AI in Insurance Market: Redefining Policy Pricing

Introduction

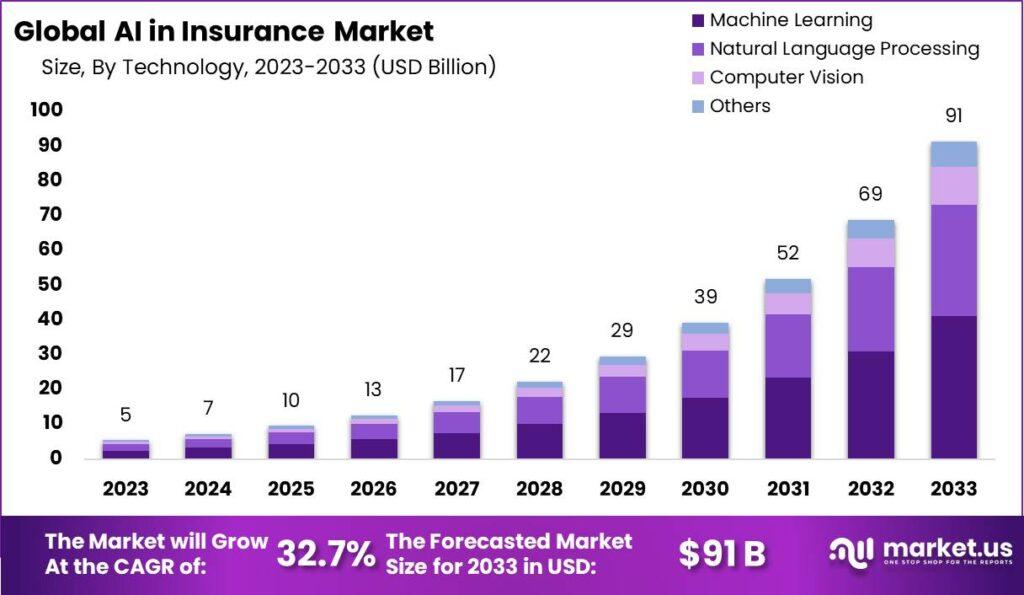

The Global AI in Insurance Market size is expected to be worth around USD 91 Billion by 2033, from USD 5 Billion in 2023, growing at a CAGR of 32.7% during the forecast period from 2024 to 2033.

Read More - https://market.us/report/ai-in-insurance-market/

The AI in Insurance Market is rapidly transforming the insurance industry, offering new ways to streamline operations, enhance customer experiences, and reduce costs. Artificial Intelligence (AI) is being used to automate routine tasks, analyze vast amounts of data, and provide personalized services, making the insurance process more efficient and customer-friendly. The growth of AI in this sector is driven by the increasing need for digital transformation, the demand for improved risk management, and the desire to provide better customer service. However, challenges such as data privacy concerns, high implementation costs, and the need for skilled personnel may slow down the adoption of AI. Nevertheless, the opportunities presented by AI, such as enhanced fraud detection, more accurate risk assessment, and improved claims processing, make it a vital tool for the future of insurance.

Emerging Trends

-

Automated Underwriting: AI-driven algorithms are increasingly used to automate the underwriting process, allowing for faster and more accurate policy approvals.

-

Chatbots and Virtual Assistants: Insurance companies are deploying AI-powered chatbots to handle customer inquiries, provide quotes, and assist with claims, improving customer service.

-

Predictive Analytics: AI is enabling insurers to predict customer behavior, assess risk more accurately, and offer personalized products based on data-driven insights.

-

AI-Powered Fraud Detection: Advanced AI systems are being implemented to detect fraudulent activities in real-time, reducing losses and improving trust in the insurance process.

-

Telematics and IoT Integration: The integration of AI with telematics and the Internet of Things (IoT) is helping insurers gather real-time data from vehicles and homes to offer personalized insurance solutions.

Top Use Cases

-

Claims Processing: AI is automating the claims process, making it faster and more efficient by quickly assessing damage, verifying claims, and even predicting future claims based on historical data.

-

Risk Assessment: AI is being used to evaluate risk more accurately by analyzing vast amounts of data from various sources, leading to better pricing and more personalized insurance products.

-

Customer Support: AI-powered chatbots and virtual assistants are providing 24/7 customer support, answering questions, and helping customers file claims or update policies.

-

Fraud Detection: AI systems are identifying patterns of fraudulent behavior, helping insurers detect and prevent fraud before it results in significant losses.

-

Marketing and Sales: AI is helping insurance companies target potential customers more effectively by analyzing data to understand customer needs and preferences, leading to more personalized marketing campaigns.

Major Challenges

-

Data Privacy Concerns: The use of AI requires access to large amounts of personal data, raising concerns about data security and privacy.

-

High Implementation Costs: Implementing AI technologies can be expensive, particularly for smaller insurance companies, which may struggle to afford the necessary infrastructure.

-

Lack of Skilled Personnel: There is a shortage of skilled professionals who can develop, implement, and maintain AI systems, which can hinder adoption.

-

Regulatory Compliance: The insurance industry is highly regulated, and ensuring AI systems comply with all regulations can be challenging and time-consuming.

-

Customer Trust Issues: Some customers may be hesitant to trust AI-driven decisions, particularly in areas like claims processing and risk assessment, where human judgment has traditionally played a key role.

Market Opportunity

-

Enhanced Customer Experience: AI can significantly improve the customer experience by offering personalized services, faster claims processing, and 24/7 support, making insurance more accessible and user-friendly.

-

New Revenue Streams: AI enables insurers to develop new products and services tailored to specific customer segments, opening up new revenue opportunities.

-

Operational Efficiency: By automating routine tasks and processes, AI can reduce operational costs, allowing insurers to allocate resources more effectively.

-

Improved Risk Management: AI can analyze vast amounts of data to provide more accurate risk assessments, enabling insurers to offer better pricing and coverage options.

-

Scalability: AI allows insurance companies to scale their operations more easily, handling larger volumes of data and transactions without the need for proportional increases in staffing or infrastructure.

Conclusion

The AI in Insurance Market is set to revolutionize the industry by making processes more efficient, reducing costs, and enhancing customer experiences. While challenges such as data privacy, high implementation costs, and regulatory compliance need to be addressed, the opportunities presented by AI are immense. As AI continues to evolve, it will play an increasingly important role in helping insurers meet the demands of the digital age, offering more personalized, efficient, and trustworthy services. The future of insurance lies in the successful integration of AI, making it a crucial area for innovation and investment.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology