Summary:

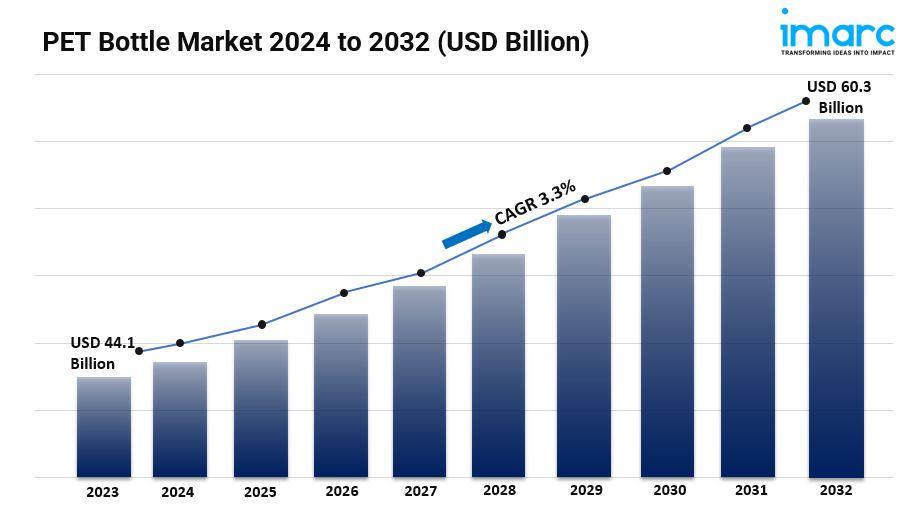

- The global PET bottle market size reached USD 44.1 Billion in 2023.

- The market is expected to reach USD 60.3 Billion by 2032, exhibiting a growth rate (CAGR) of 3.3% during 2024-2032.

- Asia Pacific leads the market, accounting for the largest PET bottle market share due to rapid urbanization and increasing disposable incomes.

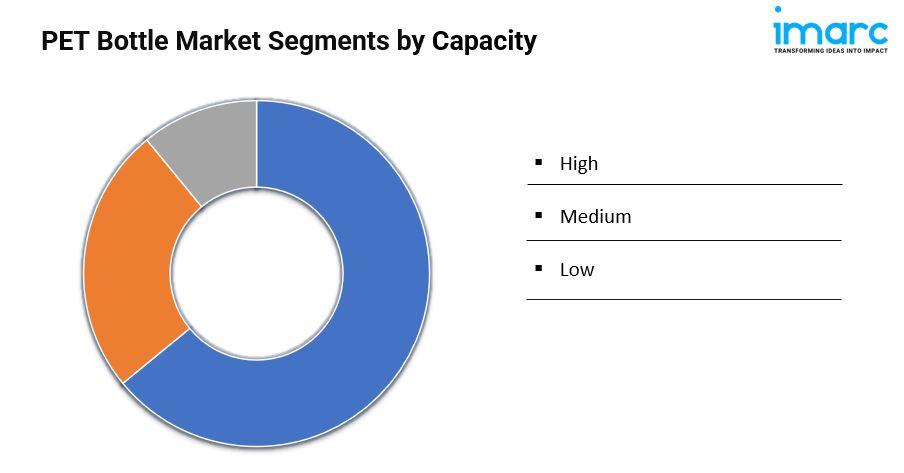

- Medium accounts for the majority of the market share in the capacity segment as they are widely used for beverages.

- Business to business holds the largest share in the PET bottle industry due to high volume sales of PET bottles to manufacturers.

- Transparent remains a dominant segment in the market, owing to their aesthetic appeal.

- Stretch blow molding represents the leading technology segment because it offers superior strength.

- Packaged water accounted for the majority of the market share as consumers demand convenient hydration solutions.

- The rising demand for packaged beverages is a primary driver of the PET bottle market.

- The implementation of sustainability and recycling initiatives are further reshaping the PET bottle market.

Request to Get the Sample Report: https://www.imarcgroup.com/pet-bottle-manufacturing-plant/requestsample

Industry Trends and Drivers:

- Growing Demand for Packaged Beverages:

The increasing demand for packaged beverages is one of the primary drivers of the PET bottle market. As global consumption of bottled water, soft drinks, and alcoholic beverages rises, manufacturers are seeking efficient and effective packaging solutions that meet consumer needs. PET bottles have gained popularity in this context due to their lightweight and durable properties, making them an ideal choice for beverage packaging.

The convenience of bottled drinks aligns with modern consumer lifestyles, where on-the-go consumption is prevalent. Additionally, the health trend emphasizing hydration has led to a significant increase in bottled water sales, further boosting the demand for PET bottles. Furthermore, PET's ability to maintain the integrity and freshness of beverages, along with its resistance to impact and breakage, makes it a preferred choice for manufacturers.

- Sustainability and Recycling Initiatives:

Sustainability is becoming a critical concern across industries, driving significant growth in the PET bottle market. With rising awareness of environmental issues and plastic pollution, consumers and manufacturers are increasingly favoring recyclable packaging options. PET bottles are particularly advantageous because they are fully recyclable, and many brands are adopting practices that prioritize the use of recycled PET (rPET) in their packaging.

This shift is encouraged by various global and local initiatives aimed at reducing plastic waste and promoting circular economy practices. Many governments are implementing regulations that require the use of recycled materials in packaging, further incentivizing manufacturers to embrace sustainability. Moreover, brand loyalty is increasingly tied to environmental responsibility, with consumers opting for products that align with their values.

- Lightweight and Cost-Effective:

The lightweight nature of PET bottles is a significant factor contributing to their market growth, particularly in the beverage industry. Being lighter than glass or metal alternatives, PET bottles reduce shipping and transportation costs, which is a critical consideration for manufacturers. The decreased weight translates to lower fuel consumption during transportation, resulting in both economic savings and a reduced environmental impact.

This cost-effectiveness is particularly advantageous for companies looking to optimize their supply chains and improve overall operational efficiency. Additionally, PET's durability ensures that products remain safe during transit, minimizing the risk of breakage and product loss. Furthermore, the versatility of PET allows for various designs and customization options, enabling brands to create appealing packaging that captures consumer attention without significantly increasing costs.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=583&flag=C

PET Bottle Market Report Segmentation:

Breakup By Capacity:

- High

- Medium

- Low

Medium holds the majority of the market share as they are widely used for beverages like soft drinks and juices, striking a balance between portability and volume that appeals to a broad consumer base.

Breakup By Distribution Channel:

- Business to Business

- Retail

- Supermarkets and hypermarkets

- Convenience Stores

- Online

- Others

Business to business accounts for the largest market share due to the high volume sales of PET bottles to manufacturers, bottlers, and retailers in the beverage industry.

Breakup By Color:

- Transparent

- Coloured

Transparent represented the majority of the market share owing to their aesthetic appeal and the ability to showcase the product inside, making them popular among consumers and manufacturers alike.

Breakup By Technology:

- Stretch Blow Molding

- Injection Molding

- Extrusion Blow Molding

- Thermoforming

- Others

Stretch blow molding holds the majority of the market share because it offers superior strength, clarity, and design flexibility compared to other methods.

Breakup By End-Use:

- Packaged Water

- Carbonated Soft Drinks

- Food Bottles & Jars

- Non-Food Bottles & Jars

- Fruit Juice

- Beer

- Others

Packaged water accounted for the largest market share as consumer demand for convenient hydration solutions continues to rise globally.

Breakup By Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Asia Pacific holds the leading position owing to rapid urbanization, increasing disposable incomes, and a growing preference for packaged beverages in developing countries.

Top PET Bottle Market Leaders: The PET bottle market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

- Amcor Limited

- Cospack America Corporation

- BERICAP GmbH & Co. KG

- Rexam, Inc.

- Berry Global, Inc

- Graham Packaging Company Inc.

- Container Corporation of Canada

- Ontario Plastic Container Producers Ltd.

- Constar Internationals, Inc.

- Alpha Packaging

- Alpack Plastics

- Plastipak Holdings, Inc.

- Resilux NV

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1–631–791–1145