The global blood screening market is expected to reach USD 6.62 billion by 2030, registering a CAGR of 11.7% from 2023 to 2030, according to a new report by Grand View Research, Inc. The growth of the market is attributed to the increase in screening of donor and continuous technological advancement by the market players. Demand for blood screening tests is increasing continuously due to increasing donation, rising awareness about transfusion-transmitted diseases, and technological developments in the industry. Furthermore, governments of various countries are in process to mandates testing all donated blood for several viruses.

Thorough screening is necessary for all donated blood to ensure that recipients receive the safest products. As of 2015, such testing consists of screening for red cell antibodies, and the infectious diseases agents: HIV-1, HIV-2, hepatitis virus, West Nile Virus (WNV), Human T-Lymphotropic Virus (HTLV) T. Cruzi, and T. pallidum (syphilis). The result of all these assays must be negative for blood donation.

Technological developments increase the sensitivity and efficiency of the tests. For instance, in 2016, the U.S. FDA approved the Procleix Zika virus assay from Hologic, Inc. and Grifols to screen donated blood. Furthermore, the U.S. FDA approved next-generation sequencing (NGS) technology in 2013. The technology is cheaper and faster than previous DNA analysis methods.

Gather more insights about the market drivers, restrains and growth of the Blood Screening Market

Detailed Segmentation:

Product Insights

On the basis of product, the market is segmented into instruments and reagents. The reagent segment accounted for the largest revenue share of around 73.0% in 2022 and is expected to grow at the fastest CAGR of 12.0% over the forecast period owing to higher accuracy and specificity in detecting the presence and type of various elements in a small sample would drive the market.

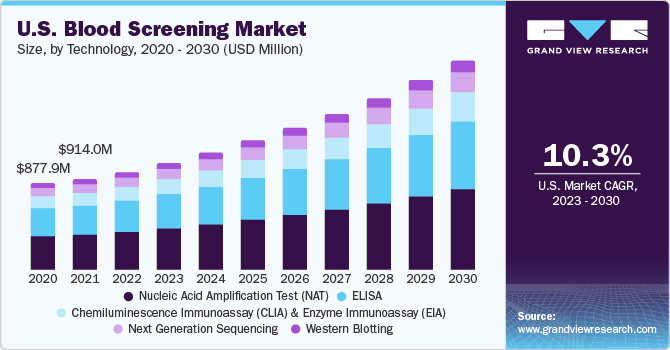

Technology Insights

On the basis of technology, the market is segmented into nucleic acid amplification tests, ELISA, CLIA, EIA, NGS, and western blotting. The NAT segment accounted for the largest revenue share of 41.8% in 2022, owing to its high sensitivity and specificity for viral nucleic acid. The test detects nucleic acid earlier than other screening methods and, thus, narrows the window period of HBV, HCV, and HIV. According to the WHO, HIV has claimed 40.1 million lives till now and remains a global health concern with the current transmission in all countries where 1.5 million people attained HIV in 2021.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 39.0% in 2022 owing to the presence of key industry players, increased adoption of the blood screening process, stringent FDA regulations for transfusion, rising infectious disease prevalence, and greater patient affordability are responsible for maintaining its position during the forecast period. The U.S. leads the market due to the local presence of leading players such as Roche Diagnostics, Abbott, and Danaher. One of the reasons for their continued dominance is the presence of well-established R&D infrastructure and favorable reimbursement policies.

Browse through Grand View Research's Medical Devices Industry Research Reports.

• The global electron microscopes market size was valued at USD 5.05 billion in 2023 and is projected to grow at a CAGR of 8.1% from 2024 to 2030.

• The global ambient assisted living market size was valued at USD 7.36 billion in 2023 and is projected to grow at a CAGR of 26.8% from 2024 to 2030. .

Key Companies & Market Share Insights

Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies used by market participants to maintain and grow their global reach.

For instance, in March 2023, Abbott received U.S Food and Drug Administration (FDA) clearance for a laboratory traumatic brain injury blood test, the first commercially available lab-based test for the assessment of mild traumatic brain injuries (TBIs), commonly referred to as concussions, which will be made widely available to hospitals across the U.S. This test, which is powered by Abbott’s Alinity i laboratory tool, will enable clinicians to evaluate individuals with mild traumatic brain injuries in a timely manner.

Furthermore, in May 2023, Siemens Healthcare introduced Atellica HEMA 570 and 580 next-generation hematology analyzers, which have user-friendly interfaces and can be connected to multiple analyzers to remove workflow barriers and provide high throughput time.

Key Blood Screening Companies:

• Abbott

• Danaher Corporation (Beckman Coulter)

• Becton Dickinson and Company

• Bio-Rad Laboratories, Inc.

• Hoffman-La Roche Ltd.

• Grifols, S.A.

• Ortho-Clinical Diagnostics, Inc.

• Siemens Healthcare GmbH

• Thermo Fisher Scientific, Inc.

• SOFINA s.a (Biomerieux)

Blood Screening Market Segmentation

Grand View Research has segmented the blood screening market by product, technology, and region:

Blood Screening Technology Outlook (Revenue, USD Million, 2018 - 2030)

• Nucleic Acid Amplification Test (NAT)

• ELISA

• Chemiluminescence Immunoassay (CLIA) and Enzyme Immunoassay (EIA)

• Next Generation Sequencing

• Western Blotting

Blood Screening Product Outlook (Revenue, USD Million, 2018 - 2030)

• Reagent

• Instrument

Blood Screening Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

• Europe

o UK

o Germany

o France

o Italy

o Spain

o Sweden

o Norway

o Denmark

• Asia Pacific

o Japan

o China

o India

o Australia

o Thailand

o South Korea

• Latin America

o Brazil

o Mexico

o Argentina

• Middle East and Africa

o Saudi Arabia

o South Africa

o UAE

o Kuwait

Order a free sample PDF of the Blood Screening Market Intelligence Study, published by Grand View Research.