The global steel rebar market size was valued at USD 270.18 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.9% from 2022 to 2030. The market is anticipated to be driven by the rising investments in infrastructure development projects and construction activities. Government spending on propelling supporting infrastructural developments to boost economic growth is anticipated to benefit the market growth. For instance, in 2021, the Chinese government allocated USD 573 billion as special-purpose bonds (SPBs) to its local governments for rebuilding the country’s infrastructure. Of the funds raised through issuing SPBs, 50% were used for the industrial park and transport infrastructure development.

The U.S. is one of the major consumers of steel rebar and this trend is anticipated to prolong considering the rising spending on infrastructure rebuilding projects. In 2021, the U.S. government passed the Infrastructure Investment Jobs that focuses on boosting the economy and rebuilding public infrastructure by investing in various projects such as bridges, rails, roads, communication, and ports. Infrastructure revamping programs in the U.S. are expected to drive the steel rebar demand during the forecast period.

Gather more insights about the market drivers, restrains and growth of the Global Steel Rebar Market

Furthermore, according to the U.S. government, major highways and 45,000 bridges are to be repaired in the country. The Act mandates the allocation of USD 110.00 billion for rebuilding the infrastructures. Moreover, the government has decided to allocate funds for the development of ports, water supply, and airports as well. These investments are projected to lift the demand for steel rebar in the U.S. across the forecast period.

In addition, expenditures on non-residential and residential construction have increased considerably compared to the past years. According to the U.S. Census Bureau, the total construction spending surged by 9.7% in May 2022 to reach USD 1.77 trillion compared to USD 1.62 trillion in the same period the previous year. The spending on residential construction has raised by 18.7% to reach USD 947.27 billion.

Detailed Segmentation:

Application Insights

Construction dominated the market in 2021 with a revenue share of more than 55.0% and this trend is expected to continue during the forecast period. Various investments in the construction industry are projected to augment segment growth. For instance, in April 2022, Alliance Group, a leading real estate developer, announced to an investment of USD 1.12 billion for its residential construction projects in Hyderabad, Chennai, and Bengaluru, India.

The infrastructure segment is anticipated to register the fastest growth rate of 5.1%, in terms of revenue, across the forecast period. Rising government expenditure on infrastructure for revamping economic growth from the crisis, followed by the pandemic, is expected to boost the segment growth over the coming years. For instance, in July 2021, the Canadian federal government and the provincial government of Quebec decided to invest in water treatment infrastructure. The federal government and the Quebec government have planned to invest USD 16.1 million each in the project.

Regional Insights

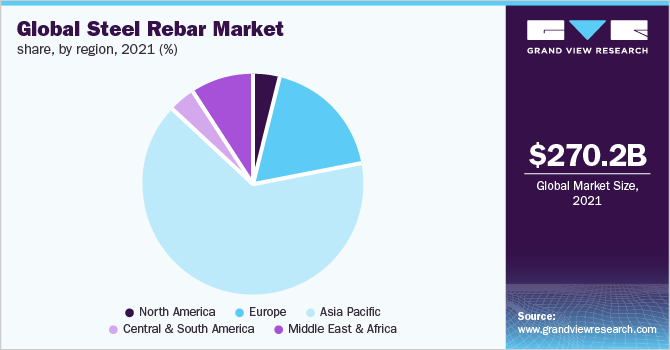

The Asia Pacific held the largest revenue share of over 60.0% in 2021. Investments in several construction activities, mainly by China and India, are projected to boost the steel rebar demand in the region across the forecast period. For instance, at the beginning of 2022, the Indian government allocated USD 1.89 billion to aid initiatives such as ‘Housing for All’ and ‘Smart Cities Mission, according to the Ministry of Commerce and Industry.

North America is projected to register a growth rate of 4.8%, in terms of revenue, from 2022 to 2030. The growth rate is expected to get influenced by the increasing flow of funds toward various infrastructure projects from the government of the U.S., Mexico, and Canada. For instance, in April 2022, the Mexican government announced the third infrastructure development fund along with private players for revamping the country’s economy. The fund is focused on the redevelopment of airports, rail lines, and ports in the country.

Browse through Grand View Research's Advanced Materials Industry Research Reports.

- District Heating Market: The global district heating market size was valued at USD 190.5 billion in 2023 and is anticipated to grow at a CAGR of 5.2% from 2024 to 2030.

- Spherical Silicon Carbide Market: The global spherical silicon carbide market size was estimated at USD 3.68 billion in 2023 and is projected to grow at a CAGR of 11.0% from 2024 to 2030.

Key Companies & Market Share Insights

The global market is fragmented with the presence of established as well as small-scale players across the world. The established players give tough competition to other small players by adopting various strategies such as capacity expansions, mergers & acquisitions, product innovation, and joint ventures.

For instance, in February 2022, FABco, LLC, a leading provider of concrete construction material and supplier of steel rebars, acquired Volunteer Rebar. This acquisition is expected to help the company to accelerate its growth and increase services to customers based in Tennessee, U.S. Some prominent players in the global steel rebar market include:

- ArcelorMittal

- NIPPON STEEL CORPORATION

- NLMK

- Nucor

- Tata Steel

- JSW

- POSCO HOLDINGS INC.

- Jiangsu Shagang Group

- SAIL

- Steel Dynamics, Inc.

Order a free sample PDF of the Steel Rebar Market Intelligence Study, published by Grand View Research.