysis of trends and innovations in the metal stamping industry. Firstly, there is a growing emphasis on sustainability and eco-friendly manufacturing practices, driving the adoption of recyclable materials and energy-efficient processes. Secondly, digitalization and automation are transforming production workflows, enhancing efficiency, and reducing lead times. Lastly, collaboration and partnerships between manufacturers and technology providers are fostering innovation and driving industry growth.

Geographical Region Analysis

Geographically, the metal stamping industry exhibits varying growth trajectories across regions. Developed economies in North America and Europe continue to dominate the market, driven by established automotive and aerospace sectors. However, Asia-Pacific emerges as a key growth region, fueled by rapid industrialization, infrastructure development, and increasing investments in manufacturing capabilities. Emerging markets in Latin America and Africa present untapped opportunities for market expansion, albeit with challenges related to infrastructure and regulatory frameworks.

In conclusion, staying attuned to emerging trends and innovations is essential for navigating the dynamic landscape of the metal stamping industry. By understanding market drivers, conducting thorough analyses, and capitalizing on emerging opportunities, stakeholders can position themselves for success in the evolving "metal stamping" landscape.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology