Juicing Up Investments: Battery Market Share and Competitive Analysis

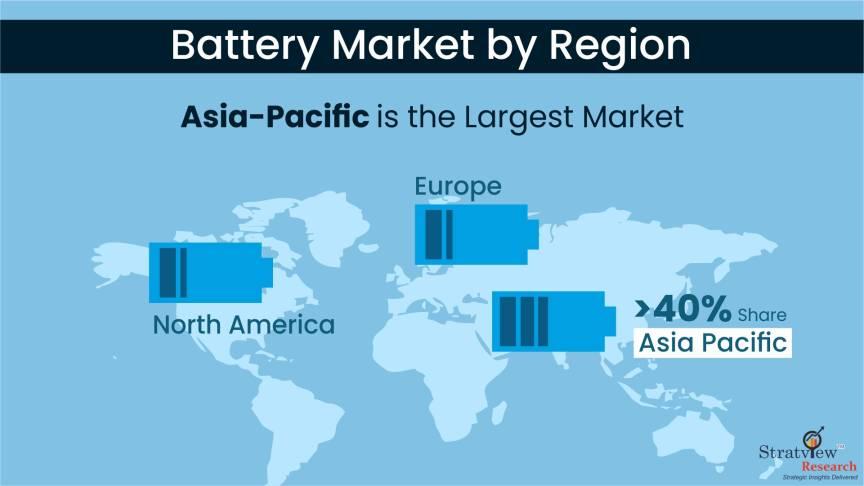

Battery Market is segmented by Battery Type (Lead-acid [Flooded, VRLA-Gel, and VRLA-AGM], Lithium-ion, and Nickel-cadmium), Industry Type (Marine, Railway, Defense, Aviation, and Telecom), and Region (North America, Europe, Asia-Pacific, and Rest of the World).

As the demand for energy storage solutions continues to surge, investors are eyeing the battery market for potential growth opportunities. Here's a comprehensive analysis of the battery market share and competitive landscape to help investors make informed decisions.

Current Market Scenario

According to Stratview Research, The Battery Market was estimated at US$ 7.4 billion in 2022. The market is projected to grow at a CAGR of 2.7% during 2023-2028, reaching US$ 8.9 billion by 2028. Notably, the Asia-Pacific region is expected to maintain its dominance as the largest market for batteries.

Market Share Analysis

Major players in the battery market include Panasonic Corporation, LG Chem Ltd., Samsung SDI Co., Ltd., and BYD Company Limited. These companies hold a significant market share due to their robust product offerings, technological expertise, and global presence. However, emerging players and startups are also making strides in the market, disrupting traditional dynamics, and expanding the competitive landscape.

Competitive Analysis

Competition in the battery market is fierce, with companies vying for market share through product innovation, strategic partnerships, and mergers and acquisitions. Key factors driving competition include price competitiveness, product quality, and sustainability initiatives. Understanding the competitive landscape is essential for investors to identify growth opportunities and mitigate risks.

Conclusion

The battery market presents ample opportunities for investors looking to capitalize on the growing demand for energy storage solutions. By analyzing market share and understanding the competitive landscape, investors can identify promising investment prospects and juicing up their portfolios for long-term success.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology