India Paper Packaging Market Overview

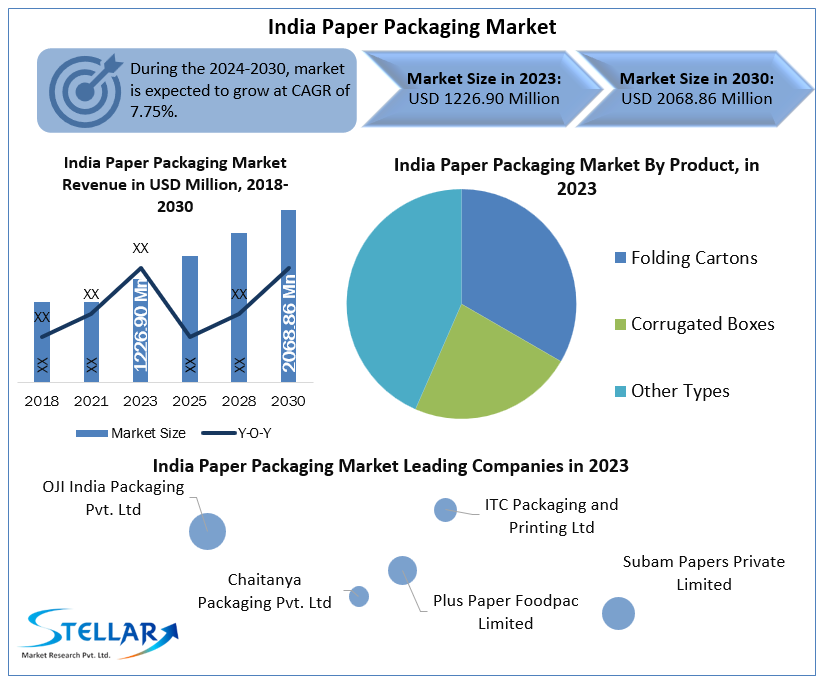

The India Paper Packaging Market, valued at USD 1226.90 million in 2023, is anticipated to experience steady growth, reaching USD 2068.86 million by 2030, with a projected compound annual growth rate (CAGR) of 7.75%. Paper packaging is gaining popularity as a sustainable alternative, offering advantages such as recyclability, lightweight properties, and biodegradability, making it a preferred choice across various industries. As India’s packaging sector, the fifth largest globally, embraces eco-friendly trends, paper packaging is positioned as one of the fastest-growing sectors within this industry.

Market Dynamics

Government initiatives aimed at reducing single-use plastics have been a key driver for the increasing demand for paper packaging in India. As businesses adapt to environmental regulations and shifting consumer preferences, the market is seeing a surge in the adoption of eco-friendly packaging solutions. The e-commerce sector, fueled by a growing young population, internet penetration, and rising disposable incomes, is one of the most significant end-users of paper packaging. This sector alone is expected to contribute significantly to the market's growth, with a forecasted CAGR of over 5.75% during the upcoming years.

Additionally, the expansion of the organized retail sector, including the rapid rise of supermarkets and modern shopping centers, is driving demand for paper packaging. The ban on single-use plastics, coupled with fluctuating plastic raw material prices, further bolsters the appeal of paper packaging as an eco-friendly and economically viable alternative.

Key Drivers for Future Growth

-

Eco-Friendly Consumer Preferences: The shift towards sustainable and recyclable packaging materials is reshaping the landscape of the Indian paper packaging industry. Urbanization, rising disposable incomes, and increasing environmental awareness are key contributors to this shift.

-

Government Support: The Indian government’s policies to reduce plastic waste, along with 100% foreign direct investment (FDI) in the paper and packaging industry, provide substantial growth opportunities for new market entrants.

-

FMCG and E-Commerce Boom: The growing fast-moving consumer goods (FMCG) sector, coupled with the explosive growth of e-commerce, has increased the demand for paper packaging solutions. The food and beverage industry is also a significant contributor, with increasing demand for safe, biodegradable packaging options for delivery services and grocery sales.

Market Segmentation

-

By Grade:

- Carton board

- Containerboard

- Others

-

By Product:

- Folding Cartons

- Corrugated Boxes

- Other Types

-

By End-User Industry:

- Food & Beverage

- Healthcare

- Personal Care

- Household Care

- Electrical Products

- Others

The food and beverage industry is currently the largest end-user of paper packaging in India, driven by increased consumer awareness about sustainable packaging and a rise in the consumption of packaged foods. This sector is expected to maintain its dominance in the forecast period, aided by ongoing trends such as contactless food deliveries and stringent packaging regulations from the Food Safety and Standards Authority of India (FSSAI).

Regional Insights

States like Andhra Pradesh, Karnataka, Maharashtra, and Gujarat are witnessing significant demand for paper packaging due to rapid urbanization, industrial growth, and government initiatives to reduce plastic waste. The rise of e-commerce and the retail sector across these states is further fueling demand for sustainable packaging solutions. Consumers in these regions are increasingly turning to online platforms for groceries, daily essentials, and food items, which is anticipated to boost the market for paper packaging.

Competitive Landscape

The India Paper Packaging Market is highly competitive, with several key players focusing on innovations to enhance product quality, cost efficiency, and sustainability. Companies like Safe Pack Solutions are leading the way by offering specialized packaging solutions for various food products, such as frozen, moist, and greasy items. Additionally, companies like WestRock India are investing in the development of fully recyclable and compostable packaging products, aligning with market trends toward sustainability.

Key market players include:

- WestRock India

- Trident Paper Box Industries

- Kapco Packaging

- OJI India Packaging Pvt. Ltd.

- Parksons Packaging Ltd.

- ITC Packaging and Printing Ltd.

- Plus Paper Foodpac Limited

These companies are adopting strategies such as new product launches, mergers and acquisitions, and partnerships to maintain their competitive edge in the rapidly evolving market. The emphasis on innovation, sustainable practices, and cost-effective solutions is expected to be a key focus area for companies in the future.

Conclusion and Future Outlook

The India Paper Packaging Market is poised for significant growth, driven by increasing consumer demand for sustainable packaging, supportive government policies, and the rapid expansion of the e-commerce and FMCG sectors. As the market continues to evolve, opportunities for investment and innovation are abundant, particularly in the areas of recyclable and eco-friendly packaging solutions. The shift away from plastics and toward paper-based packaging options is expected to remain a key trend throughout the forecast period, positioning India as a crucial player in the global paper packaging landsc