Industrial Refrigeration Systems Market: Opportunities in Sustainable and Energy-Efficient Solutions

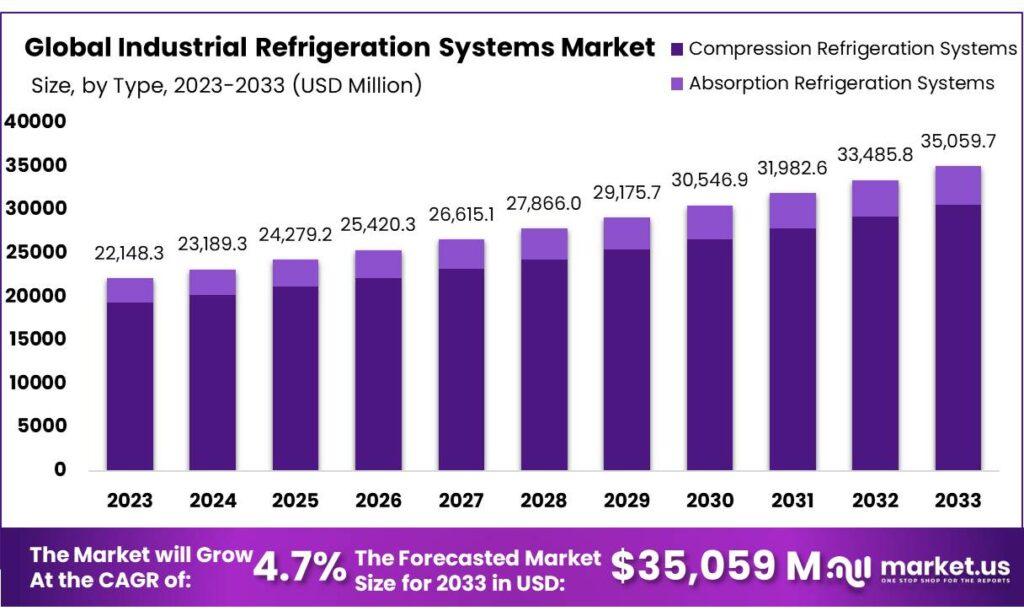

The Industrial Refrigeration Systems Market size is expected to be worth around USD 35,059.7 Million by 2033, from USD 22,148.3 Million in 2023, growing at a CAGR of 4.7% during the forecast period from 2023 to 2033.

The industrial refrigeration systems market encompasses the technologies and equipment used to cool and maintain low temperatures in various industrial applications. These systems are essential for preserving perishable goods, maintaining product quality, and supporting processes in sectors such as food and beverage, pharmaceuticals, chemicals, and manufacturing. Industrial refrigeration systems typically include components such as compressors, condensers, evaporators, and refrigerants, and they operate on principles like vapor-compression and absorption refrigeration. With increasing demand for efficient temperature control and energy-saving solutions, the market is driven by advancements in refrigeration technology, rising industrial production, and the need for compliance with stringent regulatory standards for environmental sustainability.

Market Key Players:

-

Mitsubishi Electric Corporation

-

Daikin Industries, Ltd.

-

Johnson Controls International Plc

-

Carrier Global Corporation

-

Emerson Electric Co.

-

Danfoss A/S

-

Ingersoll Rand Inc.

-

GEA Group AG

-

SPX Technologies, Inc.

-

Bitzer SE

-

Baltimore Aircoil Company, Inc.

-

Frick India Limited

-

Other Key Players

Click here for request a sample: https://market.us/report/industrial-refrigeration-systems-market/request-sample/

By Type:

In the industrial refrigeration systems market, compression refrigeration systems dominated with an 87.3% revenue share in 2023. Their superiority is due to their efficiency, scalability, and versatility, making them ideal for large-scale applications where precise temperature control is crucial, such as in food processing, pharmaceuticals, and chemicals. Compression systems reach lower temperatures quickly and maintain consistent cooling, which drives their widespread use and preference over absorption refrigeration systems.

Component Analysis:

Among industrial refrigeration system components, compressors led the market with a 39.3% share in 2023. Compressors are essential as they compress refrigerants, raising their pressure and temperature to facilitate heat absorption and dissipation. Their critical role in the refrigeration cycle, along with advancements in technology and the increasing demand for efficient, adaptable solutions across various industries, solidifies their dominance in the market.

By Refrigerant Type:

Ammonia was the leading refrigerant type in 2023, capturing 59.8% of the market due to its high latent heat of vaporization and energy efficiency. Ammonia’s ability to absorb more heat while vaporizing at a lower volume results in lower operating costs and smaller equipment requirements, making it a cost-effective choice for large-scale industrial refrigeration. Its superior thermodynamic properties contribute to its prominence over other refrigerants.

Application Analysis:

In 2023, the food and beverage industry was the largest application segment in the industrial refrigeration market, holding a 28.6% share. The critical need for refrigeration in preserving perishable items like fruits, vegetables, dairy, meats, and seafood drives this dominance. Refrigeration extends shelf life and meets HACCP standards for food safety, making it indispensable in the sector. The industry's reliance on refrigeration is fueled by food safety regulations, technological advancements, and growing consumer demand.

Key Market Segments:

By Type

-

Compression Refrigeration Systems

-

Absorption Refrigeration Systems

By Component

-

Compressors

-

Reciprocating Compressor

-

Screw Compressor

-

Centrifugal Compressor

-

Others

-

-

Condensers

-

Evaporators

-

Controls

-

Other Components

Refrigerant Type

-

Ammonia

-

Ammonia/CO2

-

CO2

-

Other Refrigerant Types

By Application

-

Refrigerated Warehouse

-

Food & Beverage

-

Fruits & Vegetables

-

Beverages

-

Dairy and Dairy Products

-

Meat, Poultry, and Fish

-

Others

-

-

Refrigerated Transportation

-

Chemicals & Pharmaceuticals

-

Petrochemical

-

Other Applications

Drivers:

The industrial refrigeration systems market is significantly driven by the rapid growth of the food and beverage industry, which relies heavily on refrigeration for preservation, processing, and storage. The increasing demand for processed foods due to changing lifestyles and busy schedules necessitates advanced refrigeration systems to ensure product safety and quality. Additionally, technological advancements, such as improved energy efficiency, eco-friendly refrigerants, and smart systems, are further propelling market growth by reducing operational costs and enhancing system performance.

Restraints:

The high initial investment and operating costs associated with industrial refrigeration systems are major restraints. These systems are energy-intensive, leading to substantial ongoing expenses, particularly with rising energy prices. For small and medium-sized enterprises, the costs of installation, maintenance, and compliance with environmental regulations can be prohibitive. This makes it challenging for businesses to upgrade to more efficient systems and manage long-term operational costs effectively.

Opportunities:

There are significant opportunities in the industrial refrigeration market due to the growing emphasis on sustainability and energy efficiency. Advances in research and development are focusing on creating eco-friendly refrigeration solutions that meet regulatory mandates for reduced energy consumption and greenhouse gas emissions. Companies investing in these technologies can benefit from market incentives and expand into sectors sensitive to environmental concerns, offering long-term cost savings and improved sustainability.

Trends:

The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) is transforming the industrial refrigeration systems market. AI enhances system efficiency by predicting equipment failures and optimizing maintenance schedules, while IoT provides real-time monitoring and centralized control. These technologies improve operational efficiency, compliance with regulatory standards, and cost management, driving innovation and advancement in the market.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology