Oncology Based In-Vivo CRO Industry

Summary:

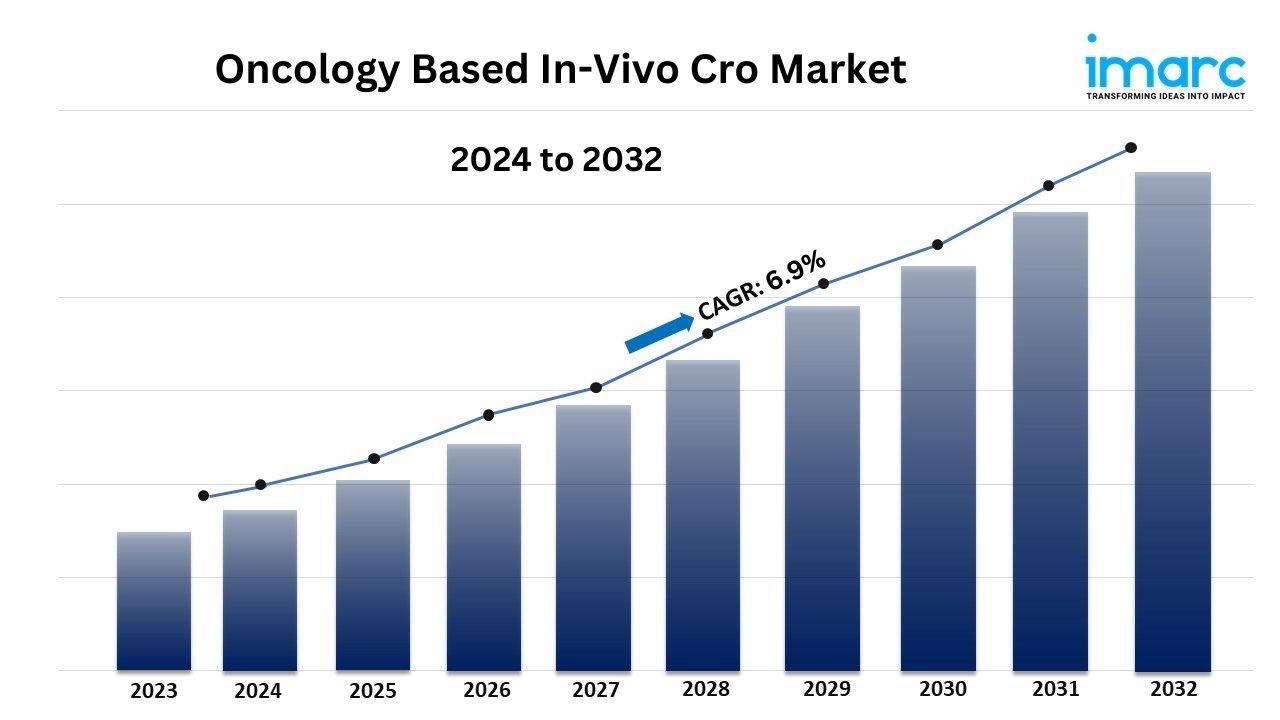

- The global oncology based in-vivo CRO market size reached USD 1.2 Billion in 2023.

- The market is expected to reach USD 2.3 Billion by 2032, exhibiting a growth rate (CAGR) of 6.9% during 2024-2032.

- North America leads the market, accounting for the largest oncology based in-vivo CRO market share.

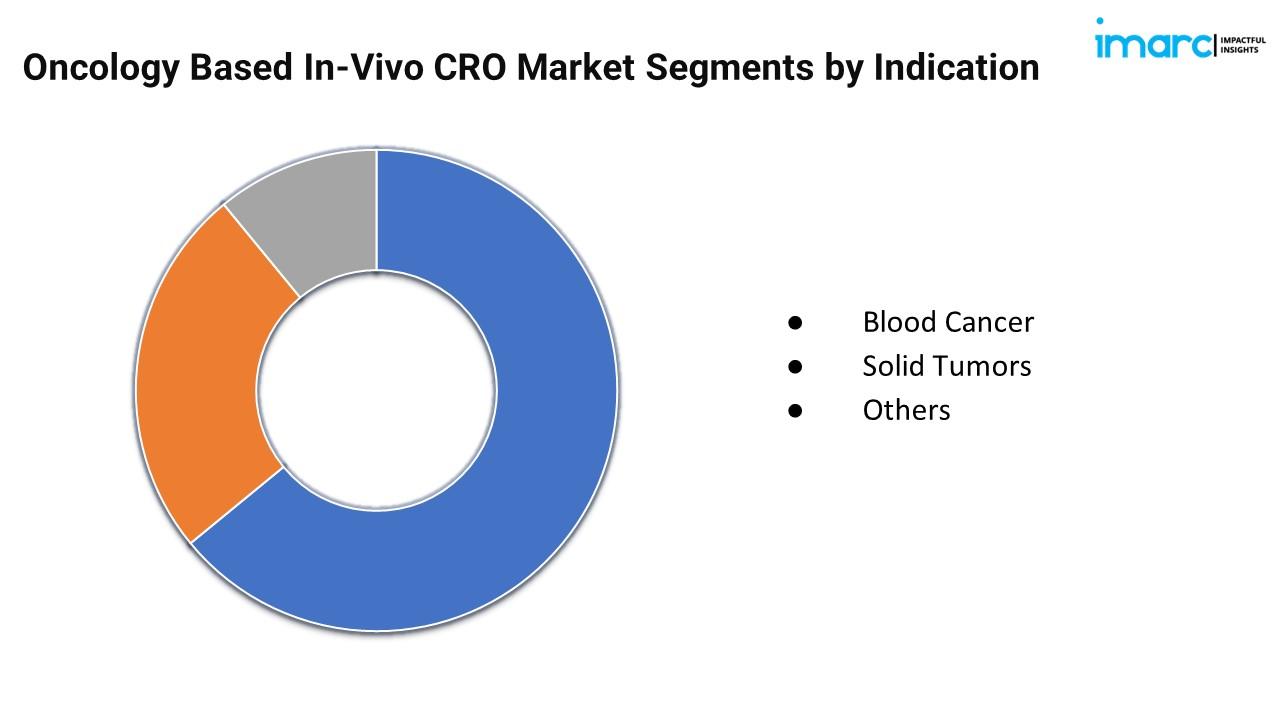

- Solid tumors account for the majority of the market share in the indication segment owing to their high prevalence and the demand for effective preclinical models for treatment development.

- Patient derived xenograft (PDX) holds the largest share in the oncology based in-vivo CRO industry.

- Based on the application, the market has been bifurcated into hospitals and rehabilitation centers.

- The increasing funding in pharmaceutical and growing biotech and pharmaceutical startups' are primary drivers of the oncology based in-vivo CRO market.

- Technological advancements and the development of advanced animal models are transforming cancer research which is reshaping the oncology based in-vivo CRO market.

Industry Trends and Drivers:

- Rising Investment in Pharmaceutical Research and Development (R&D)

The pharmaceutical industry has seen a marked increase in research and development (R&D) investments, with a strong focus on the oncology sector. This growth is driven by the urgent need to discover new cancer treatments, as the global burden of cancer continues to rise. Pharmaceutical and biotech companies are increasingly outsourcing the in-vivo studies to Contract Research Organizations (CROs) to accelerate drug development and reduce associated costs. Moreover, outsourcing allows these companies to leverage the specialized expertise and advanced technologies of CROs without the need for significant internal investment. Moreover, by collaborating with CROs, pharmaceutical companies can streamline their research processes, ensuring that they meet regulatory requirements while managing costs effectively. As a result, the partnership between pharmaceutical companies and CROs is becoming an integral part of the drug development pipeline, particularly in the oncology space, where the stakes are high and innovation is key.

- Growth in Biotech and Pharmaceutical Startups

The rise of biotech and pharmaceutical startups, especially those focusing on cancer therapeutics, has significantly contributed to the growing demand for in-vivo CRO services. These startups often operate with limited resources and lack the comprehensive in-house capabilities required for advanced in-vivo testing. This gap has made CROs indispensable to their R&D strategy, providing technical expertise and also access to sophisticated laboratory environments and specialized animal models necessary for cancer research. Moreover, startups benefit from partnering with CROs as it allows them to focus on their core competencies developing innovative therapies while outsourcing the labor-intensive and technically demanding aspects of drug testing. As a result, the burgeoning biotech sector is widely dependent on CROs to advance their R&D efforts, underscoring the critical role these organizations play in fostering innovation and accelerating the development of new cancer treatments.

- Technological Advancements

The emerging technological advancements in in-vivo imaging and the development of more sophisticated animal models have revolutionized cancer research. These innovations have enhanced researchers' ability to observe and analyze tumor development and the effects of new treatments with unprecedented precision. Additionally, advanced imaging techniques, such as high-resolution MRI and PET scans, allow for real-time monitoring of biological processes within living organisms, providing critical insights into the efficacy and safety of new drugs. Moreover, the creation of more accurate and diverse animal models has enabled a deeper understanding of cancer's complexity and the way it responds to potential treatments. These advancements have increased the reliance on specialized CROs that possess the necessary technology and expertise to conduct such advanced studies.

For an in-depth analysis, you can request a sample copy of the report: https://www.imarcgroup.com/oncology-based-in-vivo-cro-market/requestsample

Oncology Based In-Vivo CRO Market Report Segmentation:

Breakup By Indication:

● Blood Cancer

● Solid Tumors

● Others

Solid tumors represent the largest segment due to their high prevalence and the demand for effective preclinical models for treatment development.

Breakup By Model:

● Syngeneic

● Xenograft

● Patient Derived Xenograft (PDX)

● Others

Patient derived xenograft (PDX) accounts for the largest market share as they closely mimic human tumor biology, providing more accurate data for drug development.

Breakup By Application:

● Hospitals

● Rehabilitation Centers

Based on the application, the market has been bifurcated into hospitals and rehabilitation centers.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America holds the leading position owing to its advanced healthcare infrastructure, significant research and development (R&D) investments, and the presence of major pharmaceutical companies.

Top Oncology Based In-Vivo CRO Market Leaders:

● Champions Oncology Inc.

● Charles River Laboratories International Inc.

● Crown Bioscience Inc.

● Eurofins Scientific

● Evotec SE

● ICON Plc

● Labcorp Drug Development (Laboratory Corporation of America Holdings)

● Living Tumor Laboratory

● Taconic Biosciences Inc.

● The Jackson Laboratory

● WuXi AppTec

● Xentech

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.