Emerging Opportunities in Furfural: From Foundry Applications to Polyurethane Innovations

Overview :

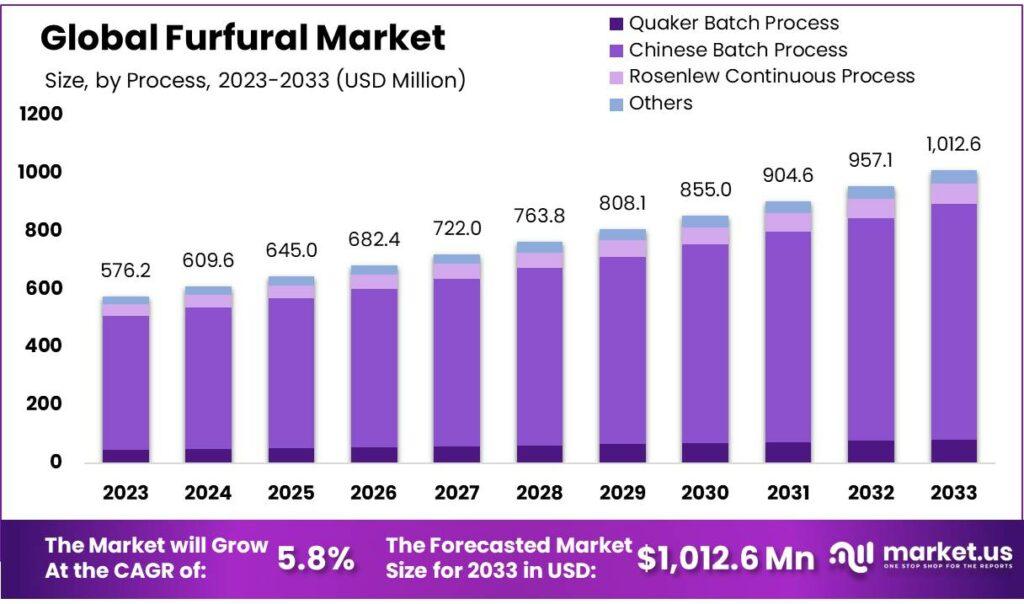

Furfural Market size is expected to be worth around USD 1012.6 Million by 2033, from USD 576.2 Million in 2023, growing at a CAGR of 5.8% during the forecast period from 2023 to 2033.

Download a sample report in MINUTES@ https://market.us/report/furfural-market/request-sample/

The furfural market refers to the industry involved in the production, distribution, and consumption of furfural, a chemical compound derived from agricultural byproducts like corn cobs, sugarcane bagasse, and oat hulls. Furfural is a key ingredient used in various industrial applications, including as a solvent in the production of resins, lubricants, and in the petrochemical sector. It also serves as a precursor for the synthesis of other chemicals and can be used in the manufacture of furfuryl alcohol, which has applications in foundry sand binders and as an intermediate in chemical production.

In recent years, the furfural market has experienced fluctuations influenced by environmental concerns and global events. The COVID-19 pandemic notably impacted the market in 2020, causing a decline in production due to lockdowns, social distancing measures, and disruptions in supply chains and logistics. This led to reduced furfural production and a temporary slowdown in market activities. However, with increasing environmental regulations pushing for sustainable and bio-based chemicals, the demand for furfural is expected to grow as industries seek greener alternatives. The market is anticipated to recover and expand as production and logistical challenges are addressed and the focus shifts toward sustainable chemical solutions.

Process Analysis:

The furfural market is predominantly driven by the Chinese batch process, which accounted for 80.3% of global revenue in 2023. This process is favored due to its cost-efficiency and high output, although it relies heavily on sulfuric acid as a catalyst.

Raw Material Analysis:

Corncob, leading the market with over 68.5% share in 2023, remains the preferred raw material for furfural production due to its high yield and renewable energy potential. sugarcane bagasse, a significant byproduct in countries with high sugarcane production, offers a cost-effective alternative but presents storage and handling challenges.

By Application:

Solvents and intermediates also hold substantial market positions, contributing to applications in paints, coatings, and pharmaceutical production, while other uses like flavors and fragrances add diversity to the market landscape.

End-Use Analysis:

Refineries led the furfural market with over 48.9% revenue share in 2023, driven by its role as a solvent in petroleum refineries and specialty adhesives. Furfural also finds significant use in agriculture as an insecticide and fungicide, as well as in pharmaceuticals, highlighting its versatile applications across multiple sectors.

Кеу Маrkеt Ѕеgmеntѕ:

By Process:

-

Chinese Batch Process

-

Quaker Batch Process

-

Rosenlew Continuous Process

-

Other Process

By Raw Material:

-

Sugarcane bagasse

-

Corn cob

-

Rice husk

-

Sunflower hull

-

Other Raw Materials

By Application:

-

Furfuryl Alcohol

-

Solvent

-

Intermediate

-

Others

By End-Use:

-

Pharmaceuticals

-

Agriculture

-

Food & Beverage

-

Paints & Coatings

-

Refineries

-

Other End-uses

Маrkеt Кеу Рlауеrѕ:

-

Central Romana Corporation

-

ILLOVO SUGAR AFRICA (PTY) LTD

-

KRBL Ltd.

-

LENZING AG

-

Pennakem, LLC

-

Hongye Holding Group Corporation Limited

-

Silvateam SpA

-

Tanin d.d.

-

TransFurans Chemicals bvba

-

Xingtai Chunlei Furfuryl Alcohol Co. Ltd (hebeichem)

-

Zibo Xinye Chemical Co. Ltd

-

Arcoy Industries Pvt. Ltd.

-

GoodRich Sugar

-

Zibo Huaao Chemical

-

Tieling North Furfural (Group) Co. Ltd.

Driver:

The growing demand for furfuryl alcohol is a significant driver for the furfural market. Furfuryl alcohol is essential in making foundry sand binders and is used in producing tetrahydrofurfuryl alcohol (THFA) for pharmaceuticals.

Restraint:

The availability of cheaper crude oil-based alternatives is a major restraint for the furfural market. Phenolic resin, derived from crude oil, competes with furan resin used in foundries due to its lower cost.

Opportunity:

The rise in spandex usage in textiles and the growing PU market, driven by applications in various sectors, particularly in China, creates substantial growth prospects for furfural manufacturers. Increased demand for PU, in particular, highlights an opportunity for expanding furfural applications.

Challenge:

A notable challenge for the furfural market is the low yield of furfural from traditional production technologies. Although innovations like Supra Yield technology have shown promising results, achieving high yields on a commercial scale remains difficult.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology