AI TRiSM Market Size & Trends

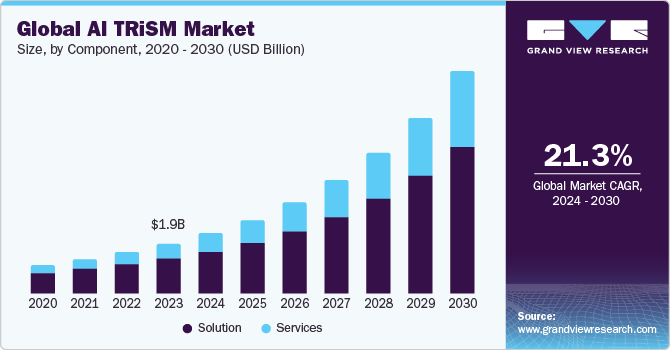

The global AI trust, risk and security management market size was estimated at USD 1.96 billion in 2023 and is projected to grow at a CAGR of 21.3% from 2024 to 2030. The growth is primarily attributed to the increasing demand for ethical AI practices. Organizations are increasingly recognizing the ethical and societal implications of AI applications, resulting in the rising need for comprehensive frameworks that ensure fair and responsible AI deployment. The importance of AI trust, risk and security management (AI TRiSM) solutions has become prominent as they play a key role in establishing trust by handling ethical concerns, thereby promoting a positive image of AI technologies. Organizations are increasingly seeking AI governance solutions to manage the AI lifecycle responsibly. At the same time, evolving regulations are mandating AI TRiSM practices to ensure regulatory compliance. As consumers become more informed, there is a growing demand for AI applications that prioritize trust, security, and ethical considerations.

The adoption of AI technology is gaining traction across various industries and industry verticals. While most AI providers claim that their respective solutions are designed to ensure adequate data security and privacy protection, concerns over AI-related risks, such as invasion of privacy and compromised data security, show no signs of abating. Calls for ensuring trust and transparency in AI usage in the wake of the growing concerns related to discriminatory algorithms, data breaches, and AI-powered surveillance systems are particularly putting pressure on organizations to demonstrate responsible AI practices. To address these concerns, organizations are typically adopting AI TRiSM solutions not only to mitigate AI-related risks but also to build public trust by enhancing their brand image and market reputation.

Gather more insights about the market drivers, restrains and growth of the Global AI Trust, Risk And Security Management Market

Component Insights

The solution segment led the market with a revenue share of 70.7% in 2023. AI TRiSM solutions are software solutions that allow ML practitioners and software developers to monitor, evaluate, interpret, and provide insights on the number of ML models being created before finalizing the model to be deployed in the final software. These solutions ensure trustworthiness by communicating model predictions to the stakeholders. These solutions are readily used as part of the software development process, wherein these solutions optimize instant debugging, ensure the quality of the model being developed, provide analytics on model performance, and streamline complex logic into simple, actionable insights.

Type Insights

The explainability segment accounted for the largest revenue share in 2023. Organizations are recognizing the importance of building trust in AI systems, especially in critical domains, such as healthcare, finance, and autonomous driving, where decisions impact human lives and well-being. At this point, enhanced explainability not only fosters trust but also aids in regulatory compliance for responsible AI usage. Consequently, businesses investing in AI TRiSM solutions prioritize explainability to ensure accountability, mitigate risks, and understand the complex landscape of AI ethics and governance, thereby driving the segment’s growth.

Application Insights

The governance & compliance segment accounted for the largest revenue share in 2023. The growth of the segment can be attributed to the widespread adoption of AI in various industries, driving the demand for robust governance and compliance frameworks. Other factors include the rising reliance on AI technologies, growing awareness about associated risks, such as bias and security vulnerabilities, the evolving regulatory landscape, and increased public scrutiny as consumers demand ethical and responsible AI practices.

Deployment Insights

The on-premises segment accounted for the largest revenue share in 2023. Many enterprises favor on-premises AI TRiSM solutions to retain direct control over their infrastructure. On-premises deployment provides organizations with the ability to manage and customize security measures according to their specific needs and regulatory requirements. This level of control is particularly crucial in industries such as finance and healthcare, where stringent regulations mandate a high degree of oversight and control over data handling and security protocols.

Enterprise Size Insights

The large enterprise segment accounted for the largest revenue share in 2023. This can be attributed to the growing integration of AI across diverse domains, from marketing and sales to finance and risk management, within large enterprises. The need for AI TRiSM solutions arises from the increased reliance on AI technologies, emphasizing the need for responsible and secure implementation within large enterprises. AI TRiSM solutions aid large enterprises in demonstrating regulatory compliance, offering tools to manage data privacy, and ensuring model explainability and fairness in AI models. Large enterprises also recognize the potential risks associated with AI, including bias, security vulnerabilities, and explainability issues.

End-use Insights

The IT & telecommunication segment accounted for the largest revenue share in 2023. AI technology helps IT companies optimize and automate their IT infrastructure, improve business productivity and efficiency, deliver personalized customer experience, enhance data management, and perform real-time analytics subject to business processes. Thus, AI technology can cater to several business applications associated with the IT & telecom industry. However, with the growing use of AI; risks, such as data breach, data leakage, and malicious attacks, are also growing. Several IT companies are implementing regulatory solutions to monitor AI-enabled solutions and secure data and proprietary products as part of the efforts to mitigate these risks.

Regional Insights

North America dominated the market and accounted for a 32.6% share in 2023. North America has a competitive advantage in the AI market place owing to the presence of some of the world’s leading technology companies in the region. These companies have foundational AI capabilities, such as cloud platforms and governance structures, which grant them competitive differentiation and prominent growth opportunities. The capability to showcase AI systems of high quality and reliability, which are also prepared for regulatory compliance, provides a substantial advantage to industry frontrunners in both the short and long run. This advantage allows them to draw in new customers, maintain existing ones, and build investor confidence.

Key AI Trust, Risk And Security Management Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in December 2023, SAP SE and Robert Bosch GmbH, a German multinational engineering and technology company, collaborated to leverage the potential of secure multi-party computation (MPC) for privacy-preserving data analysis. This collaboration was aimed at enhancing MPC capabilities and unlocking new business opportunities for customers and partners across various industries.

Key AI Trust, Risk And Security Management Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in December 2023, SAP SE and Robert Bosch GmbH, a German multinational engineering and technology company, collaborated to leverage the potential of secure multi-party computation (MPC) for privacy-preserving data analysis. This collaboration was aimed at enhancing MPC capabilities and unlocking new business opportunities for customers and partners across various industries.

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

- 5G Infrastructure Market Size, Share & Trends Analysis Report By Component, By Type, By Spectrum, By Network Architecture, By Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Computer Aided Engineering Market Size, Share And Trends Analysis By Component (Software, Services), By Deployment Model, By End-use, By Region, And Segment Forecasts, 2024 - 2030

Key AI Trust, Risk And Security Management Companies:

The following are the leading companies in the AI TRiSM market. These companies collectively hold the largest market share and dictate industry trends.

- AT&T Inc.

- International Business Machines Corporation

- LogicManager, Inc.

- Moody's Analytics, Inc.

- RSA Security LLC.

- SAP SE

- SAS Institute Inc.

- ServiceNow Inc.

- Hewlett Packard Enterprise Development LP

AI TRiSM Market Segmentation

Grand View Research has segmented the global AI trust, risk and security management market based on component, type, application, deployment, enterprise size, end-use, and region:

AI TRiSM Component Outlook (Revenue, USD Billion, 2017 - 2030)

- Solution

- Services

AI TRiSM Type Outlook (Revenue, USD Billion, 2017 - 2030)

- Explainability

- ModelOps

- Data Anomaly Detection

- Data Protection

- AI Application Security

AI TRiSM Application Outlook (Revenue, USD Billion, 2017 - 2030)

- Governance & Compliance

- Bias Detection & Mitigation

- Security & Anomaly Detection

- Privacy Management

AI TRiSM Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

- On-premises

- Cloud

AI TRiSM Enterprise Size Outlook (Revenue, USD Billion, 2017 - 2030)

- Large Enterprise

- Small & Medium Enterprise

AI TRiSM End-use Outlook (Revenue, USD Billion, 2017 - 2030)

- IT & Telecommunication

- BFSI

- Manufacturing

- Retail & E-Commerce

- Healthcare

- Government

- Media & Entertainment

- Others

AI TRiSM Regional Outlook (Revenue, USD Billion, 2017 - 2030)

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- Kingdom of Saudi Arabia

- UAE

- South Africa

Order a free sample PDF of the AI Trust, Risk And Security Management Market Intelligence Study, published by Grand View Research.

Recent Developments

- In October 2023, International Business Machines Corporation launched AI-powered Threat Detection and Response Services. These services include 24x7 monitoring, automated remediation, and investigation of security alerts across the client's hybrid cloud environments. The scope encompasses existing security tools and investments, spanning on-premise, cloud, and operational technologies.

- In September 2023, Wipro Limited, an Indian multinational corporation, collaborated with ServiceNow to launch Wipro CyberTransform, an intelligent ServiceNow risk and security solution. This solution empowered organizations to integrate their risk, compliance, and security postures efficiently.

- In June 2023, TruEra Inc. introduced TruEra Monitoring, an AI quality monitoring solution that enhances the company's existing model evaluation tool, TruEra Diagnostics. This continuous monitoring system operates throughout the entire model lifecycle, enabling AI teams to promptly identify and address issues for optimal data model quality and performance.

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Explore Horizon, the world's most expansive market research database