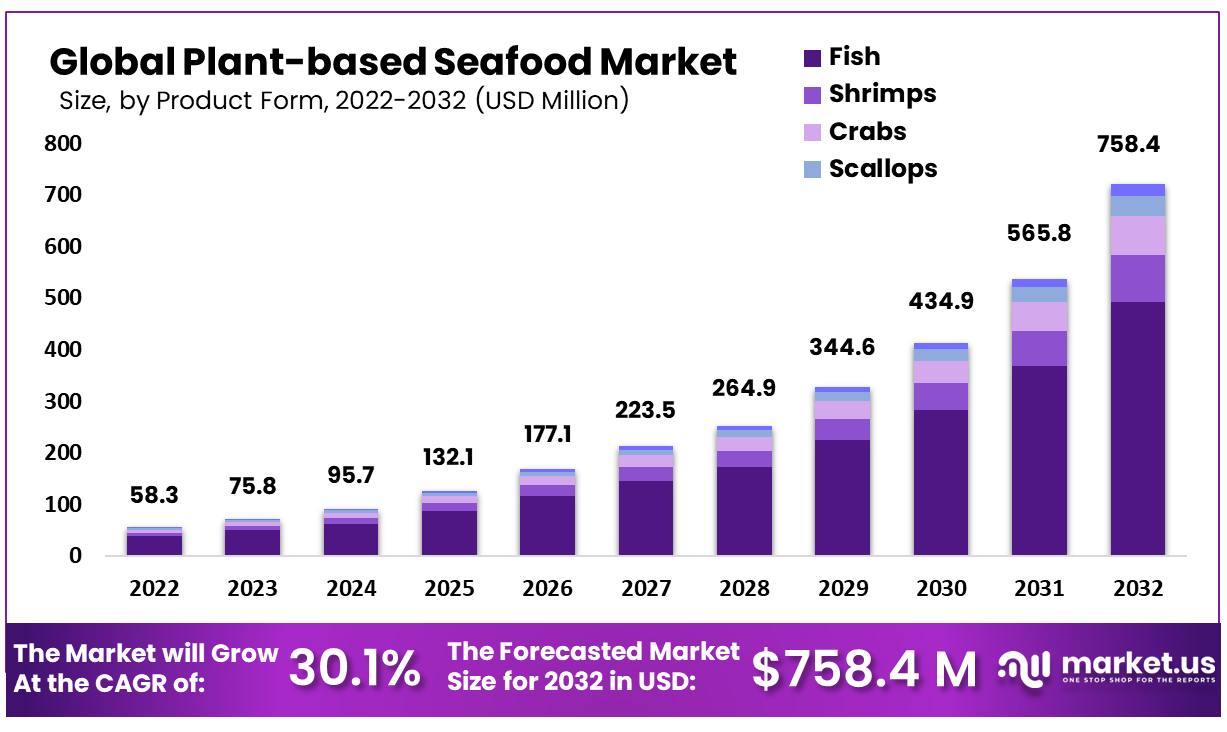

In 2022, the Global Plant-Based Seafood Market was valued at USD 58.3 million and is expected to reach USD 758.4 Million in 2032. Between 2023 and 2032, this market is estimated to register 30.1%.

The Plant-based Seafood Market encompasses the production, distribution, and sales of seafood alternatives made from plant-derived ingredients, designed to mimic the taste, texture, and nutritional profile of traditional seafood. These products, crafted from a variety of plant sources such as algae, legumes, and soy, cater to consumers seeking sustainable, health-conscious, and ethical food options. The market is driven by increasing awareness of overfishing, environmental concerns, and dietary preferences towards vegetarian and vegan lifestyles. Plant-based seafood offers a viable solution to meet the growing demand for seafood while reducing the environmental impact associated with conventional seafood production, making it a rapidly expanding segment in the broader plant-based food industry.

Market Key Players

-

Garden Protein International, Inc.

-

Good Catch

-

New Wave Foods

-

Sophie’s Kitchen

-

Ocean Hugger Foods

-

Ocean’s Halo

-

SoFine Foods BV

-

Quorn Foods

-

PURIS Foods

-

Plant Based Seafood Co.

-

Good2Go Veggie

-

Loma Linda

-

OmniFoods

-

Hungry Planet Inc.

-

Other Key Players

Click here for request a sample : https://market.us/report/plant-based-seafood-market/request-sample/

Product Form Analysis: -

In 2022, the fish segment held the largest market share in the plant-based seafood market at 65.3%, driven by its wide consumption, demand for sustainable alternatives, and ability to mimic the taste and texture of real fish. Plant-based fish products, such as fillets and fish sticks, appeal to eco-conscious consumers seeking vegan options. The shrimp segment is the fastest-growing, as plant-based shrimp offers a sustainable alternative to traditional shrimp farming, addressing ecological concerns like deforestation and habitat destruction.

-

Source Analysis:

-

The soy segment led the plant-based seafood market in 2022 with a 37.2% share, thanks to its robust nutritional profile, including high protein and essential amino acids, and its familiarity in the plant-based food industry. Soy’s health benefits, such as low saturated fat and high fiber content, make it a trusted source. Pea followed soy in market share, offering significant health benefits like high protein, vitamins, and minerals that support immune function, bone health, and cardiovascular well-being.

-

Distribution Channel Analysis:

-

Online retail is expected to dominate the plant-based seafood market with a CAGR of 45.2% due to its convenience, accessibility, and detailed product information. Consumers prefer the ease of online shopping and the ability to explore various products from home. Supermarkets/hypermarkets held the largest market share in 2022, providing a tangible shopping experience and the convenience of one-stop shopping.

-

End-User Analysis:

-

The residential segment dominates the plant-based seafood market, driven by environmentally conscious consumers seeking sustainable diets and the convenience of home meal preparation. The commercial segment is the fastest-growing, with increased demand for plant-based seafood in the hospitality, food service, and catering industries, which are expanding their ethical and diverse menu offerings.

Key Market Segments:

Based on the Product Form

-

Fish

-

Shrimps

-

Crabs

-

Scallops

-

Other Product Forms

Based on Source

-

Soy

-

Wheat

-

Pea

-

Konjac

-

Seaweed

-

Lentils

-

Legumes

-

Other Sources

Based on the Distribution Channel

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

HoReCa

-

Online Retail

Based on End-User

-

Residential

-

Commercial

Drivers :

Ethical and environmental concerns are reshaping consumption patterns, significantly driving the global plant-based seafood market. Consumers are increasingly seeking sustainable alternatives due to worries about overfishing and marine ecosystem impacts. Plant-based seafood offers a guilt-free option with lower saturated fats and cholesterol levels, providing a comparable culinary experience while addressing ethical concerns.

Restraints:

The price disparity between plant-based and conventional seafood is a significant restraint in the market. Higher costs of specialized ingredients and production processes make plant-based options more expensive, potentially deterring price-sensitive consumers. To bridge this gap, manufacturers need to achieve economies of scale, optimize production processes, and develop cost-effective sourcing strategies.

Opportunity:

The demand for convenient, ready-to-eat plant-based seafood solutions presents a major opportunity. As busy lifestyles become more common, consumers seek hassle-free meal options that align with health and sustainability goals. Developing pre-cooked, pre-seasoned, and easily prepared plant-based seafood products can attract a broader audience, including working professionals and families, making ethical and wholesome dining more accessible.

Trends:

A key trend in the plant-based seafood market is the fusion of global cuisines and cross-cultural flavors. Chefs and manufacturers are incorporating diverse culinary influences into plant-based seafood products, creating innovative dishes like Asian-inspired sushi and Mediterranean-style stews. This trend appeals to adventurous eaters and culturally diverse consumers, driving market growth by offering a rich variety of enticing and novel experiences.