The global wound care market is anticipated to reach USD 29.57 billion by 2030, growing at a CAGR of 4.17% from 2024 to 2030, according to a new report by Grand View Research, Inc. The increasing number of surgical cases, a rapidly aging population, as well as a rising number of diabetic patients, are among the major factors driving this market’s growth. For instance, according to Ageing Asia, as of 2019, more than 139 million people, i.e., about 10% of India’s total population, were over 60. This is expected to increase up to 19.5% in 2050. The geriatric population is more susceptible to wounds, and thus, increasing the number of elder populations, the wound care market is anticipated to propel during the forecast period.

The wound care market has seen significant technological advancements in recent years, leading to the development of new and innovative products for treating various types of wounds. Growth factors are naturally occurring proteins that stimulate cell growth and division. These proteins can be used in wound care to promote healing and tissue regeneration. For example, platelet-derived growth factor (PDGF) is effective in promoting the healing of chronic wounds. 3D printing technology has revolutionized the production of custom-made wound care products, such as prosthetic limbs, orthotics, and wound dressings.

Gather more insights about the market drivers, restrains and growth of the Global Wound Care Market

In addition, many leading manufacturers are undergoing strategic initiatives such as product launches, partnerships, and geographic expansion, which may help them capitalize on the increasing demand for wound care products during the forecast period. For instance, Human Biosciences planned on launching two new wound care products in the Indian market. The launch of these products in the Indian market is expected to help the company capture the post-pandemic wound care market in India. Thus, similar initiatives by other market players are anticipated to boost the wound care market post-pandemic.

Wound Care Market Report Highlights

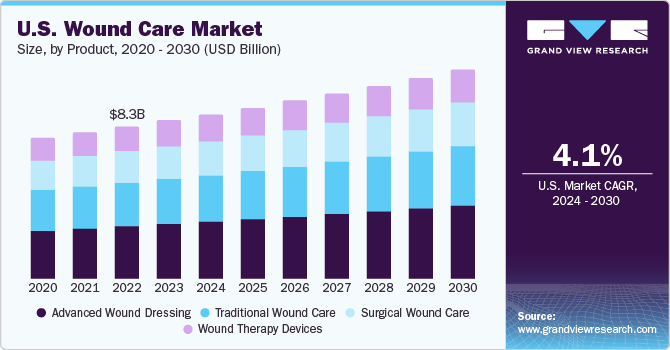

· Based on product, advanced wound dressing dominated the wound care market with a share of 34.9% in 2023, owing to the advantages offered by these dressings over traditional

· Based on application, the chronic wound segment will likely dominate the wound care market with a market share of 59.9% in 2023, owing to increased diabetic foot ulcers and pressure ulcers worldwide

· Based on end-use, the hospital segment dominated the wound care market, owing to the increasing number of surgical site infections among hospital patients. On the other hand, the home healthcare segment is anticipated to witness the fastest growth in the forecast period

· Based on the mode of purchase, the prescribed segment dominated the wound care market, with a share of 62.8% in 2023

· Based on the distribution channel, the institutional sales segment dominated the market. However, the retail sales segment is anticipated to witness the fastest growth, with a CAGR of 4.6% over the forecast period

· North America dominated the wound care market with the highest revenue share of 45.5% in 2023 owing to the increasing number of surgical procedures and technological advancements

Browse through Grand View Research's Healthcare Industry Research Reports.

· Sacral Nerve Stimulation Market: The global sacral nerve stimulation market size was valued at USD 1.60 billion in 2023 and is projected to grow at a CAGR of 11.5% from 2024 to 2030.

· Irritable Bowel Syndrome Treatment Market: The global irritable bowel syndrome treatment market size was valued at USD 3.64 billion in 2024 and is anticipated to grow at a CAGR of 8.8% from 2025 to 2030.

Wound Care Market Report Segmentation

Grand View Research has segmented the global wound care market report based on product, application, end-use, mode of purchase, distribution channel, and region:

Wound Care Product Outlook (Revenue, USD Million, 2018 - 2030)

· Advanced Wound Dressing

o Foam Dressings

o Hydrocolloid Dressings

o Film Dressings

o Alginate Dressings

o Hydrogel Dressings

o Collagen Dressings

o Other Advanced Dressings

· Surgical Wound Care

o Sutures & Staples

o Tissue Adhesive & Sealants

o Anti-infective dressing

· Traditional Wound Care

o Medical Tapes

o Cotton

o Bandages

o Gauzes

o Sponges

o Cleansing Agents

· Wound Therapy Devices

o Negative Pressure Wound Therapy

o Oxygen & Hyperbaric Oxygen Equipment

o Electric Stimulation Devices

o Pressure Relief Devices

o Others

Wound Care Application Outlook (Revenue, USD Million, 2018 - 2030)

· Chronic Wounds

o Diabetic Foot Ulcers

o Pressure Ulcers

o Venous Leg Ulcers

o Other Chronic Wounds

· Acute Wounds

o Surgical & Traumatic Wounds

o Burns

Wound Care End-use Outlook (Revenue, USD Million, 2018 - 2030)

· Hospitals

· Specialty Clinics

· Home Healthcare

· Physician’s Office

· Nursing Homes

· Others

Wound Care Mode of Purchase Outlook (Revenue, USD Million, 2018 - 2030)

· Prescribed

· Non-prescribed (OTC)

Wound Care Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

· Institutional Sales

· Retail Sales

Wound Care Regional Outlook (Revenue, USD Million, 2018 - 2030)

· North America

o U.S.

o Canada

· Europe

o Germany

o UK

o France

o Italy

o Spain

o Denmark

o Sweden

o Norway

· Asia Pacific

o Japan

o China

o India

o South Korea

o Australia

o Thailand

· Latin America

o Brazil

o Mexico

o Argentina

· Middle East & Africa

o South Africa

o Saudi Arabia

o UAE

o Kuwait

Order a free sample PDF of the Wound Care Market Intelligence Study, published by Grand View Research.