Smart Manufacturing Trends Drive Expansion in Variable Frequency Drives Market

Overview :

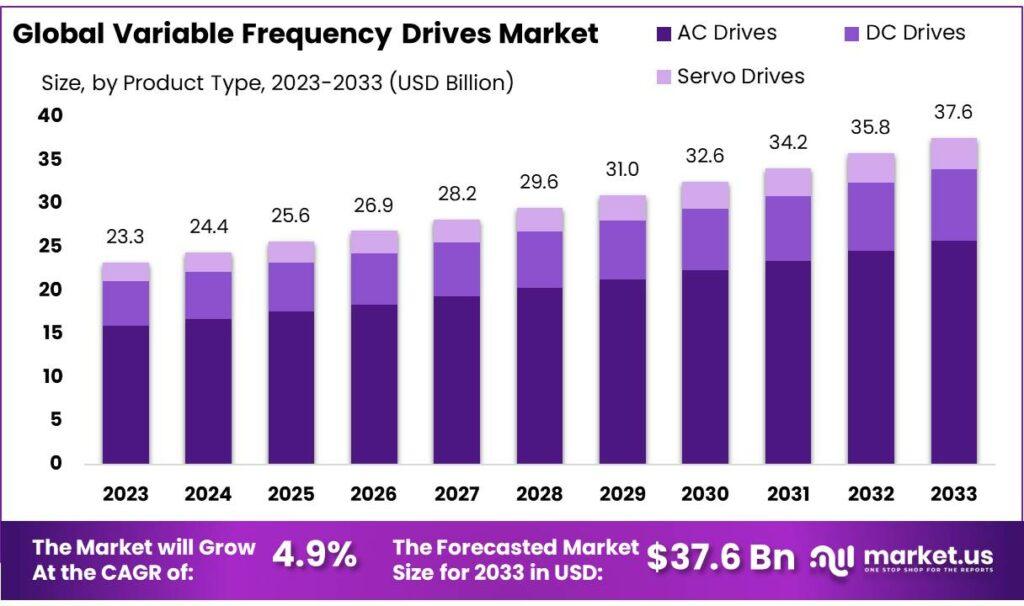

Variable Frequency Drives market size is expected to be worth around USD 37.6 billion by 2033, from USD 23.3 billion in 2023, growing at a CAGR of 4.9% during the forecast period from 2023 to 2033.

Get a Sample Copy with Graphs & List of Figures @ https://market.us/report/variable-frequency-drives-market/#requestSample

The Variable Frequency Drives (VFD) Market refers to the sector that deals with devices used to control the speed and torque of electric motors by varying the frequency and voltage of the electrical power supplied to them. VFDs are critical components in many applications, from HVAC systems in commercial and residential buildings to automation in industrial processes. By adjusting motor speed, VFDs enhance energy efficiency, reduce wear and tear on equipment, and improve operational control, making them an integral part of modern energy management systems.

The market for VFDs is experiencing growth due to increased adoption across various sectors. The rise of connected devices and smart technologies in commercial, residential, and automotive applications is driving demand for more efficient and flexible motor control solutions. Additionally, significant investments in infrastructure development are boosting the need for advanced HVAC systems, which rely heavily on VFDs for optimal performance. As these systems become more prevalent and technology advances, the VFD market is set to expand, reflecting broader trends toward automation and energy efficiency in modern industry and infrastructure.

Market Segments :

By Product Type

-

AC Drives

-

DC Drives

-

Servo Drives

By Power Range

-

Micro (0-5 kW)

-

Low (6-40 kW)

-

Medium (41-200 kW)

-

High (>200 kW)

By Application

-

Pumps

-

Electric Fans

-

Conveyors

-

HVAC

-

Extruders

-

Other Applications

By End-Use

-

Oil & Gas

-

Power Generation

-

Infrastructure

-

Other End-Uses

Product Type Analysis:

In 2023, AC Drives dominated the Variable Frequency Drives (VFD) market, capturing about 68.6% of the share. Their widespread use across industries like food and beverage, power generation, and automotive highlights their importance in controlling motor speed and enhancing operational efficiency. Meanwhile, DC Drives are expected to grow at a 6.1% CAGR through 2032.

Power Ranges Analysis :

Low Power drives led the market in 2023, accounting for over 42.3% of the share. They are commonly used in applications such as pumps and fans where moderate power is required. The medium power range drives are also seeing growth, expected to increase by 6.8% from 2023 to 2032, due to their versatility in industries like mining and petrochemicals.

Application Analysis:

Pumps were the leading application in 2023, holding over 30.2% of the market share. They are crucial for moving fluids in various industries and benefit significantly from the energy-saving capabilities of VFDs. The HVAC segment is projected to grow by 5.9% between 2023 and 2032, driven by the rising demand for energy-efficient climate control systems.

End-Use Analysis:

Oil and gas applications led the VFD market in 2023, with over 20.3% of the share. VFDs are essential in processes like pumping, drilling, and refining, enhancing efficiency and reducing power consumption. The infrastructure sector is expected to grow at a 6.8% CAGR through 2032, driven by increased industrial activities and the shift from mechanical to electric motors.

Маrkеt Кеу Рlауеrѕ

-

ABB Ltd

-

Siemens AG

-

Danfoss A/S

-

Rockwell Automation

-

GE Power

-

Toshiba International Corporation

-

Schneider Electric

-

Mitsubishi Electric Corporation

-

Honeywell International Inc.

-

Emerson Industrial Automation

-

Fuji Electric Co. Ltd

-

Johnson Controls Inc.

-

Eaton PLC

-

Hitachi Ltd.

-

Nord Drive Systems

-

Eaton

Drivers:

Variable Frequency Drives (VFDs) are increasingly essential across industries due to their energy-saving capabilities and precise motor control. Major projects in countries like China and India, which involve substantial cement and paper production, drive demand for these drives. VFDs help optimize energy use in millions of motors worldwide, leading to cost savings and enhanced efficiency.

Restraints:

The oil and gas sector, a significant user of VFDs, has faced stagnation due to reduced exploration and production activities. Volatile oil prices create uncertainty, causing companies to hesitate on new investments in VFD technology. Additionally, stringent regulations aimed at reducing greenhouse gas emissions impose further challenges, potentially leading to decreased VFD usage as companies navigate the complexities of compliance and pollution control.

Opportunities:

Upgrades to aging power infrastructure present a significant opportunity for VFD manufacturers. In regions like the US and Canada, improving outdated power networks and reducing power outages are critical needs. New regulations and investments in power systems create a growing demand for VFDs, offering a chance for companies to capitalize on the expanding market for these essential components in power management.

Challenges:

The COVID-19 pandemic disrupted the production of electric motors and VFDs due to factory closures and supply chain interruptions. Key manufacturing hubs in China and the US experienced slowdowns, impacting the availability and cost of components. This has led to financial strain for companies reliant on these parts, complicating production and distribution efforts in the VFD market.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology