The global textile chemicals market size is expected to reach USD 36.14 billion by 2030, registering a CAGR of 4.5% from 2024 to 2030, according to a new report by Grand View Research, Inc. The growth is majorly driven by increasing demand for textile products from major applications including apparel, home furnishing, technical textiles, and others.

Rapidly growing demand from the apparel industry is anticipated to propel the demand for the product during the forecast period. Home furnishing, specifically in developing economies, demanding modern and attractive furniture products is expected to have a positive impact on the growth of the market.

Numerous chemicals are used in the fabric manufacturing industry to offer a wide range of performance features during the production process, which are known as process chemicals. These end products include biopolishing enzymes, desizing enzymes, flame retardants, antiviral/antimicrobial agents, lubricating/anti-crease agents, water and oil repellents, printing auxiliaries, and softening agents.

Gather more insights about the market drivers, restrains and growth of the Textile Chemicals Market

Detailed Segmentation:

Drivers, Opportunities & Restraints

Innovations in textile manufacturing processes, such as digital printing, nanotechnology, and smart clothing, require specialized chemicals that enhance fabric properties and enable new functionalities. In addition, countries like China, India, and Bangladesh are becoming major textile manufacturing hubs due to lower labor costs and favorable government policies. For instance, in February 2024, the Government of India (GoI) announced a total budget allocation of more than INR 1000 crore, an increase of nearly 27.6%, mainly due to the allocation of INR 600 crore for the Cotton Corporation of India. Such government initiatives and expansion drive the demand for the product to meet production needs.

Industry Dynamics

The growth stage of the textile chemicals industry is currently robust, with an accelerating pace. Strategic activities, notably mergers and acquisitions, are prominent within this market segment. Key players in the global textile chemicals industry have implemented mergers and acquisitions as a strategic approach to expand product reach. This strategy leverages acquired networks to enhance product availability across diverse geographic regions. For instance, in January 2023, Archroma completed the acquisition of Huntsman Corporation's Textile Effects division, exemplifying this trend.

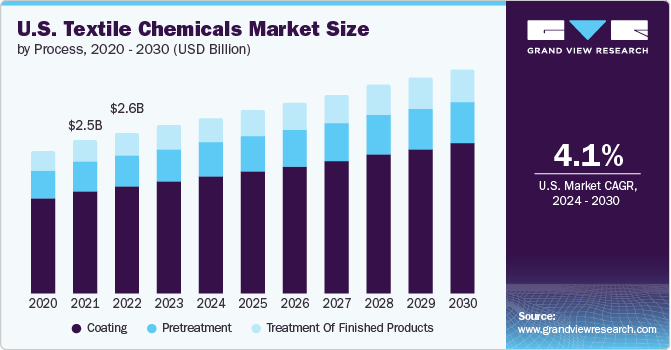

Process Insights

The coating process dominated the market and accounted for a revenue share of approximately 71.32% in 2023. Coating allows textiles to acquire specific functional properties that are not achievable through other processes alone. For example, coatings can impart antimicrobial properties or conductive properties for applications in smart textiles. Furthermore, the coating process enables customization of textiles according to specific end user requirements. Innovations in coating technologies continually expand the range of functionalities and performance characteristics that textiles can offer.

Product Insights

Coating & Sizing chemicals dominated the market and accounted for a revenue share of approximately 50.54% in 2023. Consumers are increasingly looking for high-performance textiles with specific characteristics such as stain resistance, wrinkle-free properties, and enhanced comfort. Coatings and sizing chemicals help manufacturers meet these expectations. In addition, coatings and sizing chemicals improve the physical properties of textiles, such as strength, durability, abrasion resistance, and water repellency. This makes the fabrics more suitable for various applications, from fashion to industrial uses.

Application Insights

Apparel applications dominated the market and accounted for a revenue share of 44.80% in 2023. Apparel manufacturing constitutes a significant portion of the textile industry, both in terms of volume and value. This large-scale production requires a variety of chemicals for processes such as dyeing, finishing, and sizing. In addition, different types of fabrics (natural, synthetic, blended) used in apparel production require specific chemical treatments to achieve desired characteristics such as color fastness, softness, water resistance, and durability.

Regional Insights

North America is known for its advanced manufacturing capabilities and stringent quality standards. Textile producers in the region utilize a wide range of chemicals for processes such as dyeing, finishing, and treating textiles to meet high-quality requirements and regulatory standards. There is a growing demand for technical textiles in North America, driven by sectors such as automotive, aerospace, healthcare, and industrial applications. These specialized textiles require advanced chemical treatments to enhance properties like durability, flame resistance, and antimicrobial properties, thereby boosting the demand for specialized textile chemicals.

Browse through Grand View Research's Specialty Polymers Industry Research Reports.

• The global smart polymers market size was valued at USD 12.84 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.5% from 2024 to 2030.

• The global polyolefin (POF) shrink film market size was valued at USD 8.54 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 3.5% from 2024 to 2030.

Key Textile Chemicals Company Insights

Some of the key players operating in the global textile chemicals market include Kiri Industries Ltd., AB Enzymes, Dow, BASF SE, The Lubrizol Corporation, Kemira Oyj, and Evonik Industries AG, among others.

• AB Enzymes is a biotech company that develops and manufactures enzyme preparations for a wide range of applications such as baking, fruit juice processing, grains processing, animal feed, paper, textiles, and laundry.

• BASF SE operates through six business segments, including chemicals, industrial solutions, materials, surface technologies, nutrition and care, and agricultural solutions. The chemical segment's product portfolio includes intermediates, monomers, petrochemicals, and catalysts. The company provides non-halogenated flame-retardants for several end-use industries, including the textile market.

• Evonik Industries AG is a global manufacturer of specialty chemicals. It operates through four business segments: Specialty Additives, Nutrition and care, Smart Materials, and Performance Materials. Under the Performance Materials segment, the company offers performance intermediates such as large-volume additives and intermediates, along with functional solutions such as polymer additives, potassium derivatives, cyanuric chloride, alkyl chlorides, and alkoxides.

Key Textile Chemicals Companies:

The following are the leading companies in the textile chemicals market. These companies collectively hold the largest market share and dictate industry trends.

• AB Enzymes

• Archroma

• BASF SE

• BioTex Malaysia

• Dow

• Ethox Chemicals, LLC

• Evonik Industries AG.

• Fibro Chem, LLC

• German Chemicals Ltd.

• Govi N.V.

• Huntsman International LLC

• Kemira Oyj

• Kiri Industries Ltd.

Textile Chemicals Market Segmentation

Grand View Research has segmented the global textile chemicals market based on process, product, application, and region:

Textile Chemicals Process Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

• Pretreatment

o Bleaching Agents

o Desizing Agents

o Scouring Agents

o Others

• Coating

o Anti-Piling

o Protection

o Water Proofing

o Water Repellant

o Others

• Treatment Of Finished Products

o Softening

o Stiffening

o Others

Textile Chemicals Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

• Coating & Sizing Chemicals

• Colorants & Auxiliaries

o Dispersants/levelant

o Fixative

o UV absorber

o Others

• Finishing Agents

o Antimicrobial or anti-inflammatory

o Flame retardants

o Repellent and release

o Others

• Surfactants

o Detergents & Dispersing Agents

o Emulsifying Agents

o Lubricating Agents

o Wetting Agents

• Denim Finishing Agents

o Anti-back Staining Agents

o Bleaching Agents

o Crush Resistant Agents

o Defoamers

o Enzymes

o Resins

o Softeners

o Others

Textile Chemicals Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

• Apparel

o Innerwear

o Outerwear

o Sportswear

o Others

• Home Furnishing

o Carpet

o Drapery

o Furniture

o Others

• Technical Textiles

o Agrotech

o Buildtech

o Geotech

o Indutech

o Medtech

o Mobiltech

o Packtech

o Protech

o Others

• Other Applications

Textile Chemicals Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o Turkey

o Italy

o UK

o France

o Russia

o Spain

o Poland

• Asia Pacific

o China

o India

o Japan

o South Korea

o Vietnam

o Indonesia

• Central & South America

o Brazil

o Argentina

• Middle East and Africa

o Saudi Arabia

o South Africa

o Morocco

o Tunisia

o UAE

o Kenya

Order a free sample PDF of the Textile Chemicals Market Intelligence Study, published by Grand View Research.

Recent Developments

• In January 2024, Devan Chemicals, a provider of sustainable textile finishes, is excited to announce its upcoming participation in Heimtextil 2024. Devan invites attendees to visit their booth in Hall 11.0, booth A21, to experience firsthand the latest sustainable textile finishes they have developed.

• In April 2024, BASF SE announced its portfolio of polyamides for the textile industry. The company’s sustainable polyamide PA6 and PA6.6 product range have been certified under the Recycled Claim Standard (RCS) for textile applications. This certification allows BASF SE to market textiles produced using recycled raw materials.

• In May 2023, Dystar announced its eco-advanced indigo dyeing, which aims to reduce energy consumption by up to 30% and water usage by up to 90% during the production process.

• In November 2023, Solvay introduced a textile fiber that decomposes rapidly in the oceans, minimizing the environmental impact of microplastics. The new textile polyamide, set to be manufactured at the company's industrial facility in Brazil, will decrease oceanic impact by roughly 40 times compared to traditional fibers. This product development aligns with the global trend of rising demand and market shifts toward more sustainable textile solutions.